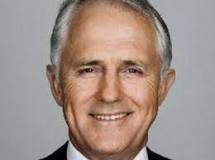

There will be no government funding for Adani’s $21.7-billion coal mine project, Australian prime minister Malcolm Turnbull said on Friday as he sought to assure a protester in fish costume that he took climate change “as seriously as you”.

Turnbull made these remarks during an election campaign in South Australia. An environmental protester dressed as a clown fish from animated movie Finding Nemo asked him to commit to no public funding for Indian mining firm Adani’s controversial project.

“Adani’s plan to build one of the world’s biggest coal mines in Australia has been hampered time and again. A federal court in August last year had revoked the original approval due to environmental concerns. In October last year, the project got a new lease of life after the Australian government gave its re-approval.

An email to Adani on Friday did not get any response. Analysts said the prime minister’s statement was a major policy shift by the Australian government as until now it had been looking at all sorts of angles to get financial support to the proposal, including the idea of the A$117-billion Future Fund stepping in. A$ is Australian dollar.

An email to Adani on Friday did not get any response. Analysts said the prime minister’s statement was a major policy shift by the Australian government as until now it had been looking at all sorts of angles to get financial support to the proposal, including the idea of the A$117-billion Future Fund stepping in. A$ is Australian dollar.

“Adani’s pivot into Australian solar project development is looking like a clear insight into how they are going to react. At least with the solar projects, they will have a multi-decade tax holiday in Australia, given they will probably end up having to write off their entire A$1.3-billion ($940 million) investment in Adani Mining Australia profit and loss to-date. This would have a major impact on shareholder equity of the listed Adani Enterprises Ltd, which stood at $2.03 billion on March 31, given Adani Mining Australia represents 46 per cent of the net book value of equity of the entire group,” said Tim Buckley, director of energy finance studies at the Institute for Energy Economics and Financial Analysis (IEEFA).

The admission from the minister that Adani’s proposed Carmichael coal mine project will receive no government money removes one of the final remote funding options for the beleaguered project, he said.

Buckley said Adani Enterprises remained relatively heavily geared, with net debt of $2.6 billion representing 1.3 times book value of shareholders equity. And taking into account the 2015 accounts filed with Australian authorities, Adani Mining Australia Pty is entirely debt-funded and is operating with negative shareholder funds. Hence, financial leverage remains an insurmountable barrier to develop the Carmichael coal proposal. “Adani appears to have no capacity to undertake the high risk A$10-billion Carmichael coal proposal, particularly since the company is now well underway on its new $5-10-billion solar investment programme in India and abroad,” said Buckley.

Apart from Adani, GVK group and Lanco group are also stuck after buying coal mines in Australia.

The Adani group had said they would go ahead with the Australian project to supply cheap coal to Indian power stations. At the same time, Coal India’s production has touched a record high to provide coal to Indian power plants. Besides, with coal-based power plants now shutting down due to high pollution in the developed world, the future of coal mines look uncertain.