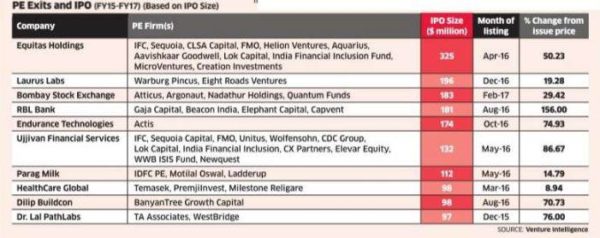

Private equity investors make big money in IPO exits. This is well known. But what is less known is that retail and other investors have also been making decent money after the exits. The largest IPO exits in the last three years made 1-14 times returns for private equity firms. But after listing, retail, HNIs and institutional investors have gained 9-156% in these firms, thanks to a strong stock market, data from Venture Intelligence show.

Private equity investors make big money in IPO exits. This is well known. But what is less known is that retail and other investors have also been making decent money after the exits. The largest IPO exits in the last three years made 1-14 times returns for private equity firms. But after listing, retail, HNIs and institutional investors have gained 9-156% in these firms, thanks to a strong stock market, data from Venture Intelligence show.

If the market rises further, the gains will only increase and private equity-like, super sized returns may still be possible. Investment bankers attribute this to the rising interest in equity market as well as strong fundamentals. “Stocks being valued attractively and appetite for IPOs have helped these companies,“ said Dharmesh Mehta, MD, Axis Capital. Financial stocks have obviously beaten the rest with RBL Bank surging 156% since listing in August 2016 followed by Ujjivan Financial Services with a gain of 87%.

Other gainers include Dr Lal PathLabs which has jumped 76% and Dilip Buildcon which has moved up 71%. In FY17, PE firms sold their complete stakes in 14 IPOs, as compared to 16 in FY16 and seven in FY15. According to Ajay Saraf, executive director, ICICI Securities, a PE exit augurs well for investors as the company could be expected to have better corporate governance and better fundamentals.

PE firms usually enter into sectors that have potential to do well and this gives comfort to investors while buying these stocks, said Saraf. “The PE exit trend is likely to gain further momentum going ahead,“ added Saraf.

Source: http://economictimes.indiatimes.com/articleshow/58157676.cms