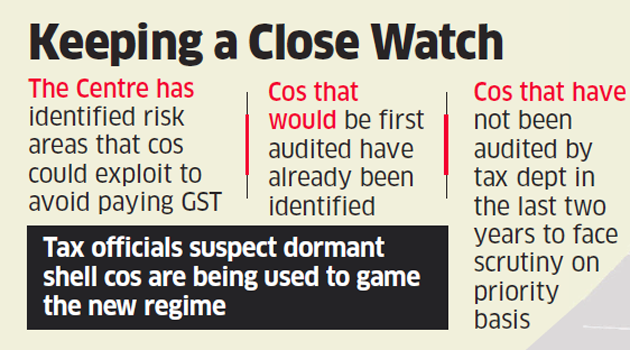

The Centre has created a detailed road map for goods and services tax (GST) audits barely 20 days after the levy’s rollout, listing risks, target industries and even potential auditees for officials examining corporate India’s transition to the new regime.

In the past week, the government has reached out to tax commissioners on the audit process, highlighting the risk areas. Beginning next week, therefore, officials could visit companies to assess whether the transition from the multiple to the single producer levy from July 1 stuck to the rule book.

The government has shared sector-wise “risk factors” companies might exploit to avoid paying GST. According to the tax official quoted above, categorisation or risk evaluation for these audits has been created by using Big Data analytics.

The government has shared sector-wise “risk factors” companies might exploit to avoid paying GST. According to the tax official quoted above, categorisation or risk evaluation for these audits has been created by using Big Data analytics.

In the internal government note shared with middle-rung tax officials, they have also been told to cause the “least inconvenience” to auditees and to even educate the taxpayers, especially small and medium enterprises (SMEs).

Industry experts, however, pointed out that a granular scrutiny could mean additional tax-related effort at many companies, as the GST audits would also take earlier taxes into account while evaluating the transition.

‘Extra book-keeping effort’

“The decision to focus on risk-based parameters in determining the audit plan is good. However, since the audits to be undertaken now would focus on earlier legislation such as excise and service tax, taxpayers will grapple with both the earlier legislation and the new legislation (GST) simultaneously,” said MS Mani, partner, GST, Deloitte India. “It would significantly increase the focus and time taken to attend to tax matters.”

A list of auditees, made up of large, medium, and small-scale companies across the country, was also shared with the tax commissioners. “Most of the companies have manipulated the system while transitioning credits from excise and service tax to GST. This is what would be the focus of the tax audits initially,” a senior tax official told ET.

“The government would have comparables. Say, if 10 consumer goods companies of a particular size pay Rs 50 crore in taxes, it is unlikely that one company, of the same revenue size, would pay Rs 1 crore. Data analytics could easily point out such anomalies, and the lens would then be on such companies,” a person in the know said.