India must prioritise implementation of public banking sector structural reforms, enhance the efficiency of labour and product markets, and modernise agriculture sector to accelerate its growth, the IMF said Friday.

The country’s growth is expected to accelerate in the medium-term as temporary disruptions due to demonetisation and the Goods and Services Tax (GST) fade, the International Monetary Fund said in its Asia and Pacific Regional Economic Outlook Update.

The GST is a landmark tax reform that should help unify the domestic market and encourage businesses to move from the informal to the formal sector, the IMF noted.

Inflation has been low compared with the mid-point target in recent months, driven by lower food prices, allowing the central bank to cut its policy rate in August, it added.

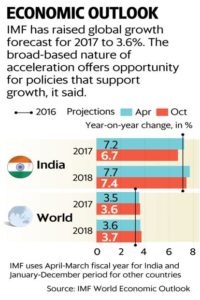

“Growth in 2017 was revised downward to reflect the recent slowdown, but is expected to accelerate in the medium term as these temporary disruptions fade,” it said.

In India, growth was revised down to 6.7 per cent in FY2017 and to 7.4 per cent in FY2018.

“Growth will be underpinned by private consumption, which has benefited from low food and energy prices, as well as civil service allowance increases,” IMF said.

Headline inflation is projected to stay close to the midpoint of the target band (4 per cent 2 per cent) in FY2017, while moving to the upper half of the target band in the medium term as food prices recover, it said.

The current account deficit should remain modest, financed by robust foreign direct investment inflows, it noted.

According to the outlook, in India, priorities should be strengthening public banks loss-absorbing buffers, implementing further public banking sector structural reforms, and enhancing public banks debt recovery mechanisms.

“Reform efforts should aim at tackling supply bottlenecks, enhancing the efficiency of labour and product markets, and modernising the agricultural sector,” the IMF said, adding that labour market reforms should be a priority to facilitate greater and higher-quality job creation.

Source: Deccan Chronicle