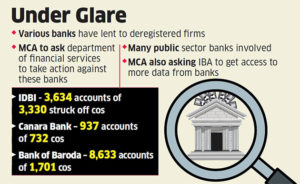

The corporate affairs ministry is likely to ask the department of financial services to take action against the banks which have continued lending to companies that have been deregistered.

The ministry is also likely to raise the issue of banks not showing urgency in sharing information on transactions of these companies before and after the announcement of demonetisation on November 8 last year.

The Registrar of Companies, which comes under the corporate affairs ministry, had struck off 2.09 lakh companies from the list of active establishments after they failed to comply with regulatory requirements. Banking transactions of these companies are restricted only for settling liabilities.

Despite this, according to sources, one government-owned bank has lent more than Rs 280 crore to a company after it was deregistered. Such transactions are likely to have occurred among other public sector banks as well, but the government still doesn’t have detailed data on the dealings, they said. “There is a need for greater transparency. We are simply waiting for the banks to come up with more information. Only a few have shared (the information) so far,” a senior government official said.

So far 13 banks have provided information to the government on 13,140 accounts of 5,820 deregistered companies, with the most startling details emerging from IDBI Bank, Bank of Baroda and Canara Bank.

So far 13 banks have provided information to the government on 13,140 accounts of 5,820 deregistered companies, with the most startling details emerging from IDBI Bank, Bank of Baroda and Canara Bank.

Earlier this month, the government said these 5,820 companies had deposited Rs 4,573 crore post demonetisation in banks and withdrew Rs 4,552 crore, even as they held balances of just Rs 22 crore on the day demonetisation was announced. This number is likely to go up manifold once the banks share more data.

The government is probing accounts of all the 2.09 lakh companies that were struck off the registry, which previously had about 13 lakh companies.

Four banks — Qatar National Bank, Doha Bank, Emirates NBD Bank and Punjab Gramin Bank — stated that they didn’t hold any accounts of the suspect companies.