India is considering tougher rules for audit firms, including a cap on the number of listed companies they can examine, according to a person with knowledge of the matter, as the government seeks to tighten oversight after a recent spate of governance lapses.

In India, 70% of the about 1,800 companies that trade on the National Stock Exchange are audited by firms affiliated to EY, Deloitte & Touche, KPMG and PWC, according to Delhi-based Prime Database. Current rules stipulate that individual auditors can examine accounts of up to 20 companies, though there is no limit on number of audits for the company.

The Big Four in India operate through a network of local chartered accountants firms. One way for them is to partner as a member of a local firm. They can also allow their brand name to be used by sub-licensee of a member local firm. The ministry hasn’t decided if the cap on audits will be at the group level or on each member firm, the person said.

The government is planning to expand the list of services which can’t be offered by statutory auditors under the Companies Act. Currently, statutory auditors can’t offer nine services, directly or indirectly, including internal audit, investment banking, and actuarial services. There is no restriction on providing services such as taxation or restructuring and valuation.

One option is to tweak the present cap on fees that can be generated through offering non-audit services, the person said. This cap, fixed in 2002, says fees from non-audit work can’t be more than the aggregate statutory audit fees. A spokeswoman for the corporate affairs ministry declined to comment.

A government-appointed panel on regulating auditors and the networks had suggested that the fee from non-audit services should not be more than 50% of the audit fee.

Deloitte Ban

Governance lapses and negligence has loaded the nation’s banks with one of the world’s worst piles of bad debt. In some cases, allegations of fund diversion have surfaced, while the founders of some shadow banks have faced accusations of accepting kickbacks in exchange for loans.

The corporate affairs ministry earlier this month sought a ban on Deloitte Haskins & Sells and BSR & Co. for their role as auditors to IL&FS Financial Services, a part of the IL&FS Group that was seized by the government last year after a string of debt defaults.

Deloitte in an emailed statement said it’s fully compliant with Indian audit standards, while BSR said it would defend its position in accordance with the law.

Meanwhile, the banking regulator forbid EY affiliate S. R. Batliboi & Co. from taking on bank audits for a year and, in 2018, the markets watchdog banned the local unit of PricewaterhouseCoopers LLP for two years in relations to work from a decade earlier.

Source: Economic Times

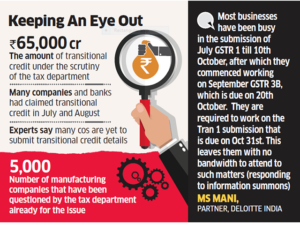

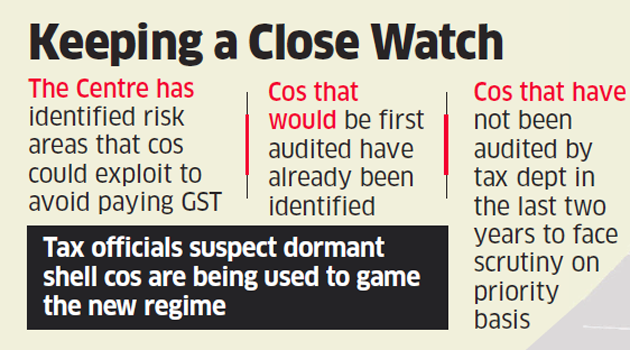

The government has shared sector-wise “risk factors” companies might exploit to avoid paying GST. According to the tax official quoted above, categorisation or risk evaluation for these audits has been created by using Big Data analytics.

The government has shared sector-wise “risk factors” companies might exploit to avoid paying GST. According to the tax official quoted above, categorisation or risk evaluation for these audits has been created by using Big Data analytics.