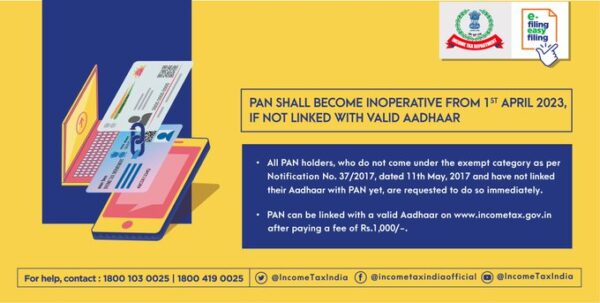

“As per the Income Tax Act, 1961, the last date to link PAN with Aadhaar is 31.3.2023 for all PAN card holders, who do not fall in the exempted category.

If not linked with Aadhaar, PAN will become inactive,” tweeted the CBDT through the IT department’s handle, adding that such users won’t be able to use PAN starting April 1, 2023.

The Central Board of Direct Taxes (CBDT), the apex body of the Income Tax department, has urged Permanent Account Number (PAN) card holders who are yet to link their PAN with Aadhaar card, to do so by March 31 next year, or else the former will be deactivated.

Steps to link PAN card with Aadhaar card:

In the Income Tax portal, enter your PAN and Aadhaar number on the required fields and then click on ‘Validate’

If the message ‘PAN is already linked with the Aadhaar or with some other Aadhaar’ pops up on your screen, it means your Adhaar is already linked with PAN

If your PAN is not linked to your Aadhaar and you have paid a challan on the NSDL Portal

The fee payment for PAN-Aadhaar Linkage needs to be made through e-Pay Tax functionality available on e-filing Portal

If you have bank account in any of the designated banks in the tax portal, you can follow below mentioned steps:

Provide your PAN, Confirm PAN and Mobile number to receive OTP

Post OTP verification, you will be redirected to a page showing different payment tiles

Click Proceed on the Income Tax portal

Select AY and Type of Payment – as other Receipts (500) and Continue

Enter the amount as Rs. 1000 under ‘Others’ field in tax break-up and proceed with further steps

If you have other bank accounts (bank that is not designated for payment through e-Pay tax), please follow below steps:

Click on hyperlink ‘Click here to go to NSDL (Protean) tax payment page for other banks’ given below on e-Pay tax page to redirect to Protean (NSDL) portal

Click Proceed under Challan No./ITNS 280

Select (0021) Income Tax (Other than Companies) under Tax Applicable (Major Head)

Select (500) Other Receipts) under Type of Payment (Minor Head)

Provide other mandatory details and Proceed

You are required to wait 4-5 working days before submitting the linkage request if the payment details are not authenticated on the e-filing portal and if you have already paid the amount on the NSDL portal.

After the payment, the information will be validated by electronic filing

You will receive a pop-up notification stating that “Your payment details are verified” after confirming your PAN and Aadhaar.

Click the Link Aadhaar option, and then enter the 6-digit OTP received on your mobile phone number

After successfully submitting your request for an Aadhaar-PAN link, you may now check its status.

Here is how you can check PAN and Aadhaar linkage status

Visit “https://www.incometax.gov.in/iec/foportal/” and under the ‘Quick Links’ section, click on ‘Link Aadhaar Status’.

Enter your PAN and Aadhaar Number, and then click on the ‘View Link Aadhaar Status’ option.

Your PAN and Aadhaar linkage status will be displayed on the screen upon successful validation.

PAN Holders should note that they need to check the status again if the UIDAI is still processing their request to link PAN and Aadhaar for confirmation.