Multiples Alternate Asset Management, the private equity fund founded by former ICICI Venture CEO Renuka Ramnath, is set to raise as much as $1billion in what could be one of the largest capital-raising plans by a domestic asset manager.

The programme, which is expected to start in February, will target pension funds, sovereign wealth funds and university endowments in North America, Europe, the Middle East and South East Asia, two people with knowledge of the matter said.

The proposed fund will be equivalent to almost one-third of the capital raised by 29 India-focused private equity and venture capital funds in 2017.

The fund is being launched with appetite for long-term capital after a relative lull of almost a decade. Big-ticket asset owners such as pension and sovereign funds have started putting in money since last year, especially after Moody’s Investors Service upgraded India’s sovereign rating outlook, which lifted sentiment towards one of the fastest-growing economies.

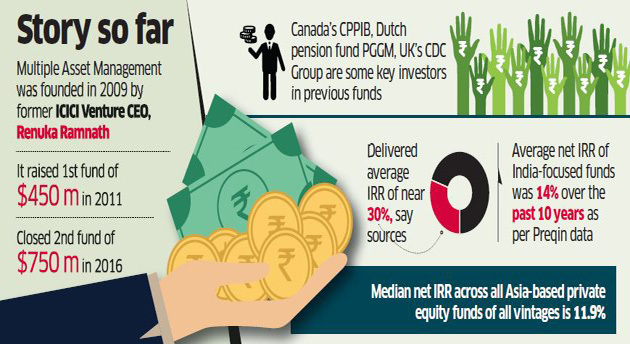

Multiples raised its first fund of $400 million in 2011 and its second fund of $750 million in 2016. It has delivered an average internal rate of return (IRR) of 30% to investors, sources said.

The average net IRR of India-focused funds was 14% over the past 10 years, according to London-based data tracker Preqin, compared with the median net IRR of 11.9% across all Asia-based private equity funds of all vintages.

“Yes, we have already started discussions with our existing limited partners and are looking to start marketing roadshows from Febru-ary. We expect the first close by mid of this year and a final close by December,” said one of the two people.

Founded in 2009 by Ramnath, former managing director and CEO of ICICI Venture, the private equity arm of the country’s biggest private lender, ICICI Bank, Multiples manages close to $1billion assets, its website showed. It counts Canada Pension Plan Investment Board and other North American pension money managers and university endowments as its largest limited partners or investors.

These investors have already committed to the fresh fundraising. Some of the investments by Multiples include Arvind, Cholamandalam Investment & Finance, Indian Energy Exchange and RBL. Last January, the firm sold its 14% stake in India’s largest movie hall chain PVR to rival private equity fund Warburg Pincus for Rs 820 crore, making a return on more than three times on its four-year-old investment, in constant currency terms.

India-focused funds together raised about $3.1 billion in 2017, according to Preqin data. This is more than double the money raised by 18 asset managers in 2016. Last year, former Temasek India head Manish Kejriwal’s Kedaara Capital raised about $750 million for its second fund, while IDFC Alternatives raised $350 million.

India-focused funds together raised about $3.1 billion in 2017, according to Preqin data. This is more than double the money raised by 18 asset managers in 2016. Last year, former Temasek India head Manish Kejriwal’s Kedaara Capital raised about $750 million for its second fund, while IDFC Alternatives raised $350 million.

PE fundraising slowed soon after the Lehman crisis with asset managers struggling to get out of their investments as valuations were rearranged, said the head of a large US fund in India. “The Moody’s upgrade and related strength seen in the economy and continued strong sentiment are expected to keep the India story intact,” he added.

Source:Economic Times