Government grants further extension in timelines of Income tax compliances

Government grants further extension in timelines of Income tax compliances

The Government has granted further extension of timelines of compliances under Income Tax Act.

It has also announced tax exemption for expenditure on COVID-19 treatment and ex-gratia received on death due to COVID-19. The details are as follows:

A.Tax exemption

- Many taxpayers have received financial help from their employers and well-wishers for meeting their expenses incurred for treatment of Covid-19. In order to ensure that no income tax liability arises on this account, it has been decided to provide income-tax exemption to the amount received by a taxpayer for medical treatment from employer or from any person for treatment of Covid-19 during FY 2019-20 and subsequent years.

- Unfortunately, certain taxpayers have lost their life due to Covid-19. Employers and well-wishers of such taxpayers had extended financial assistance to their family members so that they could cope with the difficulties arisen due to the sudden loss of the earning member of their family. In order to provide relief to the family members of such taxpayer, it has been decided to provide income-tax exemption to ex-gratia payment received by family members of a person from the employer of such person or from other person on the death of the person on account of Covid-19 during FY 2019-20 and subsequent years. The exemption shall be allowed without any limit for the amount received from the employer and the exemption shall be limited to Rs. 10 lakh in aggregate for the amount received from any other persons.

Necessary legislative amendments for the above decisions shall be proposed in due course of time.

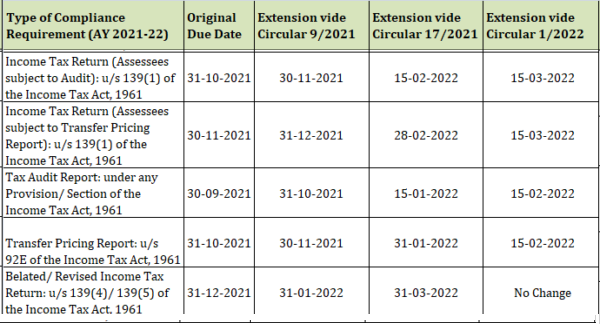

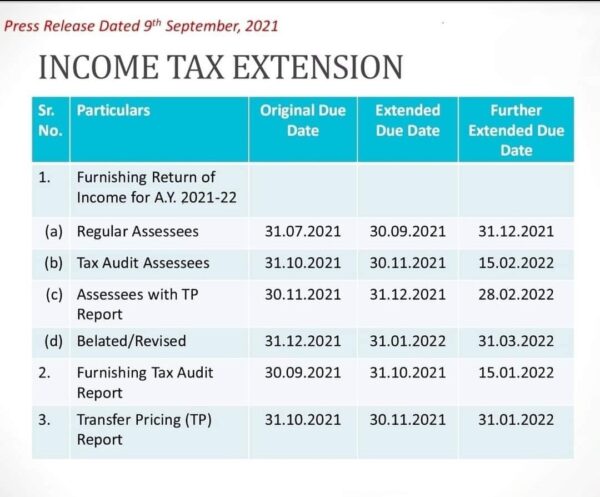

B.Extension of Timelines

In view of the impact of the Covid-19 pandemic, taxpayers are facing inconvenience in meeting certain tax compliances and also in filing response to various notices. In order to ease compliances to be made by taxpayers during this difficult time, reliefs are being provided through Notifications nos. 74/2021 & 75/2021 dated 25th June, 2021 Circular no. 12/2021 dated 25th June, 2021. These reliefs are:

1.Objections to Dispute Resolution Panel (DRP) and Assessing Officer under section 144C of the Income-tax Act, 1961 (hereinafter referred to as “the Act”) for which the last date of filing under that section is 1st June, 2021 or thereafter, may be filed within the time provided in that section or by 31st August, 2021, whichever is later.

2.The Statement of Deduction of Tax for the last quarter of the Financial Year 2020-21, required to be furnished on or before 31st May, 2021 under Rule 31A of the Income-tax Rules,1962 (hereinafter referred to as “the Rules”), as extended to 30th June, 2021 vide Circular No.9 of 2021, may be furnished on or before 15th July, 2021.

3.The Certificate of Tax Deducted at Source in Form No.16, required to be furnished to the employee by 15th June, 2021 under Rule 31 of the Rules, as extended to 15th July, 2021 vide Circular No.9 of 2021, may be furnished on or before 31st July, 2021.

4.The Statement of Income paid or credited by an investment fund to its unit holder in Form No. 64D for the Previous Year 2020-21, required to be furnished on or before 15th June, 2021 under Rule 12CB of the Rules, as extended to 30th June, 2021 vide Circular No.9 of 2021, may be furnished on or before 15th July, 2021.

5.The Statement of Income paid or credited by an investment fund to its unit holder in Form No. 64C for the Previous Year 2020-21, required to be furnished on or before 30th June, 2021 under Rule 12CB of the Rules, as extended to 15th July, 2021 vide Circular No.9 of 2021, may be furnished on or before 31st July, 2021.

6.The application under Section 10(23C), 12AB, 35(1)(ii)/(iia)/(iii) and 80G of the Act in Form No. 10A/ Form No.10AB, for registration/ provisional registration/ intimation/ approval/ provisional approval of Trusts/ Institutions/ Research Associations etc., required to be made on or before 30th June, 2021, may be made on or before 31st August, 2021.

7.The compliances to be made by the taxpayers such as investment, deposit, payment, acquisition, purchase, construction or such other action, by whatever name called, for the purpose of claiming any exemption under the provisions contained in Section 54 to 54GB of the Act, for which the last date of such compliance falls between 1st April, 2021 to 29th September, 2021 (both days inclusive), may be completed on or before 30th September, 2021.

8.The Quarterly Statement in Form No. 15CC to be furnished by authorized dealer in respect of remittances made for the quarter ending on 30th June, 2021, required to be furnished on or before 15th July, 2021 under Rule 37 BB of the Rules, may be furnished on or before 31st July, 2021.

9.The Equalization Levy Statement in Form No. 1 for the Financial Year 2020-21, which is required to be filed on or before 30th June, 2021, may be furnished on or before 31st July, 2021.

10.The Annual Statement required to be furnished under sub-section (5) of section 9A of the Act by the eligible investment fund in Form No. 3CEK for the Financial Year 2020-21, which is required to be filed on or before 29th June, 2021, may be furnished on or before 31st July, 2021.

11.Uploading of the declarations received from recipients in Form No. 15G/15H during the quarter ending 30th June, 2021, which is required to be uploaded on or before 15th July, 2021, may be uploaded by 31st August,2021.

12.Exercising of option to withdraw pending application (filed before the erstwhile Income Tax Settlement Commission) under sub-section (1) of Section 245M of the Act in Form No. 34BB, which is required to be exercised on or before 27th June, 2021, may be exercised on or before 31st July, 2021.

13.Last date of linkage of Aadhaar with PAN under section 139AA of the Act, which was earlier extended to 30th June, 2021 is further extended to 30th September, 2021.

14.Last date of payment of amount under Vivad se Vishwas (without additional amount) which was earlier extended to 30th June, 2021 is further extended to 31st August, 2021.

15.Last date of payment of amount under Vivad se Vishwas (with additional amount) has been notified as 31st October, 2021.

16.Time Limit for passing assessment order which was earlier extended to 30th June, 2021 is further extended to 30th September, 2021.

17.Time Limit for passing penalty order which was earlier extended to 30th June, 2021 is further extended to 30th September, 2021.

18.Time Limit for processing Equalisation Levy returns which was earlier extended to 30th June, 2021 is further extended to 30th September, 2021.