The Ministry for Corporate Affairs Ministry has hinted that the suspension of the Insolvency and Bankruptcy Code (IBC) is likely to be revoked after March 24.

he Ministry for Corporate Affairs Ministry has hinted that the suspension of the Insolvency and Bankruptcy Code (IBC) is likely to be revoked after March 24.

This has been conveyed in a written submission by the Ministry to the Standing Committee on Finance headed by Jayant Sinha. This submission came along with the note on allocation and utilisation of funds for the Insolvency and Bankruptcy Board of India (IBBI), which is the insolvency regulator.

“It is expected that the suspension of the Insolvency and Bankruptcy Code will likely be revoked after March 24 and activities of IBBI will be increased manifold in the next financial year,” the MCA submission said.

Given that the economy is now in recovery mode, it is widely expected that the Centre will revoke the suspension after March 24. Also, any extension of the suspension this date would require Parliament approval, legal experts said.

6-month suspension

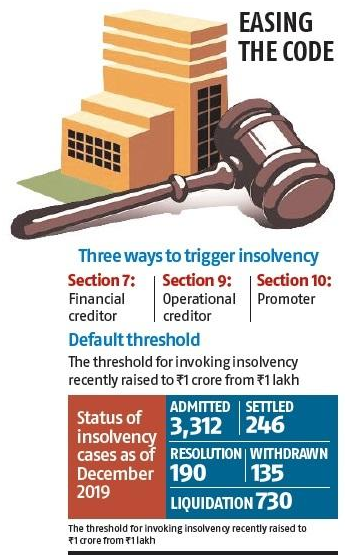

A six-month suspension was first introduced in June 5 for debt defaults arising post March 25, 2020, when the Covid-induced lockdown was announced. The suspension was to end on September 25, but was extended up to December 25. In mid-December, the suspension was further extended by three months, up to March 25.

In effect, the government had ensured that any corporate debt default during Covid, between March 25, 2020 and March 25, 2021, will remain outside the IBC purview. However, for defaults before March 25, 2020, there will be no protection, said experts.

While the law protects the corporate debtor from insolvency proceedings for the one-year period till March 25, it does not disallow such action against the personal guarantors of a corporate debtor.

‘Go digital’

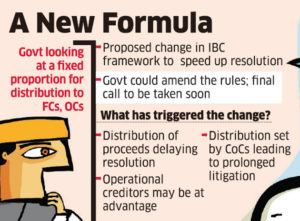

In a separate development, the Standing Committee on Finance has, in its latest report tabled in the Lok Sabha on Tuesday, directed the MCA to move towards full digitisation of its functions, particularly of its statutory bodies. It sees the quasi judicial bodies facing a deluge of cases post withdrawal of the moratorium and underscored stressed the need to enhance their digital and infrastructural capacities to handle the increase in caseload.

Source: Business Line