The annual mandatory compliances which a private limited company has to follow are listed below:

- Appointment of Auditor

The Statutory Auditor of the company shall be appointed for the 5 (Five) years and e-Form ADT-1 shall be filed for 5-year appointment. After that, in every year AGM, Shareholders shall ratify the Auditor, though there is no need to file e-Form ADT-1. The first Auditor of a company shall be appointed within one month from the date of incorporation of the Company.

- Statutory Audit of Accounts

Every Company shall prepare its Accounts and get the same audited by a Chartered Accountant at the end of the Financial Year compulsorily. The Audit Report and the Audited Financial Statements shall be attached for the purpose of filing it with the Registrar.

- Filing of Annual Return (e-Form MGT-7)

Every Private Limited Company is required to file its Annual Return within 60 days of holding of Annual General Meeting. Annual Return will be for the period 1st April to 31st March. There shall be attached the list of shareholders, as annexure to the e-Form MGT-7.

Annual Return shall be digitally signed by a Director and the Company Secretary; or where there is no Company Secretary by a Company Secretary in Practice.

If paid up capital of the company is more than Rs. 10 crore or turnover is more than Rs. 50 crore, a copy of e-Form MGT-8 (Certificate by Practicing Professional) is required to be annexed in e-Form MGT-7.

- Filing of Financial Statements (e-Form AOC-4)

Every Private Limited Company is required to file its Balance Sheet along with statement of Profit and Loss Account and Directors’ Report in this e-Form AOC-4, within 30 days of holding of Annual General Meeting.

- Holding Annual General Meeting (AGM)

It is mandatory for every Private Limited Company to hold an Annual General Meeting of the shareholders in every Calendar Year. Companies are required to hold their AGM within a period of six months, from the date of closing of the Financial Year.

- Holding of Board Meeting

Every Company shall hold a minimum number of FOUR meetings of its Board of Directors every year in such a manner that maximum gap between two meetings should not be more than 120 (One hundred twenty) days. Company should hold at least 1 (one) Board Meeting every quarter of calendar year.

Preparation of Directors’ Report

Directors’ Report shall be prepared with a mention of all the information required under Section 134 of the Companies Act, 2013. Board’s report and any annexures thereto shall be signed by the ‘Chairperson’ authorized by the board or at least by two directors.

The above are the minimum annual compliances for a Private Limited Company in India – essentially, having minimum of 4 board meeting in a year, having an annual general meeting and having the audited accounts and filing e-Forms MGT-7, AOC-4 and ADT-1 with Ministry of Corporate Affairs.

Non-Compliance

If a Company fails to comply with the rules and regulations of the Companies Act, then the Company and every officer who is in default shall be punishable with fine for the period for which default continues.

If there is delay in any filing, then additional fees is required to be paid, which keeps on increasing as the time period of non-compliance increases.

Other event-based filing with e-Form MGT-14

Besides Annual Filings, there are various other compliances to be made as and when any event takes place in the Company. The instances of such events are:

- Change in Authorised or Paid up Capital of the Company. – e-Form SH-7

- Allotment of new shares or transfer of shares – e-Form PAS-3

- Amendment of Objects Clause of Memorandum of Association

- Change of situation of the Registered Office – e-Form INC 22 / e-Form INC 23

- Giving Loans to other Companies.

- Giving Loans to Directors

- Appointment of Managing or whole time Director and payment of remuneration.

- Availing of Term Loan / Working Capital or enhancement of WC limits from banks or institutions.

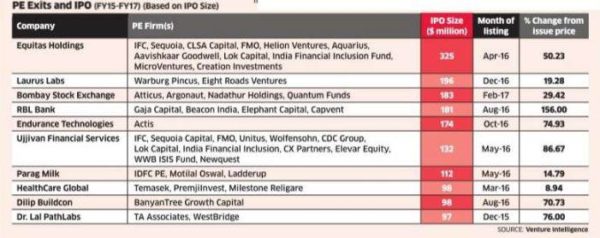

- Raising of Private Equity or going for IPO.

- Appointment or change of the Statutory Auditors of the Company.

Different forms are required to be filed with the Registrar for all such events, with e-filing of resolutions and agreements to the Registrar in e-Form MGT-14, within specified time periods. In case, the same is not done, additional fees or penalty might be levied. Hence, it is necessary that such compliances are met on time.

Home service startup UrbanClap has raised Rs.20 Crore of debt funding from California-Based Trifecta Capital through Non-Convertible Debentures.

Home service startup UrbanClap has raised Rs.20 Crore of debt funding from California-Based Trifecta Capital through Non-Convertible Debentures.