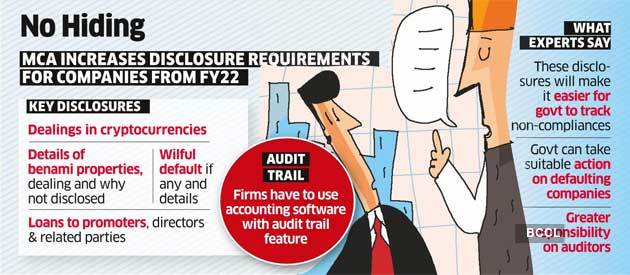

India Inc will have to declare investments in cryptocurrencies, relationships with dissolved companies and loans extended to related parties, among a host of other disclosures mandated by the government to improve transparency.

Starting April 1, companies must state if they have been declared wilful defaulters by banks, financial institutions or other lenders.

The ministry of corporate affairs announced a new set of disclosures rules under the Companies Act on Wednesday, significantly enhancing financial and general reporting requirements for companies.

The ministry also mandated companies to record audit trails of their accounts. Firms using accounting software to maintain their books need to use features that can record the audit trail of each transaction and create an edit log, including the date of such changes.

Amending the Companies (Accounts) Rules, the ministry said firms must ensure the audit trail feature on the accounting software cannot be disabled. The move is aimed at curbing backdated entries and will affect mainly smaller companies as the bigger ones already use such software, according to Shalu Kedia, a partner at Nangia & Co.

Additional disclosures to be made under schedule III of the Companies Act, 2013, relate to matters such as corporate social responsibility spending, cryptocurrency dealings, benami property, relationship with struck-off, or dissolved, companies, and ageing of payables & receivables with vendors.

These disclosures will make it easier for the government to track non-compliance and take action against defaulting companies, experts said.

“Earlier, the companies were only required to disclose trade payables and receivables, but there was no requirement to provide ageing details. This disclosure will mandate the company to disclose the ageing payment cycle for MSMEs and non-MSME vendors,” said Nischal Arora, a partner at Nangia Andersen LLP.

Dealings in cryptocurrencies must be disclosed with details of the profit or loss on such transactions, amounts of such currency held and deposits or advances from any person for trading or investing in these currencies.

“While the government is already working on a bill on cryptocurrency, the disclosure for such currency has made it clear that the government wants to gather data on cryptocurrency,” said Arora.

Another important change was related to the disclosure of any benami property holdings.

“This disclosure is another step to improve transparency for the stakeholders as they will have to disclose any proceeding that has been initiated or pending against the company for holding any benami property and also provide a reasoning and view on the same,” said Amit Maheshwari, a partner at AKM Global.

The additional disclosures will make it mandatory for companies to provide details of shortfall in CSR spending for the previous years, including reasons for not meeting targets.

Loans granted to promoters, directors and related parties that are repayable on demand or without specific repayment terms from companies must be declared in terms of amount and percentage to total loans granted.

While this will push firms to regularly service their loans, it “will be helpful for the investor and other lenders to be aware about these types of companies before making any investment or lending the money,” Maheshwari said.

Schedule III Amendment Notification_24032021

Source: Economic Times