The Income-Tax Department has launched an online facility to link Permanent Account Numbers with Aadhaar.

It was reported that taxpayers were finding it difficult as their names did not match in both systems (Eg. Names with initials in one and expanded initials in another). Responding to such grievances,the Department has come out with a simple solution now.

Under the facility, the taxpayer will have to provide the PAN and Aadhaar number, which then will be verified from the Unique Identification Authority of India, and then the two will be linked.

Visit www.incometaxindiaefiling.gov.

“In case of any minor mismatch in Aadhaar name provided, Aadhaar one time password (OTP) will be required,” as per the clarification from Central Board of Direct Taxes (CBDT). The taxpayers must ensure that the date of birth and gender in PAN and Aadhaar are exactly same for the facility to work.

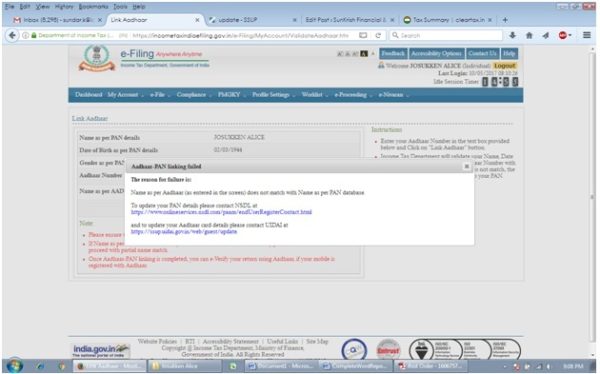

In case the Aadhaar name is different from the name in PAN, then the linking will fail. The taxpayer will then be prompted to change the name in either the Aadhaar or in the PAN database.

Assessees can use the new utility https://onlineservices.tin.egov-nsdl.com/Aadhaar_Seeding/ for Aadhar – PAN linking on NSDL website. The Aadhaar one time password (OTP) will be generated for the above validation.

To update your PAN details, please visit NSDL: https://www.onlineservices.

To update your Aadhaar card details, please visit UIDAI: https://ssup.uidai.gov.in/web/

Please use the simplified process to complete the linking of Aadhaar with PAN asap. This is required for E-Verification of Income Tax returns using Aadhaar OTP.