MCA extends deadline for mandatory Demat of Private Company shares until 30th June 2025

The Ministry of Corporate Affairs (MCA) has officially extended the deadline for the mandatory dematerialization of securities for private companies. According to the latest notification issued on February 12, 2025, the new compliance deadline has been pushed to June 30, … Continued

MCA grants extension of time for Limited Liability Partnerships

The Ministry of Corporate Affairs (MCA) has recently extended the deadline for filing Form LLP BEN-2 and LLP Form No. 4D for Limited Liability Partnerships (LLPs). Here are the details: Background: The MCA introduced LLP BEN-2 and LLP Form No. 4D as crucial forms for declarations under … Continued

Mandatory requirement of Unlisted Companies to have shares in Demat Form

Background: Till now, only public limited companies were required to issue these securities in dematerialized form and private limited companies were exempted and hence could issue their securities in the form of a physical document. Previously, the Ministry of Corporate … Continued

Amnesty Scheme for LLPS – MCA issues circular condoning delay in filing Form 3, 4 and 11

The Ministry of Corporate Affairs (MCA) has notified the Limited Liability Partnership (LLP) Amnesty Scheme. The ministry vide circular number No. 8/2023 issued on 23rd August 2023 condoning the delay in filing of Form-3, Form-4 and Form-11 under Section 67 … Continued

MCA amends strike-off rules – Mandatory filing of overdue Financial Statements, before striking-off of companies

The Ministry of Corporate Affairs (MCA) has notified an amendment to the Companies (Removal of Names of Companies from the Register of Companies) Rules, 2016. The amendment provides more clarity on the filing requirements of overdue financials before applying for … Continued

Ministry of Corporate Affairs to launch 56 forms in V3 portal from Jan, 2023

Source: MCA Circular The Ministry of Corporate Affairs (MCA) is all set to launch the Second Set of Company Forms on the MCA21 V3 portal, in January 2023, comprising of total 56 forms. The first lot will consist of 10 … Continued

MCA extends time for filing e-form DIR-3-KYC & DIR-3-KYC-WEB

The MCA vide General Circular No. 09/2022 dated September 28, 2022 extends the timeline for filing e-form DIR-3-KYC and web-form DIR-3-KYC-WEB without fee upto October 15, 2022. Director’s KYC Filing is an annual compliance and applies to every person who … Continued

Small Companies thresholds further increased by MCA (Paid-up Capital/ Turnover)

MCA has further revised/ increased the ‘paid-up capital’ and ‘turnover’ thresholds applicable in the case of ‘small companies’ under the Companies Act, 2013, to reduce compliance burden for more number of companies to be treated as ‘small companies’, as part … Continued

MCA further extends due date of filing Annual Return and Financial Statement till March 15.

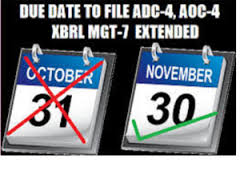

The Ministry of Corporate Affairs (MCA) has again extended the due date of filing Annual Return and Financial Statement. The MCA has again relaxed the levy of additional fees for filing of e-forms AOC-4, AOC-4 (CFS), AOC-4, AOC-4 XBRL AOC-4 … Continued

MCA grants extension of time for filing Financial Statements & Annual Return for 2020-21

The Ministry of Corporate Affairs has recently granted the much-needed relief by extending the dates for filing of the 5 important e-forms with the removal of additional fees on the e-forms, namely Forms Annual Financial Statements -AOC-4, AOC-4 (CFS), AOC-4, … Continued

MCA relaxes additional fees in filing of Annual Financial Statement under the Companies Act, 20l3

On October 29, 2021, the Ministry of Corporate Affairs (MCA) has announced the relaxation in levy of additional fees in filing of e-forms AOC-4, AOC-4 (CFS), AOC-4, AOC-4 XBRL AOC-4 Non-XBRL and MGT-7 / MGT-7A for the financial year ended … Continued

MCA gives compliance relief to businesses due to second wave of COVID-19

The ministry of corporate affairs (MCA) has offered relaxation in certain compliance requirements for businesses, including a longer interval between two board meetings in view of the hardships during the second wave of the pandemic. Companies are normally required … Continued

SEBI extends deadlines for filing financial results for Indian listed firms due to COVID-19

The Securities and Exchange Board of India (SEBI), on Thursday, relaxed the deadline for listed Indian firms to announce their financial results in the wake of surging covid-19 cases in the so-called second wave of the pandemic in the country. … Continued

MCA allows India Inc to spend CSR funds for COVID-19 vaccination awareness campaigns

In a significant boost to corporate India looking to undertake CSR around the COVID-19 pandemic, the corporate affairs ministry (MCA) has clarified spending of CSR funds for setting up “makeshift hospitals and temporary Covid care facilities” would be treated as … Continued

New MCA rules make cryptocurrencies, benami, loan disclosures mandatory

India Inc will have to declare investments in cryptocurrencies, relationships with dissolved companies and loans extended to related parties, among a host of other disclosures mandated by the government to improve transparency. Starting April 1, companies must state if they … Continued

MCA establishes Central Scrutiny Centre for scrutiny of Straight Through Processes (STP) e-forms

In the Budget 2021, it was mentioned that govt. will be establishing technology based on data analytics, artificial intelligence, machine learning tools in the areas of finance, taxation and online compliance monitoring among others. Accordingly, MCA has now established a … Continued

Year-long IBC suspension to be lifted ‘after March 24’, hints MCA

The Ministry for Corporate Affairs Ministry has hinted that the suspension of the Insolvency and Bankruptcy Code (IBC) is likely to be revoked after March 24. he Ministry for Corporate Affairs Ministry has hinted that the suspension of the Insolvency … Continued

Companies get relaxation for Annual Filings of 2019-20 upto 15/02/2021 without additional fees.

Keeping in view of various requests received from stakeholders regarding relaxation on levy of additional fees for annual financial statement filings required to be done for the financial year ended on 31.03.2020, it has been decided that no additional fees … Continued

AGM due date extended till 31.12.2020 for all companies

A major relief has been granted to around 1.2 million companies, by MCA granting extension of 3 months for holding annual general meeting. The MCA had earlier allowed companies to hold virtual AGMs due to Covid-19. However, companies were finding … Continued

Extension of Annual General Meeting for the FY 2019-20 – MCA

Due to the widespread of COVID-19 and social distancing norms and consequential restrictions linked thereto, MCA has received several representations to allow companies to hold their Annual General Meeting for the financial year ended on 31st March, 2020 beyond the … Continued

SEBI extends deadline for filing April-June corporate financial results to September 15

In a major relief to companies, the Securities and Exchange Board of India (SEBI) today extended the deadline for submission of financial results for the quarter, half-year, and financial year ended 30 June 2020 to September 15. The SEBI circular … Continued

SEBI signs MoU with CBDT for Data Exchange

A formal Memorandum of Understanding (MoU) was signed today between the Central Board of Direct Taxes (CBDT) and the Securities and Exchange Board of India (SEBI) for data exchange between the two organizations. The MoU was signed by Smt. … Continued

IBBI proposes to limit cases with insolvency professionals

In what may bring about major reform and efficiency in the insolvency regime in India, the Insolvency and Bankruptcy Board of India (IBBI) has proposed to limit the number of cases an insolvency professional can handle to five as it … Continued

Companies get more time to meet deposit repayment and debenture reserve norms amid COVID-19

The government has given a three-month extension to companies to set aside a part of the deposits and debentures maturing in FY21 in a dedicated account, a statutory requirement under the Companies Act. The Ministry of Corporate Affairs (MCA) said … Continued

ICAI enables generation of Bulk UDINs for Certificates

A provision for generating UDIN in bulk for Certificates has been incorporated in UDIN Portal. Using this facility now the members will be able to generate UDIN in bulk (uptil 300 UDINs) for various types of Certificates in one go. … Continued

MCA relaxes time to file forms for creation/modification of charges

In a view of the pandemic situation due to COVID-19 outbreak and several representations made, by the stake holders, Ministry of Corporate Affairs (MCA) has came out with a new scheme called “Scheme for relaxation of time for filing forms … Continued

EGMs deadline extended upto 30 Sept 2020 by MCA

MCA extends the deadline for conducting extra ordinary general meetings (EGMs) through VC/ OAVM/ Postal Ballot and passing of ordinary/ special resolutions, from 30 June to 30 Sept. 2020, provided the other guidelines of the framework, prescribed earlier, are adhered … Continued

Despite pandemic, Tamil Nadu attracts 17 investors worth Rs.15,128

As many as 17 MoUs’ to bring in fresh industrial investments worth Rs 15,128 crore into Tamil Nadu were signed between a host of foreign companies and the Tamil Nadu government in the presence of chief minister Edappadi K Palaniswami … Continued

NCLAT quashes NCLT order to make MCA party in all insolvency cases

The National Company Law Appellate Tribunal (NCLAT) quashed an order of the National Company Law Appellate Tribunal (NCLT) directing that the Ministry of Corporate Affairs (MCA) be made a party to every case under the Insolvency and Bankruptcy Code (IBC) … Continued

MCA has extended the period for names reserved and re-submission of forms

Ministry of Corporate Affairs ( MCA ) has extended the period for names reserved and re-submission of forms. Issue description and Period/Days of Extension are as below: – Names reserved for 20 days for new company incorporation.SPICe+ Part B needs … Continued

Govt suspends IBC provisions that trigger fresh insolvency proceedings

The government has decided to suspend insolvency and bankruptcy proceedings for at least six months owing to challenges businesses are facing due to the Covid-19 pandemic. A new Section is likely to be added to the Insolvency and Bankruptcy Code … Continued

Companies Fresh Start Scheme, 2020 (CFSS-2020)

The Ministry of Corporate Affairs has introduced the “Companies Fresh Start Scheme, 2020” and revised the “LLP Settlement Scheme, 2020” which is already in vogue to provide a first of its kind opportunity to both companies and LLPs to make … Continued

Nirmala Sitharaman: ITR / GST Return filing dates extended, relief from late fee, penalties

Finance minister Nirmala Sitharaman announced a slew of measures for extension of statutory and regulatory compliances in view of the corona virus pandemic spreading its wings and impacting the economy. Allaying fears that there is no economic emergency in the … Continued

Companies and LLPs confirm their readiness towards COVID-19: MCA

Advisory on Preventive measures to contain the spread of COVID19 The Ministry of Corporate Affairs ( MCA ) is in the process of developing and deploying a simple web form named CAR (Company Affirmation of Readiness towards COVID-19) for companies/LLPs … Continued

MCA notifies Companies (Auditor’s Report) Order 2020 – CARO 2020.

CARO 2020 – Companies (Auditor’s Report) Order, 2020 MCA in place of existing the Companies (Auditor’s Report) Order, 2016, has notified CARO 2020 after consultation with the National Financial Reporting Authority constituted under section 132 of the Companies Act, 2013. … Continued

Key features of SPICe+ for Incorporation of New Companies in India

As part of Government of India’s Ease of Doing Business (EODB) initiatives, the Ministry of Corporate Affairs would be shortly notifying & deploying a new Web Form christened ‘SPICe+’ (pronounced ‘SPICe Plus’) replacing the existing SPICe form. SPICe+ would save … Continued

MCA notifies (Winding Up) Rules, 2020: Shutting business now easier for small firms

The Ministry of Corporate Affairs (MCA) on Tuesday notified rules for winding up of companies, making it easier for smaller firms to wind up businesses without taking approval. The rules have provided summary procedures for liquidation of companies with asset … Continued

Large unlisted companies face quicker disclosure rule

Large unlisted companies may have to make quarterly or half-yearly filings, like their listed counterparts, as the government is considering amendments to the Companies Act to mandate more frequent disclosures in the aftermath of the IL&FS collapse. The ministry of … Continued

SEBI action against auditors not ‘turf war’: Ajay Tyagi

Capital markets regulator Sebi on Wednesday said its actions against auditors for faulty audits are within its “Parliamentary mandate”, and there is no question of “turf wars” on this issue. SEBI Chairman Ajay Tyagi said the watchdog is working only … Continued

MCA amends threshold limits for Related Party Transactions.

The central government notified the Companies (Meetings of Board and its Powers) Second Amendment Rules, 2019 on 18 November 2019. The amendment rules amend sub-clause 3 of rule 15 of the Companies (Meetings of Board and its Powers) Rules, 2014. … Continued

Insolvency regime for personal guarantors to corporate debtors from December 1

The insolvency regime for individual guarantors to corporate debtors will be in force from December 1, according to the government. The provisions for resolution for individuals under the Insolvency and Bankruptcy Code (IBC) is being implemented in a phased manner. … Continued

IBC proceeds formula may be reworked to avoid squabbles, legal delays

The government is considering a formula for distributing the proceeds of insolvency resolution among financial and operational creditors in a fixed proportion, said people with knowledge of the matter. The goal is to protect the interests of operational creditors and … Continued

Re-activate your de-activated DIN

Deactivation of DIN for non-compliance of KYC by company Directors has since been marked as ‘Deactivated due to non-filing of DIR-3 KYC’. The Ministry of Corporate Affairs website (“MCA”), MCA has stated that the DINs which have not complied with the … Continued

MCA extends due date for filing of AOC 4 and MGT 7 (Financial Statements & Annual Return)

MCA has notified that the due date for filing of financial statements and annual return in e-forms AOC 4, AOC (CFS) and AOC-4 XBRL upto 30 Nov. 2019 and e-form MGT 7 up to 31 Dec. 2019 by companies without … Continued

MCA plans to amend CA Act to remove conflict of interest in audits

The Ministry of Corporate Affairs is planning to amend the Chartered Accountants Act to build disciplinary mechanisms for removing possible conflicts of interest between audit firms and companies they audit. The government is also looking at ways to address the … Continued

DIR-3 KYC for Financial year 2018-19 has been extended

As per Ministry of Corporate Affairs, if any person has been allotted “Director Identification Number” and the status of such DIN appears to be Approved then such Director needs to file a form to update DIR-3 KYC details in the … Continued

Government mulls ceiling for audit firms amid crack down on lapses

India is considering tougher rules for audit firms, including a cap on the number of listed companies they can examine, according to a person with knowledge of the matter, as the government seeks to tighten oversight after a recent spate … Continued

Clarification on Auditor’s Certificate on Return of Deposits-DPT-3

Clarification on Auditor’s Certificate on Return of Deposits pursuant to Rule 16 of the Companies (Acceptance of Deposits) Rules, 2014 This has reference to Rule 16 of the Companies (Acceptance of Deposits) Rules, 2014 and further amendments. In this … Continued

All companies to file a one-time return of all outstanding receipts of money or loans from April 1, 2014, to March 31st, 2019

With a spate of corporate irregularities coming to the fore, the Centre has decided to make disclosure norms more stringent. Corporate India is now required to submit details of transactions involving the receipt of money or loans taken by them, which are … Continued

Income tax department eyes over Rs 100 bn from ‘struck off’ firms

The income-tax (I-T) department is estimating tax recovery of over Rs 100 billion from companies that have been struck off from records of the Registrar of Companies (RoC) last year. The tax department is in the process of filing a petition before the National Company … Continued

GST annual return due date extended till 31 August 2019 for FY 2017-18

35th GST Council Meeting Highlights 35th GST Council Meeting was held on 21 June 2019 at New Delhi, after a gap of more than three months, chaired by Union Finance Minister, Mrs Nirmala Sitharaman. This GST Council meeting has been … Continued

MCA sees Rs 2.8 lakh cr recovery from IBC-led resolution process

Terming the current insolvency process and its outcomes as ‘super success, Ministry of Corporate Affairs sees total recovery amount touching Rs 2.8 lakh crore through resolutions with the settlement of two key accounts, including some others — Essar Steel, where … Continued

MCA brings more clarity on guidelines for reserving the name of the Company

MCA has created a dedicated unit Central Registration Centre (CRC) to expedite the incorporation related activities including Name approval. Yet the stakeholders were facing difficulty in getting the name approved due to lack clarity in the Rules for selection of … Continued

Government releases compliance schedule to ensure MSME payments

Directors of companies delaying payments for supplies made by small businesses will face imprisonment up to six months or pay fines between Rs 25,000 and Rs 3,00,000. The Ministry of Corporate Affairs has notified new guidelines to address the concerns … Continued

DIR-3-DIN eKYC annual filing deadline extended to 30th June of next financial year

MINISTRY OF CORPORATE AFFAIRS NOTIFICATION New Delhi, 30th April, 2019 MCA has notified that the Deadline for Annual Filing of Form DIR 3 ((KYC of Directors) has been Extended from 30 April to 30 June, of the … Continued

MCA Extends Due date of filing form INC 22A (ACTIVE) till 15th June 2019

The Government of India, through the Ministry of Corporate Affairs, has made it mandatory for to file ACTIVE eForm or INC-22A. The due date for filing INC-22A was 25th April 2019. There have been representations made to the MCA for … Continued

Filing of e-Form DIR 3 for KYC of Directors mandatory, on Annual Basis – MCA

MCA’s Clarification on filing of e Form DIR – 3 KYC, annually, by all Directors holding DIN The Ministry of Corporate Affairs (MCA) has on 13th April, 2019, given the clarification with regards to filling of e-Form DIR – 3 … Continued

All Active Companies to submit “Active Company Tagging Identities and Verification” Form_INC-22A before 26th Apr 2019

Inactive Companies, Vanishing Companies, Shell Companies, Multiple Companies registered under the same address and Companies without proper Registered Offices operating have all been a problem with the Indian regulatory framework which have significantly hampered the ability of the MCA to … Continued

President promulgates Unregulated Deposit Scheme Ordinance

The President on Thursday promulgated the Banning of Unregulated Deposit Scheme Ordinance which seek to curb the menace of ponzi schemes and make such unregulated deposit scheme punishable. The Ordinance will help put a check on illicit deposit taking activities … Continued

The Companies (Amendment) Ordinance, 2019 – highlights

The Companies (Amendment) Ordinance, 2019 was promulgated on January 12, 2019. It repeals and replaces the Companies (Amendment) Ordinance, 2018 promulgated on November 2, 2018. The 2019 Ordinance amends several provisions in the Companies Act, 2013 relating to penalties, among … Continued

MCA extends Annual Return due date upto 31 Dec. 2018

Keeping in view the requests received from various stakeholders seeking extension of time for filing of financial statements for the financial year ended 31.03.2018 on account of various factors, it has been decided to relax the additional fees payable by companies on e-forms … Continued

As SEBI reforms startup listing, SMEs must ensure funds are not misused

Amid SEBI banning as many as 239 entities for alleged money laundering, taxation consultancy PwC has called for a three-year locking-in for the entire pre-listing capital held by promoters to curb tax evasion and other illegal activities through market platforms. … Continued

Keep your DIN status approved by filing DIR-3 KYC before 5 th October, 2018

The Ministry of Corporate Affairs (MCA) has decided to give 21 lakh India Inc directors another 15 days to reactivate their Director Identification Numbers (DINs) by filing Know-Your-Customer (KYC) details upon paying a reduced fee. The decision was taken by … Continued

2.1 million company directors may get another chance to adhere to KYC rules

The government is considering giving another opportunity to 2.1 million company directors who have failed to comply with the ‘know your customer’ (KYC) norms, according to a senior official. The government could give another 15 days for meeting the compliance … Continued

MCA extends due date of DIR-3KYC / E-KYC of Directors

In order to update the Directors database of The Ministry of Corporate Affairs(MCA), MCA has requested all Directors holding a DIN to complete DIN KYC before 15th September 2018. To complete DIN KYC, the Director would be required to file a … Continued

SEBI calls for stringent laws against erring auditors, valuers

India’s capital market regulator has proposed amendments to tighten laws governing auditors and other third-party individuals hired by listed companies for auditing financial results, among other things. The Kotak Committee, formed to come up with proposals for improving corporate governance, … Continued

SEBI tweaks rules for IPOs, buybacks and takeovers

The Securities and Exchange Board of India (Sebi) on Thursday eased several rules relating to Initial Public Offers (IPO), rights issues, buybacks and takeovers. The regulator’s board approved these changes as also those relating tenures of managing directors of market … Continued

Companies Act Compliance: Consequences of not filing Annual Return

The financial statements and annual returns of all company must be filed on time with the ROC / MCA each year. As per Companies Act, 2013, non-filing of annual return is an offence, consequences of which affect the directors, as … Continued

SEBI panel proposes stricter norms for RTAs

A Securities and Exchange Board of India (Sebi) panel on Friday proposed tighter ownership and governance norms for registrar and transfer agents (RTAs). According to a discussion paper released by Sebi, the panel, headed by former Reserve Bank of India … Continued

SEBI puts in place new framework to check non-compliance of listing rules

Sebi has put in place a stronger mechanism to check non-compliance of listing conditions, wherein exchanges will have powers to freeze promoter shareholding and even delist the shares of such defaulting companies. The move is aimed at maintaining consistency and … Continued

Listed SMEs to touch 1,000 in next 2 yrs: Merchant banker

The number of small and medium enterprises listed on BSE and NSE platforms is expected to reach 1,000 in the next two years from nearly 350 at present, leading merchant banker Guiness Corporate Advisory Services said today. More companies will … Continued

Non-compliance to be ‘very costly’ for companies: Government

Sending out a strong message to corporates, the government has said non-compliance will be “very costly” and strong deterrents will be there to curb the dangerous adventure of using companies for wrongful purposes. Continuing the clampdown on illicit fund flows, … Continued

MCA introduces Condonation of Delay Scheme 2018 for defaulting companies

MCA introduces Condonation of Delay Scheme 2018 (CODS-2018) for defaulting companies to file its overdue returns/documents due for filing till 30.06.2017 by temporarily activating DIN of disqualified directors General Circular No………./2017 File No. 02/04//2017 Ministry of … Continued

Cannot provide relief for de-registered firms, disqualified directors: Minister

The Corporate Affairs Ministry has ruled out providing any relief for the 2.25 lakh de-registered companies and the 3.09 lakh disqualified directors, stating that these actions were caused by the ‘operation of law’. “There is no proposal before us to … Continued

MCA scanner on banks lending to deregistered companies

The corporate affairs ministry is likely to ask the department of financial services to take action against the banks which have continued lending to companies that have been deregistered. The ministry is also likely to raise the issue of banks … Continued

MCA extends the due date for filing all AOC-4 (Annual Financial Statemet) till 28.11.2017.

Ministry of Corporate Affairs has extended the due date for filing the Audited Financial Statement for Financial Year 2016-17 till November 28,2017. Keeping in view the requests received from various stakeholders, for allowing extension of time for … Continued

Government tightens screws on assets owned by deregistered companies

The corporate affairs ministry today asked states to complete identification of properties owned by deregistered companies at the earliest and ensure district administrations prevent transactions in those assets. Amid intensifying efforts to fight the black money menace, the ministry has … Continued

MCA plans to ease process for starting biz

The Ministry of Corporate Affairs plans to simplify the existing processes for setting up a company, according to a public notice. In this regard, the ministry — which is implementing the Companies Act — has sought views from the stakeholders. … Continued

200,000 more directors disqualified for holding posts in defaulting companies

The corporate affairs ministry has disqualified another 200,000 directors for holding posts in defaulting companies that have not filed their financial returns for the last three years or more, taking the total number to over 300,000, while cancelling the registration … Continued

Bankruptcy board to register 100 more insolvency professionals to add to 940

The Insolvency and Bankruptcy Board of India (IBBI), which has so far registered 940 insolvency professionals (IPs), is in the process of granting registration to about 100 more such professionals, according to its whole time member Navrang Saini. “It is … Continued

Income-tax department, MCA team up against shell firms

The income tax (I-T) department and the Ministry of Corporate Affairs (MCA) have signed a pact to regularly share data, including PAN and audit reports of firms, to crack down on shell companies, the government said on Thursday. The pact … Continued

Centre asks banks to restrict accounts of 2.09 lakh firms

The finance ministry has advised all banks to take immediate steps to restrict transactions in bank accounts of more than 2.09 lakh companies, whose names have been struck off the Register of Companies. Banks have also been advised to step … Continued

Attack on shell firms: MCA issues notices to errant NBFCs

In yet another attempt to crack the whip on shell companies, the Ministry of Corporate Affairs has issued notices to companies which were supposed to act as non-banking financial companies (NBFCs) but have not registered with the Reserve Bank of … Continued

Directors of Shell firms can’t join other companies’ boards

Directors of shell companies which have not filed tax returns for three or more years will be barred from taking similar positions elsewhere or getting reappointed, the government said, as it intensified the crackdown on firms that exist only on … Continued

Capital gains tax evasion under CBI scanner

The Central Bureau of Investigation (CBI) is probing if any government officials were involved in misusing stock exchange platforms to benefit from the long-term capital gains tax (LTCG) exemption. According to sources, CBI officials visited the headquarters of the Securities … Continued

SEBI plans stricter norms for Independent Directors

Markets watchdog Securities and Exchange Board of India (SEBI) plans to overhaul the regulatory framework for corporate governance, including appointment and removal of independent directors, people familiar with the matter said. Besides, a high level panel is looking at corporate … Continued

Government to soon make Aadhaar compulsory for regulatory filings under Companies Act

The government will soon make quoting of Aadhaar number compulsory for key managerial personnel and directors in regulatory filings under the Companies Act. The move, primarily aimed at tackling the issue of bogus identities, comes at a time when authorities … Continued

Government prepares to strike off registration of over 2 lakh companies

The government plans to cancel the registration of more than two lakh companies that have not been carrying out business for a considerable period of time, amid stepped up efforts to tackle the black money menace. More than two lakh … Continued

CBDT allots PAN and TAN in a day for ease of doing business

In another move to improve ease of doing business in India, the Income Tax Department has tied up with the Corporate Affairs Ministry (MCA) to issue Permanent Account Numbers (PAN) and Tax Deduction Account Numbers (TAN) within a day, an … Continued

After PM Modi Order, Enforcement Directorate’s crackdown on Shell Companies begins across 100 cities

Weeks after the Prime Minister Narendra Modi’s office ordered a crackdown on shell companies used to launder money, the Enforcement Directorate on Saturday carried out nationwide searches across 100 locations targeting nearly 300 shell companies. Sources said Saturday’s ED raids … Continued

India will be home to 10,500 start-ups by 2020: Report

India continues to harbour the third largest start-up base, marginally behind the U.K., according to a Nasscom-Zinnov start-up report. The report, titled “Indian Start-up Ecosystem Maturing – 2016,” says that the ecosystem is poised to grow by an impressive 2.2X … Continued

Fund mop-ups via IPOs in 2016 three-fold higher than a year ago

Money raised through public issues in 2016 so far is three fold higher compared to the same period in 2015. As many as 21 companies have debuted on the bourses so far raising Rs 19,379.09 crore, an increase of around … Continued

India ranks 130th in ease of doing business index

India continues to rank low at 130th position in terms of ease of doing business, with the country seeing little or no improvement in dealing with construction permits, getting credit and other parameters. In the World Bank’s latest ‘Doing Business’ … Continued

MCA extends the due date of Annual filing of e-Forms till end November 2016

In view of the In view of the requests received from various stakeholders, it has been decided to extended the last date for filing the Annual Returns, under the Companies Act, 2013. Accordingly, due date for filing of e-Forms AOC … Continued

Annual Compliance to be made by Private Limited Company in India

The annual mandatory compliances which a private limited company has to follow are listed below: Appointment of Auditor The Statutory Auditor of the company shall be appointed for the 5 (Five) years and e-Form ADT-1 shall be filed for 5-year … Continued

Foreign VCs can now invest in unlisted firms sans RBI nod

Foreign venture capital entities can now invest in unlisted Indian companies without Reserve Bank of India approval. The venture capital firm will, however, have to be registered with market regulator SEBI. The investment can be made in an Indian company … Continued

Company Incorporation in India made simpler and more versatile

Ministry of Corporate Affairs (MCA) has introduced a bold initiative in Company Incorporation so that registering a company and starting business, in India, is made simpler and speedier that your business can be started within the stipulated time frame, in … Continued

India giving World Bank all evidence of improved ease of doing business

India is providing detailed evidence to the World Bank on ease of doing business as it seeks to break into the top 100 countries on the bank’s index from its current rank of 130. Officials said logs of construction permits, … Continued

Online biz firms to give contact details on their portals

Companies which conduct online business will now have to provide on their websites details about their registration with the government, as well as information about persons to be contacted for grievances. The government’s move to introduce the requirement comes against … Continued

IPOs of start-ups in India: Retail investors participation may get cleared

Retail investors might soon be allowed to participate in the initial public offerings (IPOs) of start-ups with the Securities and Exchange Board of India (Sebi) planning to scrap the Institutional Trading Platform (ITP) for these firms. The move comes after … Continued

Company Law Tribunal benches ‘will be fully functional’ in next few days

All the 11 benches of the newly constituted National Company Law Tribunal (NCLT) will be fully functional in the next “couple of days”, a top Corporate Affairs Ministry (MCA) official said. Infrastructure is ready in all the 10 cities where … Continued

Corporate Affairs Ministry again extends statutory filing deadline amid MCA21 woes

Extending the deadline for the third time, Corporate Affairs Ministry has now given time till July 7 for companies to submit their statutory filings as issues related to MCA21 portal are yet to be fully resolved. MCA21 is used for … Continued

MCA21 woes: Government extends filing deadline for stakeholders

With stakeholders facing glitches in using the upgraded MCA21 portal, the Corporate Affairs Ministry has extended the deadline for submitting various filings without additional fee till May 10. MCA21, used for making electronic filings under the Companies Act, is managed … Continued

New bankruptcy bill to speed up shutdown of failed businesses

A government panel has sought the overhaul of the bankruptcy framework to allow the speedy winding up of failed businesses to protect shareholders and lenders, aiming to modernise an outdated system that drags out closure proceedings. It has recommended new … Continued

The Companies (Amendment) Bill, 2016 introduced in Loksabha

On 16th March 2016 Lok Sabha has passed the Companies (Amendment) Bill 2016 to further amend the Companies Act, 2013 The Act introduced significant changes related to disclosures to stakeholders, accountability of directors, auditors and key managerial personnel, investor protection … Continued

Government working on approving companies’ names in 24 hours: MCA

The government is working on ensuring that the name of a new company is approved within 24 hours, a step towards improving ease of doing business and reducing overall transaction costs. Corporate Affairs Secretary Tapan Ray said his Ministry is … Continued

MCA extends last date of filing of AOC-4 and MGT-7 E-Forms to 30.01.2016 to Tamil Nadu & Pondicherry

The Circular from Ministry of Corporate Affairs extends one more month time, for Annual Filings of MGT -7 , Annual Return & AOC-4, Audited Financial Statements, without additional fees, to Tamil Nadu & Pondicherry, which were affected by floods. The … Continued

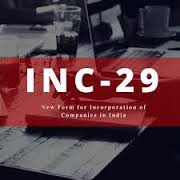

Integrated e-Form INC-29 for Company Incorporation and Ease of doing business

Analysis of integrated e-Form INC-29 for Company Incorporation and Ease of doing business With the introduction of the INC-29, the Ministry of Corporate Affairs (MCA) has begun to make good on its promise to improve India’s ranking on the World … Continued

Government wants to reduce time for registering company

During the past one year, Corporate Affairs Ministry has taken a number of steps, and is further streamlining processes and regulatory framework, to reduce the overall time taken for incorporating a company as a part of ‘ease of doing business’ … Continued

Ease of doing business in India – Related Party Transactions

Related party Transactions. As part of its ongoing efforts to improve ease of doing business in the country, the Corporate Affairs Ministry has notified changes that further relax compliance requirements. As another major step, the Companies Amendment Act, 2015 addresses … Continued

Punishment for Contravention on defaults relating to deposits

Punishment for Contravention of Section 73 and Section 76 of Companies Act, 2013 for Acceptance of Deposits by Companies [New Section 76A inserted] The Companies (Amendment) Act, 2015 has inserted a new Section 76A after Section 76 which introduces … Continued

Additional Fees for delay in e-filing under Companies Act, 2013

MCA had changed the structure of Additional Fees to be levied for delay in filing E Forms over the companies while filing their Balance Sheet and Annual Returns with concerned Registrar of Companies through MCA Portal. Such change of Additional … Continued

MCA asks companies to submit annual filings on time

To ensure that there is no last-minute congestion on its e-filing portal, the Ministry of Corporate Affairs (MCA) has asked companies to submit their financial statements and annual returns at the earliest. The Ministry’s message assumes significance as this would … Continued

Ease of doing business: Minimum Capital requirement, etc scrapped.

Companies Amendment Act, 2015 has brought in certain provisions making way for Ease of doing business in India. The Cabinet, chaired by Prime Minister Narendra Modi, had approved the changes in various provisions of the new Companies Act, 2013, which … Continued

Schedules of Companies Act, 2013 and the corresponding provisions under Companies Act, 1956

Table containing Schedules of Companies Act, 2013 as notified up to date and corresponding provisions thereof under Companies Act, 1956 Note: This is a ready reckoner for the information of stakeholders. Please refer to the relevant notifications and … Continued

Incorporation of Companies under Companies Act, 2013

Steps for Incorporation of company under Companies Act, 2013 Obtaining Digital Signature Certificate For the Directors of the company, we have to obtain the Digital Signature Certificate (DSC). For the DSC, the following documents are required: For Indian Nationals: … Continued

Ease of doing business: No need for certificate of commencement of business for companies

Ease of doing business: No certificate of commencement of business required for companies The government has done away with this requirement, taking another step to ease doing business in India. The Cabinet, chaired by Prime Minister Narendra Modi, had approved … Continued

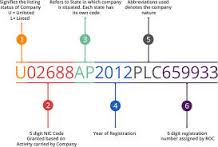

How to read the Corporate Identification Number CIN of a company

How to read the CIN of a company: You would have come across some long alphanumeric numbers of companies called CIN. The CIN (Corporate Identification Number) of a company is given as unique code of alphanumeric characters, which, every company … Continued