The amount of foreign exchange reserves that the Reserve Bank of India keeps with overseas banks has more than tripled, signalling that it may be preparing to intervene more effectively in the currency market due to impending volatility because of global factors and the possible exodus of about $30 billion of non-resident Indian deposits.

The amount of foreign exchange reserves that the Reserve Bank of India keeps with overseas banks has more than tripled, signalling that it may be preparing to intervene more effectively in the currency market due to impending volatility because of global factors and the possible exodus of about $30 billion of non-resident Indian deposits.

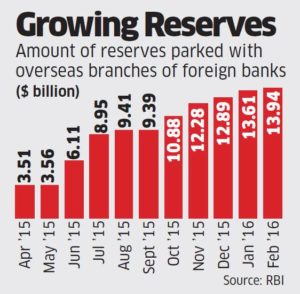

Total funds parked with the overseas branches of foreign banks rose to $13.9 billion in February from $3.5 billion in April last year, according to Reserve Bank of India data posted on its website. The central bank issues the information as a signatory to the International Monetary Fund’s special data dissemination standard, a guide to member countries on putting economic data in the public domain. The country’s foreign currency assets in the same period dipped from $351.9 billion to $348.4 billion.

“The rise in deposit component in reserves suggests RBI may be waiting for the right time to invest in overseas assets or parking it in highquality liquid assets for intervention to manage potential currency volatility,” said Vijayan Subramani, managing director, DBS Bank. “Our central bank looks for offshore (sovereign) investment at the right level with a prudent mix of diversification, be it US Treasury or European sovereign bonds.”

“The rise in deposit component in reserves suggests RBI may be waiting for the right time to invest in overseas assets or parking it in highquality liquid assets for intervention to manage potential currency volatility,” said Vijayan Subramani, managing director, DBS Bank. “Our central bank looks for offshore (sovereign) investment at the right level with a prudent mix of diversification, be it US Treasury or European sovereign bonds.”

RBI governor Raghuram Rajan has long warned of volatility in global financial markets because of divergent monetary policies with some central banks poised to normalise interest rates while others have taken them into negative territory to free up liquidity and generate economic activity. Furthermore, more than $30 billion of FCNR (Foreign Currency Non-Resident) deposits that were attracted in 2013 to boost foreign exchange reserves, are due to mature this year.

The central bank seems to be preparing to defend the rupee against volatility that could result from this money being pulled out.

“Our estimate is that that scheme came with a lot of leverage, that banks were offering loans to people who invested in that scheme and we anticipate that will not be renewed because we are not going to offer the same favourable terms again,” Rajan told reporters recently. “So we are actually estimating a fairly low rollover rate on the FCNR. The good news is we are fully prepared for whatever exit takes place and we will monitor market conditions. We think at this point that we do not anticipate volatility, but if there is, we will deal with it.”

Source: http://economictimes.indiatimes.com/articleshow/51870889.cms