Non-resident investors who do not provide permanent account number will no longer have to face higher tax deduction at source.

Non-resident investors who do not provide permanent account number will no longer have to face higher tax deduction at source.

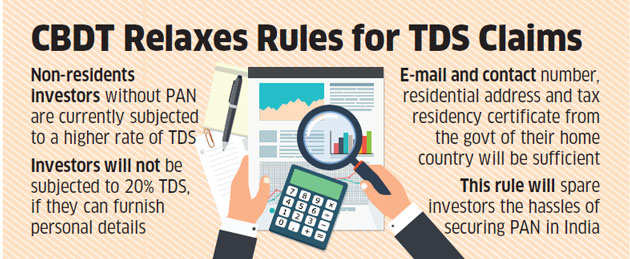

The income tax department has eased norms for non-resident investors, who will not be subjected to a higher rate of 20% tax deduction at source or TDS on their interest earnings, royalty or technical fee if they furnish some personal details and tax residency certificate from their home country and a few other easily available documents.

This clause forced non-resident investors to seek PAN, making investment process difficult.

Under the new rules 37BC, investors will instead need to provide their personal details such as e-mail and contact number, residential address and tax residency certificate from the government of their home country.

In case the country does not provide tax residency certificate, the investor can provide tax identification number or any other unique identification number issued by the country of residence. This will spare investors the hassles of securing PAN in India and attendant compliance that comes with having this number.

Finance minister Arun Jaitley had said in his budget speech in February that some concession would be provided in this regard. “Non-residents without PAN are currently subjected to a higher rate of TDS. It is proposed to amend the relevant provision to provide that on furnishing of alternative documents, the higher rate will not apply,” Jaitley had said, without spelling out the details.