India’s economic growth would slow to about six per cent in the second half of this financial year (October-March) due to demonetisation, against 7.2 per cent in the first half, the International Monetary Fund (IMF) said on Wednesday.

India’s economic growth would slow to about six per cent in the second half of this financial year (October-March) due to demonetisation, against 7.2 per cent in the first half, the International Monetary Fund (IMF) said on Wednesday.

India’s representative in IMF Subir Gokarn said the growth projections came at a time when hard data was unavailable. He described the assessment as “unduly pessimistic”. In the medium term, however, the IMF is hopeful that implementation of the Goods and Services Tax could raise India’s growth rate to more than eight per cent.

The Fund said the cost of recapitalising public sector banks would be affordable even under a negative scenario. In a report on India, the IMF said growth would gradually rebound in 2017-18.

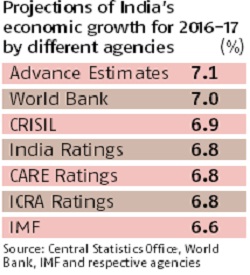

In January, it had cut India’s growth estimate to 6.6 per cent for 2016-17 due to the note ban, against 7.6 per cent estimated earlier. Growth was estimated to be 6.2 per cent in the fourth quarter of the financial year.

Taking both the estimates into consideration, the IMF said, third quarter growth might fall below six per cent.

The Central Statistics Office will come out with the third quarter gross domestic product (GDP) data and the revised advance estimates on the coming Tuesday. Its first advance estimates had shown economic growth at 7.1 per cent in 2016-17, against 7.6 per cent the previous year. The office had not taken into account the effect of demonetisation.

Commenting on IMF’s revision of growth rates, Gokarn said, “While we do not question the methodologies used to revise the estimates, the fact is that there isn’t very much hard data to base the revisions.” He said different assumptions about the impact would obviously lead to different conclusions. While virtually all forecasters have revised their projections for 2016-17 downwards, the range was relatively wide, he added.

To buttress his points, Gokarn said the World Bank and the Asian Development Bank have pegged growth at seven per cent, after accounting for change in the currency policy. The authorities’ estimate was 7.1 per cent. IMF directors supported India’s efforts to tackle illicit financial flows, but noted the strains that have emerged from the currency exchange initiative. They called for action to quickly restore the availability of cash to avoid further payment disruptions, and encouraged prudent monitoring of the potential side-effects of the initiative on financial stability and growth.

On tackling India’s $130 billion in stressed loans, the IMF said “recapitalisation costs should be manageable” at between 1.5 and 2.4 per cent of the GDP forecast, according to Reuters.

On tackling India’s $130 billion in stressed loans, the IMF said “recapitalisation costs should be manageable” at between 1.5 and 2.4 per cent of the GDP forecast, according to Reuters.

Of that, the government’s share would be between 1.0 and 1.6 per cent of GDP over the four years to March 2019, assuming 40 per cent of the loans have to be provided against. “It’s very positive that both the Reserve Bank of India (RBI) and the government are putting a shared focus on addressing the balance-sheet problem,” IMF Resident Representative Andreas Bauer told a conference call.

The chief economic advisor, Arvind Subramanian, on Wednesday backed a call by the RBI to set up an institution similar to “bad bank”, saying urgency was needed to address troubled loans weighing on the banking sector.

In a special report on corporate and banking sector risks in India, the IMF said recapitalisation costs would be “significantly higher if there is a policy shift to more conservative provisioning requirements”.

In case of a rise in the provisioning ratio to 70 per cent, cumulative recapitalisation needs would increase to 3.3-4.2 per cent of forecast GDP in the financial year to March 2019, with a government share of 2.2-2.8 per cent, the IMF said.

The IMF said with temporary demand disruptions and increased monsoon-driven food supplies, inflation was expected at about 4.75 per cent by early 2017— in line with the Reserve Bank of India’s inflation target of 5 per cent by March 2017.

The Fund said domestic risks flow from a potential further deterioration of corporate and public bank balance sheets, as well as setbacks in the reform process, including in GST design and implementation, which could weigh on domestic demand-driven growth and undermine investor and consumer sentiment.

On the upside, IMF said larger than expected gains from GST and further structural reforms could lead to significantly stronger growth; while a sustained period of continued-low global energy prices would also be very beneficial to India.