One of the sea changes brought about by the GST era is the way we determine the value of goods and services.

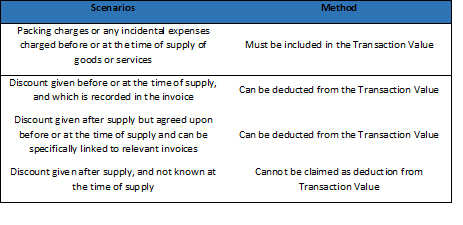

As a business, one needs to be aware of the changes in the valuation method and also how to go about valuation in some special cases, for e.g. additional charges / discounts, branch transfers (which are taxable under GST) and when a supply is made with money not being the consideration.

In order to eliminate ambiguities and avoid litigation due to inaccurate or flawed valuation of goods and services, valuation methods have been provided by the law which act as guidelines to businesses while determining the accurate taxable value.

Valuation of Taxable Supplies under GST

In the previous tax regime, different methods were adopted to determine the value of the supply, for e.g. –

a) Excise – Based on transaction value or quantity of goods or MRP

b) VAT – Based on sale value

c) Service Tax – Based on taxable value of taxable service rendered

However, in the GST regime, the value of goods and / or services supplied will solely be the transaction value, i.e. the price paid / payable at each point in the supply chain.

a) Incidental expenses such as commission

e) Any amount payable by supplier, but incurred by receiver

Thus, the transnational value is basis, for including or excluding the charges, in the valuation under GST.