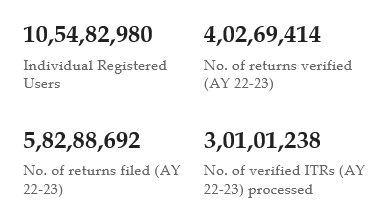

For the Financial Year ended March 31, 2022 (Asst Year 2022-23), even as 5.82 crore people filed their ITRs (Income Tax Returns), only around 4.02 crore of them were verified.

Thus, over 1.8 crore people did not verify their ITR filings as till July 31.

The Income Tax department had processed 3.01 crore verified ITRs till July 31, as per the website.

Status of Returns filed & e-verified

Verifying income tax returns are as important as filing them, since unverified ITRs are treated as invalid by the income tax department. Once the taxpayer verifies the ITR, the income tax department processes it, sends the income tax intimation and issues refunds, if applicable.

You need to verify your Income Tax Returns to complete the return filing process. Without verification within the stipulated time, an ITR is treated as invalid. e-Verification is the most convenient and instant way to verify your ITR,” said the income tax department on the e-filing website.

e-Verification of ITR: Last Date

Now, taxpayers have to electronically verify or e-verify their income tax returns (ITR) within 30 days of filing the return of income. Earlier the time limit was 120 days. In a notification, the Central Board of Direct Taxes (CBDT) said it has reduced the time limit for verification of income tax to 30 days from the date of transmitting or uploading the data of return of income electronically. This new rule will into effect from August 1, 2022, the CBDT said.

“It has been decided that in respect of any electronic transmission of return data on or after the date this Notification comes into effect, the time-limit for e-verification or submission of ITR-V shall now be 30 days from the date of transmitting/ uploading the data of return of income electronically,” the notification said.

If you still have not e-verified your ITR, you need to do so within a month of filing the returns. This means that if you filed the income tax return on July 31, you need to e-verify ITR by August 31 to get it processed. Otherwise it will be rendered invalid.

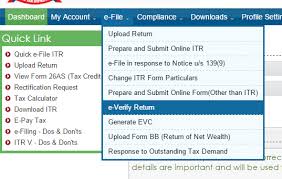

There are several ways to e-verify your ITR. These include Aadhaar-based OTP, bank and demat account, net banking, ATM or digital signature certificate.

How to e-Verify Your ITR Through Aadhaar-Based OTP.

Aadhaar-based OTP is one of the easiest methods to e-verify ITR. In this scenario, your mobile number must be linked to Aadhaar. On the e-verify page of the income tax portal, select the option that prompts you to use Aadhaar-based OTP to e-verify ITR.

A pop up will appear asking you to validate Aadhaar information, check that box. Now, click on ‘Generate Aadhaar OTP’. You will receive a six-digit OTP on your registered mobile number. Enter the OTP and submit. This OTP is valid for 15 minutes.

Source: