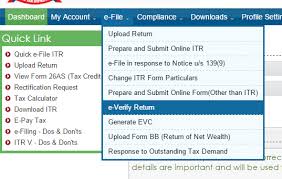

New ITR forms AY 2024-25: Taxpayers will now be required to provide information regarding cash receipts and all their bank accounts within the country according to the latest Income Tax Return (ITR) Forms for the Assessment Year 2024-25, as notified by the Central Board of Direct Taxes.

CBDT has released the new ITR forms – ITR-1 and ITR-4 for FY 2023-24 early this year.

These forms are applicable for filing income tax return for AY 2024-24 with the last date of July 31, 2024, unless extended.

One noteworthy feature of the new ITR forms is that The Finance Act, 2023 has modified Section 115 BAC, establishing it as primary tax regime for individuals, HUFs, AOPs, BOIs, and AJPs. Under this amendment, if an assessee prefers not to adhere to the new tax regime, they must expressly opt out and select the Old Regime for their taxation.

The ITR 1, also known as Sahaj, can be filed by individuals with an income up to Rs.50 lakhs. This includes income from salary, one house property, other sources such as interest, dividends, etc and agricultural income up to Rs.5,000.

Taxpayers will need to provide details of all their bank accounts operational in the previous year along with the type of account.

The updated income tax return forms also include a special section for deductions for Agniveers, the youth serving in the armed forces under the Agnipath scheme, as per Section 80CCH.

Individuals, Hindu undivided families (HUFs), and firms, excluding limited liability partnerships (LLPs), with a total income up to Rs.50 lakhs and income from business and profession, can file ITR 4, also known as Sugam.

In the previous year, the forms were notified in February. Previously, there was a separate column for cryptocurrency. However, in the new ITR, a new disclosure has been added to specify “receipts in cash’ in the New ITR 4 Form.

Here are some cases in which the assessee cannot file ITR 1 –

- Any individual having an income of more than INR 50 lakhs.

- An individual holding a directorial position in a company or having unlisted equity shares during the financial year.

- Non-residents and Resident but not ordinarily resident (RNOR).

- Individuals with income from more than one house property

- Income from lottery, horse races, and legal gambling.

- Short-term and long-term capital gains

- Agricultural income is more than 5000.

- Income from business and profession

- Any resident having assets outside India

- Individuals claiming Foreign Tax Credit under sections 90, 90A and 91.

- Deferred Income Tax on ESOP.

Here are some cases in which the assessee cannot file ITR 4 –

- If the turnover of the business exceeds Rs. 2 crores (3 crores for FY- 2023-24), the taxpayer will have to file ITR-3

- If your total income is more than INR 50 lakhs

- Have income from more than one house property and own a foreign asset

- Signing authority in any foreign account

- Having a foreign income source

- Have directorship in a company

- Non-resident or RNOR status

- Having unlisted equity shares

- If the ESOP payment is deferred to ESOP

- In case you have any brought forward losses.