Income Tax Return Form of ITR-1, 2 and 4 are enabled to file through Online mode with prefilled data at the Income Tax e-filing portal, for Assessment Year 2024-25.

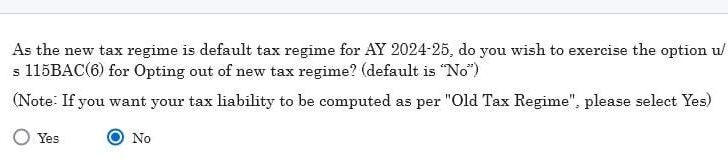

In the above, the new income tax regime has become the default option for taxpayers, in the Assessment Year 2024-25 (relating to the financial year ended March 31, 2024). Taxpayers who fail to specify their preference between the old and new regime will have their taxes processed under the New Regime.

However, taxpayers wishing to adhere to old taxation norms have been granted flexibility to change their preference, allowing them to switch between old and new regimes.

The frequency of such switches, however, is conditional on specific types of income.

Income from Salaries

Salaried individuals have the flexibility to switch between the new and old tax regimes multiple times within each financial year.

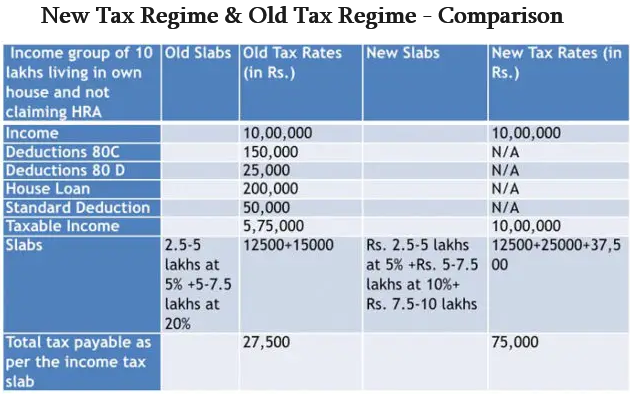

The new tax regime offers fewer tax deductions and exemptions compared to the old tax regime, which provides various deductions under Chapter VI A from taxable income.

Income from business or profession

Individuals with income from business or profession can only make a one-time choice.

For instance, if an individual with business income switches from the old to the new regime in FY2023, they will not be eligible to switch again.

Once an individual with business income opts out of the new tax regime, they cannot opt back in for the new tax regime in the future.

How to switch while filing ITR

The Central Board of Direct Taxes (CBDT) has introduced two new income tax return forms, ITR-1 (SAHAJ) and ITR-4 (SUGAM), for the Assessment Year 2024-25.

ITR Form 1 now includes the option to select the tax regime. For ITR 4 (individuals with business or professional income), taxpayers will need to file form 10-IEA to opt out of the new tax regime.

Previously, individuals had to fill out Form 10-IE to choose the new tax regime. However, Form 10-IE, which allowed individuals to opt into the new tax regime, has been discontinued.

This change aims to make the new tax regime the default setting, starting from the financial year 2023-24. Therefore, the new tax regime will automatically apply unless individuals take specific action to opt for the old regime.

Old tax regime

The old tax regime offers numerous tax exemptions and deductions for individuals. Commonly claimed exemptions and deductions include allowances such as House Rent Allowance (HRA) and Leave Travel Allowance (LTA), as well as deductions under Sections 80C, 80D, 80CCD(1b), 80CCD(2), and various others.

New tax regime

In the new tax regime, the exemptions and deductions available in the Old Regime are not applicable. If the taxable income (after all deductions) under the old regime is below Rs 5 lakh, no tax is levied. Conversely, under the New Regime, the entire income will be tax-free if the taxable income is under Rs 7 lakh.

Which form to choose:

ITR-1 is filed by individuals, including salaried class and senior citizens.

ITR-2 is filed by businesses and professionals who have opted for presumptive taxation and those individuals whose annual income doesn’t exceed Rs 50 lakh.

ITR-4 is for resident individuals, HUFs and firms (other than LLP) having total income up to Rs 50 lakh and having income from business and profession which is computed under Sections 44AD, 44ADA or 44AE and agricultural income up to Rs 5,000.

Source: https://www.incometax.gov.in/iec/foportal//latest-news#