The income-tax (I-T) department has asked large corporate entities, including multinational firms, to furnish details of employees off the payroll to check whether they are filing tax returns after deduction at source, or TDS.

The income-tax (I-T) department has asked large corporate entities, including multinational firms, to furnish details of employees off the payroll to check whether they are filing tax returns after deduction at source, or TDS.

According to I-T officials, many lawyers, chartered accountants, consultants, and designers — not on the payroll of companies — have not filed I-T returns (ITR), fearing they would have to disclose their full income.

The move is part of the government’s efforts to increase the tax base and nab potential evaders. The deadline for filing returns for the assessment year (AY) 2017-18, to track income in the fiscal year 2016-17 (FY17), is July 31.

Such professionals who could be potential evaders have been identified through a complete tax profiling, by linking their banks and transaction details.

The tax department, through its non-filer monitoring system, has identified about 13.7 million people with potential tax liabilities who have not filed returns. A preliminary examination of the data has revealed that many third-party vendors in different tax brackets have not been filing returns, while some have been inconsistent in doing so.

“Such measures are part of the second phase of the tax department’s Operation Clean Money, to bring those who have declared unaccounted cash and deposits after demonetisation under the tax net,” said a senior official of the Central Board of Direct Taxes (CBDT). Sources said the CBDT had set the target of adding 10 million taxpayers in the current financial year (FY18).

Under provisions of Section 194 (C) of the I-T Act, a company has to deduct tax at source at the rate of 10 per cent on payments made to professionals or for technical services, if their bill is Rs 30,000 or more.

“The efforts of the tax department to expand the taxpayer base are understandable. Tracking TDS is an important tool to check whether people have filed their taxes,” said Sanjay Sanghvi, partner, Khaitan & Co.

During 2015-16, there were only 55.9 million people in the country who paid income tax. Last year, the tax department had added 9.1 million taxpayers, expanding the base to 65 million.

The government had recently amended the provisions in the I-T rules dealing with the filing of returns. Those not filing on time will have to pay a fine.

For instance, for people earning below Rs 5 lakh annually, missing the deadline will make them liable to a fine of Rs 1,000; those with earnings above Rs 5 lakh annually will have to cough up Rs 5,000 as penalty.

At present, there is no fine if the returns are filed with a delay within the AY. Official data suggest that about 5 million companies registered in the country, of which only 690,000 filed I-T returns last year.

Source: Business Standard

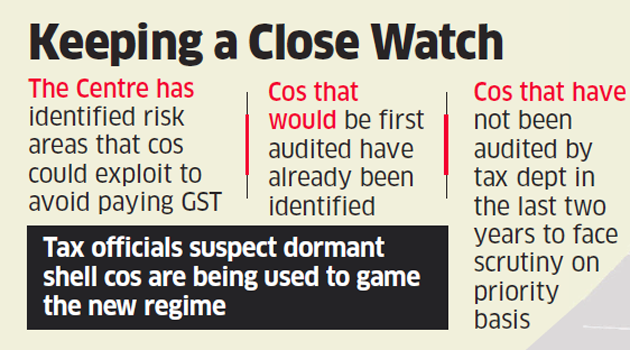

The government has shared sector-wise “risk factors” companies might exploit to avoid paying GST. According to the tax official quoted above, categorisation or risk evaluation for these audits has been created by using Big Data analytics.

The government has shared sector-wise “risk factors” companies might exploit to avoid paying GST. According to the tax official quoted above, categorisation or risk evaluation for these audits has been created by using Big Data analytics.