Businesses will have more time to file the final GST returns as the government on Monday extended the last date for filing of sales and purchase data as well as payment of taxes for the months of July and August.

Now sales return or GSTR-1 for July will have to be filed by September 10 instead of September 5 earlier and purchase returns or GSTR-2 would be filed by September 25 instead of September 10 earlier.

GSTR-3, which is the match of GSTR-1 and GSTR-2, will have to be filed by September 30, in place of September 15.

“GIC (GST Implementation Committee) decides to extend date of GSTR 1, GSTR 2 and GSTR 3 for the month of July to 10th, 25th and 30th September 2017, respectively,” the government said in a tweet.

With regard to August, the date for filing GSTR-1, GSTR-2 and GSTR-3 has been extended to October 5, October 10 and October 15 from earlier September 20, September 25 and September 30, respectively.

The industry has been demanding an extension of the date of filing final GST returns in view of scores of invoices to be uploaded.

The government will shortly issue notification to extend the date of filing returns.

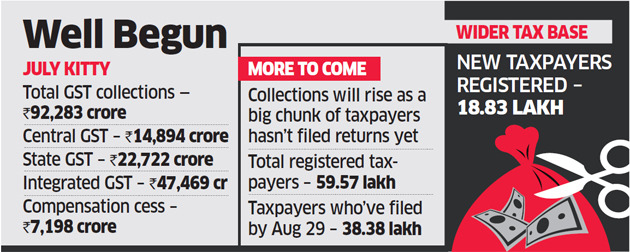

In the initial returns filed in form GSTR-3B, taxes worth Rs 92,283 crore were collected for July from just 64.42 per cent of the total taxpayer base.

Of the 59.57 lakh businesses, who should file return for July, as many as 38.38 lakh taxpayers accounting for 64.42 per cent of the total businesses who had registered in July had filed their GST returns.

Through a notification last week, the Central Board of Excise and Customs (CBEC) had waived fee for delayed filing of GSTR-3B and had allowed businesses to correct errors in the initial return form while filing the final returns.

It also said entities who had not filed GSTR-3B can file the final returns in GSTR-1, GSTR-2 and GSTR-3 and pay taxes.

Souce: The Tribune India