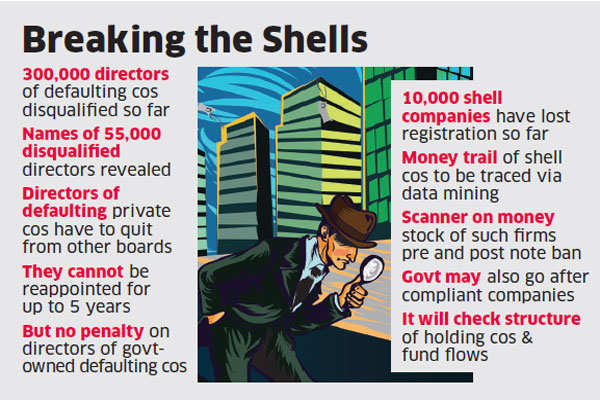

The corporate affairs ministry has disqualified another 200,000 directors for holding posts in defaulting companies that have not filed their financial returns for the last three years or more, taking the total number to over 300,000, while cancelling the registration of another 10,000 companies.

These directors won’t be able to hold board seats in other companies as well and may have to resign soon from them, potentially impacting other firms as well.

While the current law does not provide for any appeal, the government is thinking of exercising “the review power to take any such plea into consideration,” PP Chaudhary, minister of state for corporate affairs, told ET. “By operation of law, these directors are disqualified but we have to see under what provision of law we can examine this. If we need to frame a rule we will do it.”

“This exercise is part of demonetisation. No one had the guts to stop all this till now. It will prove a catalyst for the Indian economy,” said the minister of state, who took over this responsibility after the recent reshuffle. He said the money trail will be traced after data mining of these companies.

The government will prioritise those cases where there is evidence of a large movement of cash. He rejected the criticism that the action was retrospective in nature.

“Law has not been retrospective. Companies had two years to file returns… there was healing time,” the minister of state said. So far the shell firm chase has been limited to defaulting firms that have not filed their financial returns for the last three years or more but the government will soon go after compliant firms as well to check their holding companies structures and fund flows.

Chaudhary said the intent is to restore trust in the corporate structure and also improve ease of doing business in the country.

“We do not want to create any terror. Trust in the corporate structure is gone and we want to increase the investor confidence, not interfere in the corporate structure,” Chaudhary said.The government wants to promote ease of doing business to ensure investors that their money is safe in India, he added.

“This exercise has been triggered due to governance. We have shown scale and speed in an unparalleled way in the way we have acted against these companies and directors,” Chaudhary said.

Last week, the government made public the names of 55,000 directors who were disqualified under Section 164 (2) (A) of the Companies Act. The list included the names of prominent politicians including former Jammu and Kashmir chief minister Omar Abdullah and Malayalam filmstar Mohanlal among others.While the government will not impose any penalty on the directors of government-owned companies that figured in the list of defaulters, those in private firms will have to resign from other board seats and won’t be eligible for reappointment for up to five years.

The corporate affairs ministry will also look into these companies to identify shell companies to see if they have been used for money laundering or any other illegal activity. “We need to find who the shell company’s real beneficiary is… It could be in the name of the cook or a driver. We are taking stock of the money in these companies pre and post demonetisation,” Chaudhary said.

While spotting defaulting companies is an ongoing process, Chaudhary said that, using artificial intelligence, the government will sift out the shell companies from among those that are compliant with regulations and also create an early warning system. “The system will trigger alerts every time we see unusual activity taking place in a company. It will also help us find out the beneficial owner of the shell companies,” he said.