- More disclosures are aimed at improving income tax compliances & e-assessments.

- In AY 2018-19, 58.7 million returns were filed, out of which about 23.7 million people filed returns with no tax liability

While it may be commonplace in Uncle Sam’s country, India is slowly getting used to the idea of disclosing more information to the taxman. In the last five years, income tax return (ITR) forms have started asking for more details to ensure that your spending patterns match your tax return profile.

However, the department seeking details of a valid passport or foreign travel with spends of over ₹2 lakh has left many with a feeling of discomfort as it further complicates the filing process. Many experts also worry about the privacy and security issues. “Data protection law for individuals in our country is not like that in developed countries such as the US. Also, given that the Personal Data Protection Bill 2019 is under consideration, many people are worried and skeptical when it comes to divulging so much information,” said Divya Baweja, partner, Deloitte Haskins and Sells LLP, an accounting firm.

Whether asking for more information will bear fruit and result in better tax compliance continues to be a question mark. The fact remains that you need to provide additional details, for which you have to be on top of many things, including your spending patterns. Now, if you have spent more than ₹2 lakh on foreign travel or ₹1 lakh on electric bills in the current financial year (FY), you will need to furnish these details. The new ITR forms notified by Central Board of Direct Taxes (CBDT), for the upcoming assessment year (AY) 2020-21, require you to disclose such information. If your spending patterns don’t line up with your tax declarations, it may land you in hot water.

The objective is to gather more and more information and make the process of selecting cases for scrutiny easier.

New ITR Forms: ITR-1 & ITR4

ITR-1 which is also known as “Sahaj” can be used by an individual whose incomes primarily include salary income and whose total income does not exceed Rs.50 lakh during the FY. On the other hand ITR-4 can be used to file returns by resident individuals, Hindu Undivided Family (HUFs) and firms (other than LLP) having a total income of up to Rs.50 lakh from business and profession and filing return under presumptive taxation scheme.

There are two major changes in the ITR Forms – first, an individual taxpayer cannot file return either in ITR-1 or ITR4 if he is a joint-owner in house property, second, ITR-1 form is not valid for those individuals who have deposited more than Rs.1 crore in bank account or has incurred Rs2 lakh or Rs1 lakh on foreign travel or electricity respectively.

Additional info

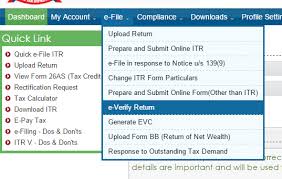

So far, the government has notified ITR-1 and ITR-4 forms for tax filing for FY 2019-20 or AY 2020-21. However, you will have to wait to file returns as online utilities are not yet updated. The new ITR forms ask you to provide a valid passport number, if you have one; and details of your employer like name, nature of business, address and TAN.

The objective is to gather more and more information about an individual, which will help the tax department carry out specific enquries and make the process of selecting cases for scrutiny easier. “These alterations may be happening because the government is slowly moving towards e-assessments and is thus seeking greater clarification from taxpayers in the return itself to save time and costs,” said Shailesh Kumar, director, Nangia Andersen Consulting Pvt. Ltd, a business tax advisory firm.

Other experts echo the thought. “The changes reflects the continuing journey of the government towards simplification and automation. It has already started providing pre-filled return forms. These disclosures will help capture the complete details of taxpayers and the validation of their financial information, wherever such information is available from more than one source,” said Kuldip Kumar, partner and leader, personal tax, PwC, an accountancy firm.

Data is the new oil

In a computerised environment, tax returns are now filed online and data is something that the government wants to be best friends with to tackle the problem of tax evasion. At the front-end, it is seen as asking for more information from you, the tax payer. However, this isn’t the first time the ITR forms have been amended. Every year, CBDT notifies the forms carrying amendments in accordance with the Finance Act. The aim is to increase the tax base as only a tiny percentage of the population files returns. Also, among the people who file returns, about 40% show that they have no tax liability.

At the back-end, the government is taking steps to strengthen the compliance ecosystem. For instance, in 2004, as a measure to widen the tax base, the concept of Annual Information Return (AIR) filing was introduced. AIR is a statutory requirement where mutual funds, institutions issuing bonds and registrars or sub-registrars, and so on are required to record and report high-value financial transactions of individuals to the tax department.

In 2006, a project for enabling e-filing of ITR was launched. Further, in 2007, the government launched integrated taxpayer data management system (ITDMS). Under this system, data from multiple sources is collected in a complex process for drawing a complete profile of the taxpayer. A non-filers monitoring system (NMS), focusing mainly on non-filers with potential tax liabilities, was also initiated by the department. The system assimilates and analyses in-house information as well as transactional data received from various sources like ITR and AIR filed by third parties and other departments to identify people who had undertaken high value financial transactions but did not file their returns.

Taking it further, in the year 2017, the tax department initiated “project insight” to strengthen the non-intrusive information-driven approach for improving tax compliance and effectively utilizing information in tax administration. Under this project, an integrated data warehousing and business intelligence platform, which includes Income Tax Transaction Analysis Centre (INTRAC) and Compliance Management Centralized Processing Centre (CMCPC), has been set up. According to the department’s website, INTRAC leverages data analytics in tax administration and performs tasks related to data integration, compliance management, enterprise reporting and research support. CMCPC uses campaign management approach (consisting of emails, SMS, reminders, outbound calls and letters) to support voluntary compliance.

Will disclosures help?

The government wants you to divulge more information for better scrutiny. However, some experts feel that this will only increase the burden on the tax payers, who are already struggling with a very complicated system of tax filing. “This is overreach and intrusion, and it’s a wasteful exercise. For instance, many people from India go to gulf countries for labour work; if such people get notices, they won’t know how to respond. There is a lot of duplication. The department has already acquired most of this information through AIR filed by different entities,” said Himanshu Sinha, partner, Trilegal, a law firm.

While giving out more information makes things more difficult, such information will be able to trace non-filers and is intended to bring more compliances.