In a relief to religious trusts, educational institutions and other charitable institutions, the income tax department on Friday deferred by 4 months till October 1 the requirement of registration of these entities.

In a relief to religious trusts, educational institutions and other charitable institutions, the income tax department on Friday deferred by 4 months till October 1 the requirement of registration of these entities.

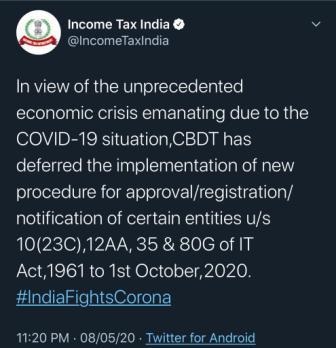

“In view of the unprecedented humanitarian and economic crisis, the CBDT has decided that the implementation of new procedure for approval/ registration/notification of certain entities shall be deferred to 1st October, 2020,” an official statement said.

Finance Act 2020 prescribed substantial changes in law pertaining to registration/approval of trusts and charitable institutions, whose income are exempt under section 10(23C), Section 11 or for the purpose of Section 80-G of the Act for tax deductible donations.

Earlier, such registrations/approvals were granted without any specific expiry period unless specifically withdrawn by concerned tax authority.

Under the new law introduced by Finance Act 2020 and effective from June 1, 2020, all such registrations/ approvals would now be issued with an expiry period of 5 years.

Further, all trusts/charitable institutions already having approval or registration were also supposed to file applications for renewal of there registration/approval within 3 months of new law coming into force, i.e. August 31, 2020.

Further, all trusts/charitable institutions already having approval or registration were also supposed to file applications for renewal of there registration/approval within 3 months of new law coming into force, i.e. August 31, 2020.

Nangia Andersen Consulting Shailesh Kumar said “in light of COVID-19 outbreak and consequent lockdown, giving relief to the taxpayers, this timeline has been deferred by 4 months. Thus, new law which was supposed to come in effect from 01 June 2020 would now come in effect from 01st October 2020.

“All existing trusts/ charitable institutions would now need to file applications for renewal of their registrations/ approvals by December 31, 2020 instead of earlier August 31, 2020,” he added.

The statement said various representations were received to the finance ministry expressing concerns over the implementation of new procedure from June 1, 2020 due to outbreak of coronavirus (COVID-19) and consequent lockdown and there have been a number of requests to defer the applicability of new procedure.

“This is a welcome move and provides expected relief in light of genuine hardships created by COVID-19. The entities benefited by this circular would be religious trusts, hospitals, educational institutions or other public charitable institutions created for welfare of public and allows exemption from income tax on account of their activities and charitable purpose,” Kumar added.

Consulting firm AKM Global Tax Partner Amit Maheshwari said, “This is a welcome clarification as in the absence of this extension, it was extremely difficult to comply with these procedures. Several representations had been made on this matter and this is indeed a welcome move.”