After rejecting “ill-conceived” suggestions by a group of Indian Revenue Services (IRS) officers, the Central Board of Direct Taxes (CBDT) directed officials not to keep any communication with assessees or issue scrutiny notices to them without the board’s approval.

According to it, any such notice would have an “adverse effect” on the assessees amid the coronavirus (Covid-19) pandemic.

These directives are part of the interim action plan for the first quarter (April-June) prepared by the direct tax board. It highlights certain areas which need immediate attention and preparedness until normalcy returns.

The move comes at a time when the tax department faced widespread criticism on a report prepared by a group of IRS officers. It had created panic and tax policy uncertainty at a time when India is already going through a difficult economic situation.

“Identification and preparedness regarding the issuance of notice under Section 148, which deals with income escaping and return filing in all eligible cases, should be done by June 30. However, these notices are to be issued only after getting fresh communication from the board in this regard,” said the CBDT note.

It added that due to the unprecedented situation arising out of Covid-19-induced social distancing and lockdown this year, a relatively short interim action plan has been issued.

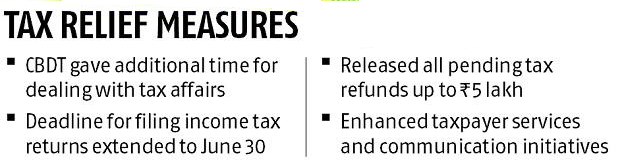

Considering the current situation, we have been putting a slew of tax relief measures to mitigate the impact on business and even on household.

Any such communication may put pressure on the taxpayers and create unnecessary panic. A new system had already been put in place to make officials accountable for their communication with assessees.

However, during the lockdown, even such communication would not go without the board consent, said a CBDT official. Other than keeping no communication with assessees, the tax officials have been asked to centralise cases where searches took place in the financial year 2019-202.

This is because once lockdown is lifted, the officials would work on disposing them on merit.

Moreover, the CBDT asked officials to be prepared for tax demands in cases of international taxation, tax deduction at source and exemption-related charges.

The board wants the department to examine all pending demands, according to permanent account number (PAN) and assessment years.

It also removed demands which are creating duplication and are lying in the system. Besides, officials were asked to reconcile brought-forward cases, especially on TDS, based on the information available on the Traces portal for TDS units. The interim action plan also instructed officials to dispose of all applications concerning granting registration to charitable trusts received upto March 31.

Meanwhile, the direct tax board told its officials to upload manual orders on the systems, especially those under Section 263. It deals with appeals where the principal commissioner or commissioner may call for and examine the record of any proceeding. He or she may consider an order passed by the assessing officer to be erroneous, if it is prejudicial to the interests of the revenue.