Goods and services tax (GST) collections have exceeded estimates in the first month of the landmark levy’s rollout despite a significant number of assessees not having filed returns yet.

“We seem to be comfortable… The redline has been crossed in the first month itself,” finance minister Arun Jaitley said at his briefing on the first set of data on tax collections on Tuesday.

“Not many had thought that the redline would be crossed in the first month itself.” GST, which replaced multiple state and central levies, took effect on July 1.

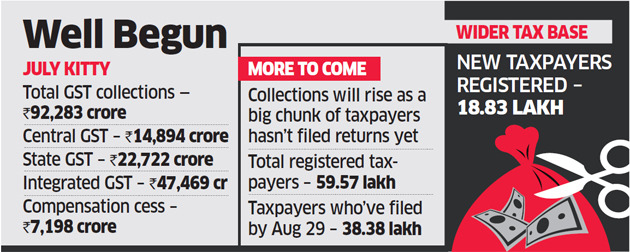

The total collection under GST for July is pegged at Rs 92,283 crore. Extrapolating Budget targets, the central government’s July tax revenue should be Rs 48,000 crore and that of states Rs 43,000 crore, adding up to Rs 91,000 crore, Jaitley said.“We have exceeded the target,” he said, adding that even after the compensation cess is excluded, the target will still be surpassed when all taxpayers file returns. The last date for payment of tax for the month of July was August 25 and for those seeking transitional credit for taxes paid in the pre-GST era, the deadline was August 28.

Of the total, central GST accounted for Rs 14,894 crore, state GST for Rs 22,722 crore and integrated GST for Rs 47,469 crore, which includes Rs 20,964 crore on imports. IGST is levied on inter-state movement of goods and imports and is equal to CGST and SGST.

The compensation cess amounts to Rs 7,198 crore, of which Rs 599 crore is that on imports.

Jaitley said the total number of taxpayers having to file returns for July stood at 5.96 million if those that registered in August and those opting for the composition scheme were excluded. Of these, the minister said, 3.84 million returns have been filed — 64.42% of the total. This suggests that by the time all returns are filed, the tax kitty could swell further.

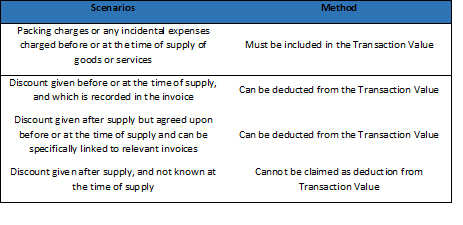

IGST will be allocated between CGST and SGST to the extent it has been used for payment of either of them. This allocation will be based on the cross-utilisation report to be received from the GST Network (GSTN), the technological backbone of the system.

Exact revenue figures of the Centre and individual states would be known after this exercise, which will be conducted before the end of month. Jaitley said it will have to be seen if any specific state needs to be compensated. The tax collection number would “somewhat increase” with greater compliance, he added.Of the total 7.23 million taxpayers, 5.85 million have fully migrated to GSTN, while 1.38 million are yet to complete procedural formalities. The number of new taxpayers that registered with GSTN up to August 29 was 1.883 million.

“On the face of it, collection of over Rs 92,000 crore in the first month looks quite encouraging, given the fact that GST is still stabilising,” said Pratik Jain, partner and leader, indirect tax, PwC.“It is also to be noted that only 64% of registered dealers have actually done the compliances and therefore the actual collection could go up in next few days. Also, a large component of IGST collected on imports might be used as an offset in coming months and some amount of GST collected would also be given as a refund to exporters. Therefore, while initial trend shows healthy collection, the real picture would emerge over next couple of months.” MS Mani, senior director, Deloitte Haskins & Sells LLP, echoed this sentiment.

“The 65% compliance achieved in the first month of GST accompanied with the collection of Rs 92,000 crore is a very good beginning and both the compliance and collections are expected to show a significant upsurge in the coming months,” he said.