Income Tax Bill, 2025 to replace Income Tax Act, 1961: Key Changes

Finance Minister Nirmala Sitharaman has presented the new Income Tax Bill 2025 in Parliament today, February 13, 2025. This presentation marks a significant step in reforming India’s direct tax system. Key Features of the Bill The Income Tax Bill 2025 … Continued

MCA extends deadline for mandatory Demat of Private Company shares until 30th June 2025

The Ministry of Corporate Affairs (MCA) has officially extended the deadline for the mandatory dematerialization of securities for private companies. According to the latest notification issued on February 12, 2025, the new compliance deadline has been pushed to June 30, … Continued

Budget-2025: A Roadmap for economic growth and inclusive development

Source: Budget 2025-26

Latest Update on ITR (U) Form: What You Need to Know

The Income Tax Department has recently made significant updates to the ITR (U) form, also known as the Updated Income Tax Return. This form allows taxpayers to rectify errors or omissions in their previously filed returns. Here’s a detailed look … Continued

CBDT extends deadline for furnishing belated / revised ITRs for Asst Year 2024-25 to January 15th, 2025

The Central Board of Direct Taxes (CBDT) has announced an extension for furnishing belated or revised income tax returns for the Assessment Year (AY) 2024-25. In a recent notification, the CBDT exercised its powers under Section 119 of the Income-tax … Continued

CBDT extends due date for filing ITR of Audited Accounts till November 15,2024

The Central Board of Direct Taxes (CBDT) has recently announced extension of the due date for filing Income Tax Returns (ITR) for audited accounts for Asst Year 2024-25. In a recent announcement, the Central Board of Direct Taxes (CBDT) has … Continued

GST Invoice Management System: A game changer for businesses from October 2024

Through an advisory issued on September 3, 2024, the IMS is set to go live for taxpayers starting October 1, 2024, marking a significant milestone in the evolution of GST compliance procedures. Key Features of the GST Invoice Management System … Continued

Advisory on reporting of supplies to un-registered dealers in GSTR-1/GSTR-5

An advisory has been issued on September 3,2024 by the Government of India for the recent amendment under Notification No. 12/2024 Central Tax, dated 10th July 2024, that lessens the threshold limit for the reporting of inter-state taxable outward supplies … Continued

MCA grants extension of time for Limited Liability Partnerships

The Ministry of Corporate Affairs (MCA) has recently extended the deadline for filing Form LLP BEN-2 and LLP Form No. 4D for Limited Liability Partnerships (LLPs). Here are the details: Background: The MCA introduced LLP BEN-2 and LLP Form No. 4D as crucial forms for declarations under … Continued

CBDT rulings relating to donations made by a trust / institution to another trust / institution.

The amendment introduced in the Finance Act, 2023 has significant implications for eligible Trusts and institutions. Let’s delve into the key points: Eligible Donations Treatment: When an eligible Trust or institution donates to another eligible Trust or institution, the donation is … Continued

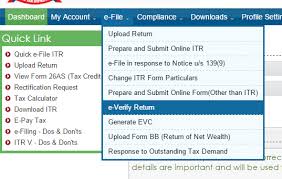

ITR filing for AY 2024-25 – New Regime & Old Regime-How to file

Income Tax Return Form of ITR-1, 2 and 4 are enabled to file through Online mode with prefilled data at the Income Tax e-filing portal, for Assessment Year 2024-25. In the above, the new income tax regime has become the … Continued

Mandatory requirement of Unlisted Companies to have shares in Demat Form

Background: Till now, only public limited companies were required to issue these securities in dematerialized form and private limited companies were exempted and hence could issue their securities in the form of a physical document. Previously, the Ministry of Corporate … Continued

Union Budget 2024 Highlights: Announcements by Finance Minister Nirmala Sitharaman

Summary of Direct and Indirect Tax Proposals: Budget 2024-25 Summary of the direct and indirect tax proposals made in the Budget 2024-25 (Finance Bill 2024) presented by Smt Nirmala Sitharaman, Union Minister of Finance and Corporate Affairs: Highlights of the … Continued

Chairman, CBIC has launched CBIC’s WhatsApp Channel – ‘CBIC India’

In the weekly newsletter dated January 8, 2024, Chairman Sanjay Kumar Agrawal of the Central Board of Indirect Taxes and Customs (CBIC) shared noteworthy updates. From the launch of CBIC’s WhatsApp channel to commendable achievements, the newsletter provides insights into … Continued

New ITR forms: What’s new in ITR-1 and ITR-4 for AY 2024-25?

New ITR forms AY 2024-25: Taxpayers will now be required to provide information regarding cash receipts and all their bank accounts within the country according to the latest Income Tax Return (ITR) Forms for the Assessment Year 2024-25, as notified … Continued

Extension of time for GSTR-3B Filing for November 2023 in specific districts of Tamil Nadu

In response to the devastation caused by the MICHAUNG cyclone in early December 2023, the deadline for monthly GST returns has been extended, in respect of the taxpayers whose principal place of business is located in the four cyclone-affected districts … Continued

Know about: “Discard Income Tax Return option.”

The income tax department has introduced a new functionality on its website- ‘Discard ITR’. This new feature will allow taxpayers to discard their previously filed but unverified Income Tax Returns (ITR). Starting from Assessment Year 2023-24, this new ‘Discard ITR’ … Continued

Updated Income Tax Return (ITR U) – Check out this option

Filing an Updated Income Tax Return (ITR-U) under section 139(8A) ITR-U refers to the Updated Return form used for filing an amended or revised income tax return in India. It is a provision provided by the Income Tax Department to … Continued

IT Refund: IT Department urges Taxpayers to respond to Past Tax Demands.

The Income Tax Department on September 23, 2023, called upon taxpayers to promptly respond to intimation of outstanding tax demands, adding that it will help in faster processing of income tax returns (ITR) and quicker issuance of refunds. For the … Continued

CBDT extends deadline for filing ITR return and submitting audit report.

Income Tax Department has extended the deadline for ITR filing for certain categories of taxpayers. This has brought great relief to the taxpayers/institutions falling in these categories and they have also been saved from paying heavy penalties due to delay. … Continued

Amnesty Scheme for LLPS – MCA issues circular condoning delay in filing Form 3, 4 and 11

The Ministry of Corporate Affairs (MCA) has notified the Limited Liability Partnership (LLP) Amnesty Scheme. The ministry vide circular number No. 8/2023 issued on 23rd August 2023 condoning the delay in filing of Form-3, Form-4 and Form-11 under Section 67 … Continued

New Annual Information Statement (AIS) – 50 Transactions reported in Income Tax Portal

The Income Tax Department has announced the roll-out of a new statement namely Annual Information Statement (AIS) which would provide you with almost all details about your financial transactions during the year. So far, the Income Tax Department has been … Continued

MCA amends strike-off rules – Mandatory filing of overdue Financial Statements, before striking-off of companies

The Ministry of Corporate Affairs (MCA) has notified an amendment to the Companies (Removal of Names of Companies from the Register of Companies) Rules, 2016. The amendment provides more clarity on the filing requirements of overdue financials before applying for … Continued

ITR filing for AY 2023-24 starts. CBDT enables Excel Utilities for ITR-1, ITR-4

ITR filing for AY 2023-24 starts. CBDT enables Excel Utilities for ITR-1, ITR-4 For the assessment year 2023-24, the Income Tax Department has released an offline Excel-based utility for filing ITR-1 Sahaj and ITR-4 Sugam. The utility is available for download … Continued

Linking PAN & Aadhaar before March 31, is mandatory

It is mandatory to link Permanent Account Numbers (PAN) to Aadhaar by March 31, 2023. The last date to link Permanent Account Number (PAN) to Aadhaar is nearing soon. According to the Central Board of Direct Taxes (CBDT), the apex … Continued

Ministry of Corporate Affairs to launch 56 forms in V3 portal from Jan, 2023

Source: MCA Circular The Ministry of Corporate Affairs (MCA) is all set to launch the Second Set of Company Forms on the MCA21 V3 portal, in January 2023, comprising of total 56 forms. The first lot will consist of 10 … Continued

CBDT extends due date for filing Income Tax Return for AY 2022-23 to Nov 7

The Central Board of Direct Taxes (CBDT) said in a notification that the ITR filing due date has been extended as it had last month extended the deadline for filing audit reports. CBDT extends the due date for furnishing Income … Continued

MCA extends time for filing e-form DIR-3-KYC & DIR-3-KYC-WEB

The MCA vide General Circular No. 09/2022 dated September 28, 2022 extends the timeline for filing e-form DIR-3-KYC and web-form DIR-3-KYC-WEB without fee upto October 15, 2022. Director’s KYC Filing is an annual compliance and applies to every person who … Continued

Small Companies thresholds further increased by MCA (Paid-up Capital/ Turnover)

MCA has further revised/ increased the ‘paid-up capital’ and ‘turnover’ thresholds applicable in the case of ‘small companies’ under the Companies Act, 2013, to reduce compliance burden for more number of companies to be treated as ‘small companies’, as part … Continued

ICAI permits CA in Practice, Firms of Chartered Accountants to register on GeM Portal for rendering Professional Services

The Institute of Chartered Accountants of India ( ICAI ) has permitted the Chartered Accountants ( CA ) in Practice, Firms of Chartered Accountants are permitted to register on GeM Portal for rendering professional services. The ICAI has said that, … Continued

MCA further extends due date of filing Annual Return and Financial Statement till March 15.

The Ministry of Corporate Affairs (MCA) has again extended the due date of filing Annual Return and Financial Statement. The MCA has again relaxed the levy of additional fees for filing of e-forms AOC-4, AOC-4 (CFS), AOC-4, AOC-4 XBRL AOC-4 … Continued

MCA grants extension of time for filing Financial Statements & Annual Return for 2020-21

The Ministry of Corporate Affairs has recently granted the much-needed relief by extending the dates for filing of the 5 important e-forms with the removal of additional fees on the e-forms, namely Forms Annual Financial Statements -AOC-4, AOC-4 (CFS), AOC-4, … Continued

I-T department rolls out new Annual Information Statement – How AIS will be helpful in filing your tax returns

The income tax department (I-T dept) on Monday rolled out the new annual information statement (AIS) on the compliance portal. This annual statement provides a comprehensive view of information to a taxpayer and the facility to submit online feedback. The … Continued

GST collection in October crosses ₹1.3 lakh crore, second highest ever

The gross GST revenue collected in the month of October 2021 exceeded ₹1.3 lakh crore. The GST revenues for October is the second highest ever since introduction of GST, second only to that in April 2021, which related to year-end … Continued

MCA relaxes additional fees in filing of Annual Financial Statement under the Companies Act, 20l3

On October 29, 2021, the Ministry of Corporate Affairs (MCA) has announced the relaxation in levy of additional fees in filing of e-forms AOC-4, AOC-4 (CFS), AOC-4, AOC-4 XBRL AOC-4 Non-XBRL and MGT-7 / MGT-7A for the financial year ended … Continued

ITR filing deadline for FY 2020-21 extended to December 31, 2021

The government on Thursday extended the deadline to file income tax return (ITR) for FY 2020-21 by 3 months to December 31, 2021 from September 30, 2021. The extension of the deadline is for those individuals whose accounts are not … Continued

Ubharte Sitaare Fund: Rs 250-crore export-oriented fund for MSMEs launched

Union finance minister Nirmala Sitharaman on Saturday launched the Ubharte Sitaare Fund (USF) for export-oriented small and mid-sized companies and startups in Lucknow. Sitharaman had announced the fund in her Budget speech in 2020 in the backdrop of constraints faced … Continued

India’s Forex reserves rise to lifetime high of $621.5 billion

The country’s foreign exchange reserves increased by $889 million to a lifetime high of $621.464 billion in the week ended August 6, 2021, RBI data showed on Friday. In the previous week ended July 30, 2021, the reserves had … Continued

CBDT extends Due Date for filing various Income Tax Forms

The Central Board of Direct Taxes (CBDT) has extended the due dates for electronic filing of various Forms under the Income-tax Act, 1961. Considering the difficulties reported by the taxpayers and other stakeholders in the electronic filing of certain Forms, … Continued

Government grants further extension in timelines of Income tax compliances

Government grants further extension in timelines of Income tax compliances The Government has granted further extension of timelines of compliances under Income Tax Act. It has also announced tax exemption for expenditure on COVID-19 treatment and ex-gratia received on … Continued

New TDS rules to be applicable from July 1- Highlights

Till date, TDS was deducted only on the notified nature of payments. From 1st July,2021, businesses are required to deduct TDS on purchase of goods along with the current scope of TDS deduction applicable on notified nature of payment or … Continued

MCA gives compliance relief to businesses due to second wave of COVID-19

The ministry of corporate affairs (MCA) has offered relaxation in certain compliance requirements for businesses, including a longer interval between two board meetings in view of the hardships during the second wave of the pandemic. Companies are normally required … Continued

Belated and Revised ITR Filing Date extended for AY 2020-21 to 31st May 2021 due to COVID-19

In view of the adverse circumstances arising due to the severe Covid-19 pandemic and also in view of the several requests received from taxpayers, tax consultants & other stakeholders from across the country, requesting that various compliance dates may be … Continued

SEBI extends deadlines for filing financial results for Indian listed firms due to COVID-19

The Securities and Exchange Board of India (SEBI), on Thursday, relaxed the deadline for listed Indian firms to announce their financial results in the wake of surging covid-19 cases in the so-called second wave of the pandemic in the country. … Continued

MCA allows India Inc to spend CSR funds for COVID-19 vaccination awareness campaigns

In a significant boost to corporate India looking to undertake CSR around the COVID-19 pandemic, the corporate affairs ministry (MCA) has clarified spending of CSR funds for setting up “makeshift hospitals and temporary Covid care facilities” would be treated as … Continued

Cabinet approves MoU between ICAI and Chartered Accountants Australia and New Zealand

This provides an opportunity to the ICAI members to expand their professional horizons and to foster working relations between the two accounting institutes.The Institute of Chartered Accountants of India (ICAI) and Chartered Accountants Australia and New Zealand (CA ANZ) will … Continued

New MCA rules make cryptocurrencies, benami, loan disclosures mandatory

India Inc will have to declare investments in cryptocurrencies, relationships with dissolved companies and loans extended to related parties, among a host of other disclosures mandated by the government to improve transparency. Starting April 1, companies must state if they … Continued

MCA establishes Central Scrutiny Centre for scrutiny of Straight Through Processes (STP) e-forms

In the Budget 2021, it was mentioned that govt. will be establishing technology based on data analytics, artificial intelligence, machine learning tools in the areas of finance, taxation and online compliance monitoring among others. Accordingly, MCA has now established a … Continued

Year-long IBC suspension to be lifted ‘after March 24’, hints MCA

The Ministry for Corporate Affairs Ministry has hinted that the suspension of the Insolvency and Bankruptcy Code (IBC) is likely to be revoked after March 24. he Ministry for Corporate Affairs Ministry has hinted that the suspension of the Insolvency … Continued

Extension of due date for furnishing of Annual Returns GSTR-9 and GSTR-9C for financial year 2019-20 to March 31, 2021

CBIC had extended, vide Press Note regarding extension of due date for furnishing of Annual Returns GSTR-9 and GSTR-9C for financial year 2019-20 to March 31, 2021. This is the second extension given by the government. The deadline was earlier … Continued

Companies get relaxation for Annual Filings of 2019-20 upto 15/02/2021 without additional fees.

Keeping in view of various requests received from stakeholders regarding relaxation on levy of additional fees for annual financial statement filings required to be done for the financial year ended on 31.03.2020, it has been decided that no additional fees … Continued

RBI removes Cooling Period for Bank Branch Audit for CAs

The Reserve Bank of India (RBI) notified the change in norms on eligibility, empanelment, the appointment of Statutory Branch Auditors in Public Sector Banks from years 2020-21 onwards. The RBI notified Rotation Policy instead of Cooling Period for Bank Branch … Continued

International Taxation: Decoding DTAA & Foreign Tax Credit

WHAT IS DOUBLE TAXATION OF INCOME? When the same income is taxed more than once, due to levying of tax by two or more jurisdictions, on the same income asset or financial transaction, this results in double taxation. This may … Continued

6 Crucial changes in GST Rules applicable from January 1st, 2021

The year 2021 has come up with the various changes in Goods and Service Tax (GST) Rules which will have a direct impact on the business registered under the GST regime and the businessmen who are planning to get themselves … Continued

Govt. cancels GST Registration of 163k Business entities for Non-Filing of Tax Returns

The Government has canceled the Goods and Service Tax (GST) registration of 163,000 business entities who have not filed monthly tax returns (GSTR-3B) for the last six months or more. Furthermore, the department would persuade 25,000 taxpayers, who have … Continued

Govt cancels GST registration of 163k business entities over non-filing of tax returns

The Government has canceled the Goods and Service Tax (GST) registration of 163,000 business entities who have not filed monthly tax returns (GSTR-3B) for the last six months or more. Furthermore, the department would persuade 25,000 taxpayers, who have not … Continued

QRMP scheme launched for GST payers with turnover up to Rs 5 crore

The government has launched the Quarterly Return Filing and Monthly Payment of Taxes (QRMP) scheme in a bid to ease the return filing experience of the Goods and Services Tax (GST) taxpayers. The scheme will come into effect from January … Continued

Income Tax department to reject tax audit reports filed without ICAI authentication

The income tax department will validate with the Institute of Chartered Accountants of India (ICAI) the unique document identification number (UDIN) of chartered accountants when they upload tax audit reports, the finance ministry said on Thursday. To curb fake certifications … Continued

Finance Ministry extends deadline for making a declaration under Vivad Se Vishwas Scheme

The Ministry of Finance has extended the deadline for making a declaration under Vivad Se Vishwas Scheme till 31′ January, 2021 from 31st December, 2020. The Ministry of Finance has extended the deadline for making a declaration under Vivad Se … Continued

Forex reserves increase by over $100 billion since March lockdown; hit lifetime high at $572 billion

Amid a severe hit to the Indian economy by the Covid pandemic in the past eight months, the country’s foreign exchange reserves increased by more than $100 billion since the Covid-induced lockdown was enforced in March-end. From $469.9 billion in … Continued

I-T refunds worth Rs 1.32 lakh cr issued to 39.75 lakh taxpayers

The Income Tax department has issued refunds worth over Rs 1.32 lakh crore to over 39 lakh taxpayers so far this fiscal. This include Personal income tax (PIT) refunds amounting to Rs 35,123 crore and corporate tax refunds amounting … Continued

RBI notifies Discontinuation of Returns/Reports under Foreign Exchange Management Act

For improving the ease of doing business in India and to reduce the cost of compliance, RBI has made a review of requirements of submission of various forms and reports under FEMA and has decided to discontinue submission of 17 … Continued

GSTN Portal now displays Annual Aggregate Turnover for Previous Financial Year

Prime Minister Narendra Modi launched GST into operation on the 1 st of July, 2017. GST was publicised as ‘one nation, one tax’ by the government, aimed to provide a simplified, single tax regime. GST is a dual levy where the Central Government … Continued

No need to apply for loan interest waiver, relief to be automatically credited into accounts: Finance Ministry

Borrowers will not need to apply for the interest-on-interest waiver scheme for the six-month loan moratorium, the finance ministry has said, asking lenders to credit ex-gratia relief amount into the accounts of those eligible. The ministry late Tuesday issued a … Continued

Finance Ministry extends due date for filing of Income Tax Returns for FY 2019-2020

The income tax return (ITR) filing deadline for FY 2019-20 has been extended to December 31, 2020, for most individual taxpayers, from the earlier deadline of November 30, 2020. This the second time the tax filing deadline for FY20 has … Continued

Govt extends due dates for filing IT returns, audit reports, GST annual return

The government on Saturday said due dates for filing income tax returns and tax audit reports for FY20 for various classes of tax payers have been extended to give more time for tax payers to comply. The government also, on … Continued

RBI releases Long Form Audit Report (LFAR)

The Reserve Bank on Saturday came up with revised long format audit report (LFAR) norms with a view to improving efficacy of internal audit and risk management systems. The LFAR, which applies to statutory central auditors (SCA) and branch … Continued

Income Tax refunds worth Rs 88,652 cr issued to 24.64 lakh taxpayers so far this fiscal

The Income Tax department on Friday said it has issued refunds worth Rs 88,652 crore to over 24 lakh taxpayers so far this fiscal. This include personal income tax (PIT) refunds amounting to Rs 28,180 crore issued to over 23.05 … Continued

A platform to honour honest taxpayers will strengthen compliance and broaden tax base

Prime Minister Narendra Modi announced several tax measures on the eve of India’s Independence Day last week honouring the honest tax-paying citizen. You will now have to file your income-tax (IT) return or pay higher percentage of tax deduction at … Continued

Pace of economic recovery appears to be gathering momentum in August: Nomura

The economy sustained an increasing pace of recovery through August so far after a prolonged period of plateauing trends in July, according to a Nomura note on Monday. The Nomura India Business Resumption Index (NIBRI) inched up to 73.7 for … Continued

CBDT revises E-Assessment Scheme, 2019: Scope extended to cover Best Judgement Assessments by Faceless Assessment

The Central Board of Direct Taxes (CBDT) on Thursday revised the ‘E-assessment Scheme, 2019’ notified on September 12, 2019. The Government notified that now, the e-Assessment scheme shall be called Faceless Assessment. Now, the National e-Assessment Centre shall intimate the … Continued

New Compliances for the Charitable Trust & Institutions

Very Important update for Charitable Trusts and Exempt Institution registered under section 80G, 12A or section 12AA : New – Fresh Registration Required : Last Date 31.12.2020 All Charitable trusts and exempt institution which are already registered under section 80G, … Continued

RBI sets new conditions for Current Accounts to improve Credit Discipline

The Reserve Bank of India set new conditions for banks to open current accounts for large borrowers in order to strengthen credit discipline. Use of multiple operating accounts by borrowers—both current well as cash/overdraft accounts—has been observed to be prone … Continued

SEBI extends deadline for filing April-June corporate financial results to September 15

In a major relief to companies, the Securities and Exchange Board of India (SEBI) today extended the deadline for submission of financial results for the quarter, half-year, and financial year ended 30 June 2020 to September 15. The SEBI circular … Continued

CBDT has refunded Rs. 71,229 crore so far to help taxpayers during COVID-19 pandemic

The Central Board of Direct Taxes (CBDT) has issued refunds worth Rs 71,229 crore in more than 21.24 lakh cases upto 11th July, 2020, to help taxpayers with liquidity during COVID-19 pandemic, since the Government’s decision of 8th April, 2020 to issue … Continued

CBDT allows One Time Relaxation for Verification of Tax Returns

The Central Board of Direct Taxes (CBDT) on Monday notified the one-time relaxation for verification of tax return for the Assessment Year 2015-16, 2016-17, 2017-18, 2018-19 and 2019-20, which are pending due to non-filing of ITR- V form and processing … Continued

SEBI signs MoU with CBDT for Data Exchange

A formal Memorandum of Understanding (MoU) was signed today between the Central Board of Direct Taxes (CBDT) and the Securities and Exchange Board of India (SEBI) for data exchange between the two organizations. The MoU was signed by Smt. … Continued

The Micro Small and Medium Enterprises (MSMEs) hit by Covid pandemic may have something to cheer at last.

Insolvency and Bankruptcy Board of India (IBBI) has formulated a Special Resolution Process (SRP) for MSMEs who find their financial position unmanageable due to Covid crisis. While presenting the ‘Atma Nirbhar Bharat’ package Finance Minister had announced to come out … Continued

IBBI proposes to limit cases with insolvency professionals

In what may bring about major reform and efficiency in the insolvency regime in India, the Insolvency and Bankruptcy Board of India (IBBI) has proposed to limit the number of cases an insolvency professional can handle to five as it … Continued

New TDS rates on high-value cash withdrawals apply from today.

In order to tighten the noose on those who don’t file income tax returns (ITR) despite earning taxable income and discourage cash transactions, the Finance Act 2020 introduced higher TDS (Tax Deducted at Source) rates on cash withdrawals for those … Continued

Government has further extended time limits for Income Tax return,TDS, Vivad Se vishwas Scheme etc

In view of the challenges faced by taxpayers in meeting the statutory and regulatory compliance requirements across sectors due to the outbreak of Novel Corona Virus (COVID-19), the Government brought the Taxation and Other Laws (Relaxation of Certain Provisions) Ordinance, … Continued

Cooperative banks to be brought under RBI supervision

The Union Cabinet on Wednesday decided to bring all co-operative banks under the Reserve Bank of India through an ordinance. This was announced by Union information and broadcasting minister Prakash Javadekar during a virtual press conference. “Government banks, including 1,482 … Continued

Companies get more time to meet deposit repayment and debenture reserve norms amid COVID-19

The government has given a three-month extension to companies to set aside a part of the deposits and debentures maturing in FY21 in a dedicated account, a statutory requirement under the Companies Act. The Ministry of Corporate Affairs (MCA) said … Continued

ICAI enables generation of Bulk UDINs for Certificates

A provision for generating UDIN in bulk for Certificates has been incorporated in UDIN Portal. Using this facility now the members will be able to generate UDIN in bulk (uptil 300 UDINs) for various types of Certificates in one go. … Continued

MCA relaxes time to file forms for creation/modification of charges

In a view of the pandemic situation due to COVID-19 outbreak and several representations made, by the stake holders, Ministry of Corporate Affairs (MCA) has came out with a new scheme called “Scheme for relaxation of time for filing forms … Continued

EGMs deadline extended upto 30 Sept 2020 by MCA

MCA extends the deadline for conducting extra ordinary general meetings (EGMs) through VC/ OAVM/ Postal Ballot and passing of ordinary/ special resolutions, from 30 June to 30 Sept. 2020, provided the other guidelines of the framework, prescribed earlier, are adhered … Continued

GST Council provides relief for GSTR 3B delays

The 40th GST Council met under the Chairmanship of Union Finance & Corporate Affairs Minister Smt Nirmala Sitharaman through video conferencing here today- 12th June 2020. The meeting was also attended by Union Minister of State for Finance & Corporate … Continued

Govt rolls out facility of filing of NIL GST Return through SMS

In a significant move towards taxpayer facilitation, the Government has today onwards allowed filing of NIL GST monthly return in FORM GSTR-3B through SMS. This would substantially improve ease of GST compliance for over 22 lakh registered taxpayers who had … Continued

Key changes notified in the ITR forms the Asst Year 2020-21

CBDT notified Income Tax Return forms of FY 2020-21 G.S.R. 338(E).— In exercise of the powers conferred by section 139 read with section 295 of the Income-tax Act, 1961 (43 of 1961), the Central Board of Direct Taxes has made the … Continued

CBDT replaces Annual Statement of TDS/TCS with new Annual Information Statement

The Central Board of Direct Taxes (CBDT) on Thursday notified Income Tax (11th Amendment) Rules, 2020. In exercise of the powers conferred by section 285BB read with section 295 of the Income-tax Act, 1961 (43 of 1961), the Central Board … Continued

Despite pandemic, Tamil Nadu attracts 17 investors worth Rs.15,128

As many as 17 MoUs’ to bring in fresh industrial investments worth Rs 15,128 crore into Tamil Nadu were signed between a host of foreign companies and the Tamil Nadu government in the presence of chief minister Edappadi K Palaniswami … Continued

NCLAT quashes NCLT order to make MCA party in all insolvency cases

The National Company Law Appellate Tribunal (NCLAT) quashed an order of the National Company Law Appellate Tribunal (NCLT) directing that the Ministry of Corporate Affairs (MCA) be made a party to every case under the Insolvency and Bankruptcy Code (IBC) … Continued

MCA has extended the period for names reserved and re-submission of forms

Ministry of Corporate Affairs ( MCA ) has extended the period for names reserved and re-submission of forms. Issue description and Period/Days of Extension are as below: – Names reserved for 20 days for new company incorporation.SPICe+ Part B needs … Continued

RBI Governor Press Conference Highlights: Repo rate cut by 40 bps to 4%

The RBI Governor Shaktikanta Das announced a slew of measures aimed at further easing the liquidity conditions and providing relief to borrowers just a few days after the government concluded unveiling its five tranches of Rs 20 lakh crore worth … Continued

Google to invest in people and partnerships in India as it catches up with Azure, AWS in cloud

Technology behemoth Google is investing heavily in people and partnerships to grab a larger share of the Indian Cloud market, as it takes on global rivals Microsoft, IBM and Amazon Web Services in the country, a top company executive said. … Continued

Relief for MSMEs! Insolvency proceedings threshold increased to Rs 1 crore from Rs 1 lakh

Finance Minister Nirmala Sitharaman on Sunday raised the minimum threshold to initiate insolvency proceedings to Rs 1 crore from the earlier Rs 1 lakh. In addition, with an eye on further enhancement of ease of doing business, the government announced … Continued

NCLT makes ‘default record’ mandatory

Financial creditors moving the National Company Law Tribunal (NCLT) for initiation of insolvency process will have to mandatorily file ‘default record’ from the information utility (IU). No new petition will be entertained without record of default under Section 7 of … Continued

Govt. extends Due Dates of all Income Tax Returns for FY 2019-20

The Central Government has extended the all due dates of all Income Tax Returns for the Financial Year 2019-20 amid COVID-19 outbreak. Due date of all income-tax return for FY 2019-20 will be extended from 31st July, 2020 & 31st … Continued

Highlights of Special GOI Package of Rs 20 lakh crores for Atmanirbhar Bharat (COVID-19)

Key Highlights of the Special economic and comprehensive package of Rs 20 lakh crores Announced by the Govt. of India, for relief and credit support related to businesses, especially MSMEs to support Indian Economy, Atmanirbhar Bharat and to fight against COVID-19. … Continued

TDS / TCS Rates for non-salaried payments reduced by 25% till March 31, 2021

In order to provide more funds at the disposal of the taxpayers, the rates of Tax Deduction at Source (TDS) for non-salaried specified payments made to residents and rates of Tax Collection at Source (TCS) for the specified receipts has … Continued

CBDT orders tax officials to not issue scrutiny notices to taxpayers

After rejecting “ill-conceived” suggestions by a group of Indian Revenue Services (IRS) officers, the Central Board of Direct Taxes (CBDT) directed officials not to keep any communication with assessees or issue scrutiny notices to them without the board’s approval. According … Continued

CBDT Defers Requirement of Registration of Charitable, Religious Trusts by 4 Months Till October 1

In a relief to religious trusts, educational institutions and other charitable institutions, the income tax department on Friday deferred by 4 months till October 1 the requirement of registration of these entities. In a relief to religious trusts, educational institutions … Continued

Govt suspends IBC provisions that trigger fresh insolvency proceedings

The government has decided to suspend insolvency and bankruptcy proceedings for at least six months owing to challenges businesses are facing due to the Covid-19 pandemic. A new Section is likely to be added to the Insolvency and Bankruptcy Code … Continued

TDS on salary and New Income Tax rates: Highlights

The Central Board of Direct Tax (CBDT) recently came out with a circular, offering clarifications for tax-paying employees on how they can migrate to the new concessional tax regime, which was announced in this year’s Union Budget. The lower income … Continued

Govt approval must for all FDIs from neighboring countries including China, in same lines as made by several countries

The government has amended the Foreign Direct Investment (FDI) policy to discourage opportunistic investment in Indian companies by neighbouring countries in the midst of the Coronavirus pandemic. This comes after China’s central bank recently raised stake in Housing Development Finance … Continued

All pending income tax refunds up to Rs 5 lakh to be released immediately, amid rise in coronavirus cases.

In the context of the COVID-19 situation and with a view to providing immediate relief to the business entities and individuals, it has been decided to issue all the pending income-tax refunds up to Rs. 5 lakh, immediately. This would … Continued

Companies Fresh Start Scheme, 2020 (CFSS-2020)

The Ministry of Corporate Affairs has introduced the “Companies Fresh Start Scheme, 2020” and revised the “LLP Settlement Scheme, 2020” which is already in vogue to provide a first of its kind opportunity to both companies and LLPs to make … Continued

Nirmala Sitharaman: ITR / GST Return filing dates extended, relief from late fee, penalties

Finance minister Nirmala Sitharaman announced a slew of measures for extension of statutory and regulatory compliances in view of the corona virus pandemic spreading its wings and impacting the economy. Allaying fears that there is no economic emergency in the … Continued

Companies and LLPs confirm their readiness towards COVID-19: MCA

Advisory on Preventive measures to contain the spread of COVID19 The Ministry of Corporate Affairs ( MCA ) is in the process of developing and deploying a simple web form named CAR (Company Affirmation of Readiness towards COVID-19) for companies/LLPs … Continued

30 important Key features of GST New Return System:

First 15 features (1-15 points) as PART-I:- Supplier can upload the Tax Invoices on real time basis in Anx-1. Recipient can view his purchase Invoices on near real time basis. Recipient can also view whether supplier has filed his return … Continued

Key features of SPICe+ for Incorporation of New Companies in India

As part of Government of India’s Ease of Doing Business (EODB) initiatives, the Ministry of Corporate Affairs would be shortly notifying & deploying a new Web Form christened ‘SPICe+’ (pronounced ‘SPICe Plus’) replacing the existing SPICe form. SPICe+ would save … Continued

CBIC extends GSTR-9 and GSTR-9C filing dates in a staggered manner

The Central Board of Indirect Taxes and Customs (CBIC) late on Friday night extended the due date for furnishing GST Annual Return and Reconciliation Statement (GSTR-9 / 9A and GSTR-9C) for FY 2017-18 in a staggered manner. The last date … Continued

MCA notifies (Winding Up) Rules, 2020: Shutting business now easier for small firms

The Ministry of Corporate Affairs (MCA) on Tuesday notified rules for winding up of companies, making it easier for smaller firms to wind up businesses without taking approval. The rules have provided summary procedures for liquidation of companies with asset … Continued

GST returns can now be filed in a staggered manner

The Finance Ministry has announced the three due dates for filing GSTR-3B for different categories of Taxpayers. The Finance Ministry today said that now GST taxpayers can file their GSTR-3B returns in a staggered manner. Considering the difficulties faced by … Continued

ITR Form for AY 2020-21: new disclosures that taxpayers need to make in new ITR forms

More disclosures are aimed at improving income tax compliances & e-assessments. In AY 2018-19, 58.7 million returns were filed, out of which about 23.7 million people filed returns with no tax liability While it may be commonplace in Uncle Sam’s … Continued

CBDT extends till Jan 31 deadline for compounding of I-T offences

Taxpayers get one more chance to clear their tax dues. The CBDT has extended till January 31 the last date for taxpayers to avail a “one-time” facility to apply for compounding of income tax offences, an order issued on Friday … Continued

Large unlisted companies face quicker disclosure rule

Large unlisted companies may have to make quarterly or half-yearly filings, like their listed counterparts, as the government is considering amendments to the Companies Act to mandate more frequent disclosures in the aftermath of the IL&FS collapse. The ministry of … Continued

Non-filing of GST returns may lead to attachment of bank accounts

December, 26th 2019 CBIC issues Standard Operation Procedure to deal with non-filers Non-filing of GST (Goods & Services Tax) returns may lead to attachment of bank accounts and even cancellation of registrations. This is part of the Standard Operating Procedure … Continued

Not filing GST return could cost businesses their tax registration, assets

Not filing Goods and Services Tax (GST) returns on time could cost businesses their assets as well as their tax registration, according to a set of instructions the government has issued to field officers, aimed at forcing compliance. The standard … Continued

Major announcements in GST council meet dt : 18th Dec 2019

Here are some of the major announcements in GST council meet dt : 18th Dec 2019 The Council decided that input tax credit will now be restricted to 10 percent as against 20 percent earlier if invoices not uploaded. Deadline … Continued

Chartered Accountants joining Unrecognized ‘Networks’ for Professional Work will be subject to Disciplinary Proceedings

The Institute of Chartered Accountants of India (ICAI) today clarified that, Chartered Accountants joining Unrecognized ‘Networks’ for Professional Work amounts may result in Disciplinary Proceedings. The ICAI has said that, It has come to the knowledge of the Institute that … Continued

SEBI action against auditors not ‘turf war’: Ajay Tyagi

Capital markets regulator Sebi on Wednesday said its actions against auditors for faulty audits are within its “Parliamentary mandate”, and there is no question of “turf wars” on this issue. SEBI Chairman Ajay Tyagi said the watchdog is working only … Continued

MCA amends threshold limits for Related Party Transactions.

The central government notified the Companies (Meetings of Board and its Powers) Second Amendment Rules, 2019 on 18 November 2019. The amendment rules amend sub-clause 3 of rule 15 of the Companies (Meetings of Board and its Powers) Rules, 2014. … Continued

Insolvency regime for personal guarantors to corporate debtors from December 1

The insolvency regime for individual guarantors to corporate debtors will be in force from December 1, according to the government. The provisions for resolution for individuals under the Insolvency and Bankruptcy Code (IBC) is being implemented in a phased manner. … Continued

IBC proceeds formula may be reworked to avoid squabbles, legal delays

The government is considering a formula for distributing the proceeds of insolvency resolution among financial and operational creditors in a fixed proportion, said people with knowledge of the matter. The goal is to protect the interests of operational creditors and … Continued

Govt extends deadline for filing GSTR-9 (Annual Return) and Form GSTR-9C (Reconciliation Statement)

In a relief to taxpayers, the government on Thursday extended the due dates for filing GST annual returns for 2017-18 to December 31 and for the financial year 2018-19, to March 31 next year. The dates for filing the reconciliation … Continued

Re-activate your de-activated DIN

Deactivation of DIN for non-compliance of KYC by company Directors has since been marked as ‘Deactivated due to non-filing of DIR-3 KYC’. The Ministry of Corporate Affairs website (“MCA”), MCA has stated that the DINs which have not complied with the … Continued

MCA extends due date for filing of AOC 4 and MGT 7 (Financial Statements & Annual Return)

MCA has notified that the due date for filing of financial statements and annual return in e-forms AOC 4, AOC (CFS) and AOC-4 XBRL upto 30 Nov. 2019 and e-form MGT 7 up to 31 Dec. 2019 by companies without … Continued

Not received your tax refund? Here is what you should do

Direct credit to bank accounts of taxpayers is the only way the income tax department credits tax refunds. Filed your income tax return (ITR) for the assessment year (AY) 2019-20 on time but yet not receive your refund? Don’t worry. … Continued

Faceless scrutiny of income tax return.. Here is all you need to know

The E-assessment Scheme 2019 aims to eliminate human interface, reduce corruption and bring in transparency. The idea of faceless E-assessment was mooted in the Budget 2018 by the late Finance Minister, Arun Jaitley, who announced the proposal to introduce the … Continued

DIR-3 KYC for Financial year 2018-19 has been extended

As per Ministry of Corporate Affairs, if any person has been allotted “Director Identification Number” and the status of such DIN appears to be Approved then such Director needs to file a form to update DIR-3 KYC details in the … Continued

CBDT extends the due date for filing ITRs & Tax Audit Reports from 30 th September to 31, October 2019

The Central Board of Direct Taxes (CBDT) has decided to extend the deadline for filing of ITRs and Tax Audits Reports by a month. Given the relentless demands by Chartered Accountants (CAs) and tax consultants, the CBDT has given a … Continued

File revised tax returns after rectifying errors

Most of us collate all information relating to our annual income, investments and tax deducted at source (TDS) before proceeding to file our income tax returns. However, the income tax filing process is a fairly comprehensive exercise. We might miss … Continued

Missed Income Tax Return (ITR) Filing Deadline? Here Are Your Options

Individuals having an annual income of up to Rs2.5 lakh are not required to file income tax returns, according to Income Tax department. Missed the August 31 deadline for filing income tax return (ITR) for financial year 2018-19 (assessment year … Continued

Government mulls ceiling for audit firms amid crack down on lapses

India is considering tougher rules for audit firms, including a cap on the number of listed companies they can examine, according to a person with knowledge of the matter, as the government seeks to tighten oversight after a recent spate … Continued

Clarification on Auditor’s Certificate on Return of Deposits-DPT-3

Clarification on Auditor’s Certificate on Return of Deposits pursuant to Rule 16 of the Companies (Acceptance of Deposits) Rules, 2014 This has reference to Rule 16 of the Companies (Acceptance of Deposits) Rules, 2014 and further amendments. In this … Continued

All companies to file a one-time return of all outstanding receipts of money or loans from April 1, 2014, to March 31st, 2019

With a spate of corporate irregularities coming to the fore, the Centre has decided to make disclosure norms more stringent. Corporate India is now required to submit details of transactions involving the receipt of money or loans taken by them, which are … Continued

Income tax department eyes over Rs 100 bn from ‘struck off’ firms

The income-tax (I-T) department is estimating tax recovery of over Rs 100 billion from companies that have been struck off from records of the Registrar of Companies (RoC) last year. The tax department is in the process of filing a petition before the National Company … Continued

MCA sees Rs 2.8 lakh cr recovery from IBC-led resolution process

Terming the current insolvency process and its outcomes as ‘super success, Ministry of Corporate Affairs sees total recovery amount touching Rs 2.8 lakh crore through resolutions with the settlement of two key accounts, including some others — Essar Steel, where … Continued

MCA brings more clarity on guidelines for reserving the name of the Company

MCA has created a dedicated unit Central Registration Centre (CRC) to expedite the incorporation related activities including Name approval. Yet the stakeholders were facing difficulty in getting the name approved due to lack clarity in the Rules for selection of … Continued

Government releases compliance schedule to ensure MSME payments

Directors of companies delaying payments for supplies made by small businesses will face imprisonment up to six months or pay fines between Rs 25,000 and Rs 3,00,000. The Ministry of Corporate Affairs has notified new guidelines to address the concerns … Continued

CBDT to share data with GST department to trap tax evaders

The government on Tuesday authorized the income tax department to share details including sales and profits that businesses have reported in their income tax returns with GSTN, the company that processes Goods and Services Tax (GST) returns, to scale up … Continued

DIR-3-DIN eKYC annual filing deadline extended to 30th June of next financial year

MINISTRY OF CORPORATE AFFAIRS NOTIFICATION New Delhi, 30th April, 2019 MCA has notified that the Deadline for Annual Filing of Form DIR 3 ((KYC of Directors) has been Extended from 30 April to 30 June, of the … Continued

MCA Extends Due date of filing form INC 22A (ACTIVE) till 15th June 2019

The Government of India, through the Ministry of Corporate Affairs, has made it mandatory for to file ACTIVE eForm or INC-22A. The due date for filing INC-22A was 25th April 2019. There have been representations made to the MCA for … Continued

Income Tax Return Forms for Salaried Class, Professionals and self-employed individuals available for e-filing

The Income Tax Department has informed that the tax return forms i.e, ITR-1 and ITR-4 for the salaried persons, Professionals, and self-employed individuals are available in the official portal for e-filing. It also said that the other forms for Companies … Continued

Filing of e-Form DIR 3 for KYC of Directors mandatory, on Annual Basis – MCA

MCA’s Clarification on filing of e Form DIR – 3 KYC, annually, by all Directors holding DIN The Ministry of Corporate Affairs (MCA) has on 13th April, 2019, given the clarification with regards to filling of e-Form DIR – 3 … Continued

All Active Companies to submit “Active Company Tagging Identities and Verification” Form_INC-22A before 26th Apr 2019

Inactive Companies, Vanishing Companies, Shell Companies, Multiple Companies registered under the same address and Companies without proper Registered Offices operating have all been a problem with the Indian regulatory framework which have significantly hampered the ability of the MCA to … Continued

President promulgates Unregulated Deposit Scheme Ordinance

The President on Thursday promulgated the Banning of Unregulated Deposit Scheme Ordinance which seek to curb the menace of ponzi schemes and make such unregulated deposit scheme punishable. The Ordinance will help put a check on illicit deposit taking activities … Continued

The Companies (Amendment) Ordinance, 2019 – highlights

The Companies (Amendment) Ordinance, 2019 was promulgated on January 12, 2019. It repeals and replaces the Companies (Amendment) Ordinance, 2018 promulgated on November 2, 2018. The 2019 Ordinance amends several provisions in the Companies Act, 2013 relating to penalties, among … Continued

Auditors barred from putting a value on companies they are auditing

An income tax tribunal has barred auditors from issuing valuation certificates to the companies they are auditing. This is set to impact several tax disputes around valuations in companies including angel tax disputes involving start-ups. The Bangalore Income Tax Appellate … Continued

32nd GST Council Meeting – Key Takeaways

Outcome of 32nd GST Council Meeting -The highlights of the reliefs announced by FM Arun Jaitley are as below: 1. Threshold limit for GST Registration increased to 40 Lakhs Effective April 1, the GST exemption threshold has been raised from … Continued

GST Council extends Due Dates for Annual Returns and other GST Returns

The 31st GST Council meeting concluded today under the guidance of Union Minister Arun Jaitley has taken some important decisions including the due date extension for GST Annual Returns and some other Returns. As per the recommendation of the Council, … Continued

MCA extends Annual Return due date upto 31 Dec. 2018

Keeping in view the requests received from various stakeholders seeking extension of time for filing of financial statements for the financial year ended 31.03.2018 on account of various factors, it has been decided to relax the additional fees payable by companies on e-forms … Continued

GSTN enables facility to claim Refund of Tax due to any Other Reason

The facility to claim Refund on account of any other reason has now enabled in the Goods and Services Tax Network ( GSTN ). In statement released today, the official twitter account of the GSTN tweeted that “Facility to claim … Continued

As SEBI reforms startup listing, SMEs must ensure funds are not misused

Amid SEBI banning as many as 239 entities for alleged money laundering, taxation consultancy PwC has called for a three-year locking-in for the entire pre-listing capital held by promoters to curb tax evasion and other illegal activities through market platforms. … Continued

Keep your DIN status approved by filing DIR-3 KYC before 5 th October, 2018

The Ministry of Corporate Affairs (MCA) has decided to give 21 lakh India Inc directors another 15 days to reactivate their Director Identification Numbers (DINs) by filing Know-Your-Customer (KYC) details upon paying a reduced fee. The decision was taken by … Continued

2.1 million company directors may get another chance to adhere to KYC rules

The government is considering giving another opportunity to 2.1 million company directors who have failed to comply with the ‘know your customer’ (KYC) norms, according to a senior official. The government could give another 15 days for meeting the compliance … Continued

CBIC to weed out a million assessees from GST tax net

The Central Board of Indirect Taxes and Customs (CBIC) has initiated a process to weed out approximately 12 lakh Goods and Services Tax (GST) assessees who have fallen off the tax map. “The CBIC has communicated to field officers to … Continued

Surge in filing of Income Tax Returns by 71% upto 31st August,2018

There has been a marked improvement in the number of Income Tax Returns (ITRs) filed during FY 2018 (upto 31/08/2018, the extended due date of filing) compared to the corresponding period in the preceding year. The total number of ITRs … Continued

MCA extends due date of DIR-3KYC / E-KYC of Directors

In order to update the Directors database of The Ministry of Corporate Affairs(MCA), MCA has requested all Directors holding a DIN to complete DIN KYC before 15th September 2018. To complete DIN KYC, the Director would be required to file a … Continued

India replaces France as world’s 6th biggest economy

India has become the world’s sixth-biggest economy, pushing France into seventh place, according to updated World Bank figures for 2017. India’s gross domestic product (GDP) amounted to $2.597 trillion at the end of last year, against $2.582 trillion for France. … Continued

SEBI calls for stringent laws against erring auditors, valuers

India’s capital market regulator has proposed amendments to tighten laws governing auditors and other third-party individuals hired by listed companies for auditing financial results, among other things. The Kotak Committee, formed to come up with proposals for improving corporate governance, … Continued

ICAI UDIN aims to address concerns of CAs with respect to forgery and fake use of name by Non CAs.

ICAI have launched Unique Document Identification Number (UDIN) facility which is a unique number, which will be generated by the system for every document certified/ attested by a Chartered Accountant and registered with the UDIN portal available at https://udin.icai.org/ with effect from 1st July … Continued

SEBI tweaks rules for IPOs, buybacks and takeovers

The Securities and Exchange Board of India (Sebi) on Thursday eased several rules relating to Initial Public Offers (IPO), rights issues, buybacks and takeovers. The regulator’s board approved these changes as also those relating tenures of managing directors of market … Continued

Companies Act Compliance: Consequences of not filing Annual Return

The financial statements and annual returns of all company must be filed on time with the ROC / MCA each year. As per Companies Act, 2013, non-filing of annual return is an offence, consequences of which affect the directors, as … Continued

GST payers can move jurisdictional tax officer to change username, password

Taxpayer would be required to approach the concerned jurisdictional tax officer to get the password for the GST Identification Number (GSTIN) allotted to the business The Finance Ministry on Thursday said that GST registrants can approach jurisdictional tax officer … Continued

I-T department bars CAs from valuing shares of closely held firms

The income tax (I-T) has barred all Chartered Accountants (CAs) from valuing shares of closely-held companies. Earlier, the fair market value of unlisted equity shares was calculated at the option of the company on either the book value on the … Continued

How new single monthly GST return system will be implemented

The Goods and Services Tax (GST) Council on Friday finally approved single monthly return with an aim to boost collections and compliance. The new system is scheduled to be implemented in next six months — but could take more time. “The … Continued

SEBI panel proposes stricter norms for RTAs

A Securities and Exchange Board of India (Sebi) panel on Friday proposed tighter ownership and governance norms for registrar and transfer agents (RTAs). According to a discussion paper released by Sebi, the panel, headed by former Reserve Bank of India … Continued

SEBI puts in place new framework to check non-compliance of listing rules

Sebi has put in place a stronger mechanism to check non-compliance of listing conditions, wherein exchanges will have powers to freeze promoter shareholding and even delist the shares of such defaulting companies. The move is aimed at maintaining consistency and … Continued

World Bank projects India’s FY19 GDP growth at 7.3%

The World Bank today projected India’s GDP growth at 7.3 per cent for the next financial year and accelerate further to 7.5 per cent in 2019-20. The World Bank’s biannual publication, India Development Update: India’s Growth Story, expects the economy … Continued

GSTR-3B may be extended till June, simplified return forms on cards

The GST Council in its meeting on Saturday is likely to extend the deadline for filing of simplified sales return GSTR-3B by three months till June. The Council, chaired by Finance Minister Arun Jaitley and comprising his state counterparts, is … Continued

Private equity investors bring in deals worth $983 mn in January: Thornton

Private equity (PE) investors announced deals worth $983 million in January, a 23 per cent rise in value terms over last year, driven by big ticket transactions, says a Grant Thornton report. According to the assurance, tax and advisory firm, … Continued

Deadline for filing revised or belated income tax return for past 2 assessment years is March 31

The date you actually need to focus on is March 31, because that is the last day to file revised and belated income tax returns (ITR) for assessment years (AY) 2016-17 and 2017-18, with interest, if any, for late filing. … Continued

SEBI READIES P-NOTE FRAMEWORK FOR GIFT CITY

Market regulator Sebi is readying a framework for issuance of participatory notes (p-notes) from international financial services centres such as GIFT City. It is in talks with FPIs, which act as issuers of p-notes, sources said. The move comes at … Continued

Shell companies crackdown: Govt removes exemptions from ITR filing

Seeking to crackdown on shell companies, the government has proposed to remove exemption available to firms with tax liability of up to Rs 3,000 from filing I-T returns beginning next fiscal. The Union Budget 2018-19 has rationalised the I-T Act … Continued

Tax incentives for International Financial Services centre

In order to promote trade in stock exchanges located in International Financial Services Centre (IFSC), the Union Finance and Corporate Affairs Minister Arun Jaitley proposed to provide two more concessions for IFSC. Presenting the General Budget 2018-19 in Parliament Jaitley … Continued

PE fund multiples to raise $1 billion for resurgent India

Multiples Alternate Asset Management, the private equity fund founded by former ICICI Venture CEO Renuka Ramnath, is set to raise as much as $1billion in what could be one of the largest capital-raising plans by a domestic asset manager. The … Continued

Foreign investors pump $3 billion into capital markets, forex at record high in January

Foreign portfolio investors (FPIs) have invested a phenomenal $3 billion (close to Rs 18,000 crore) in India’s capital markets this month on expectations of high yields as corporate earnings are expected to pick up with the economy gathering momentum after … Continued

Investment in participatory notes hits 6-month high of Rs.1.5 lakh cr in December

According to SEBI data, the total value of P-note investments in Indian markets – equity, debt, and derivatives – increased to ₹1,52,243 crore at December-end from ₹1,28,639 crore at the end of November. Investments in domestic capital markets through participatory … Continued

Government sends tax notices to cryptocurrency investors as trading hits $3.5 billion

The government has sent tax notices to tens of thousands of people dealing in cryptocurrency after a nationwide survey showed more than $3.5 billion worth of transactions have been conducted over a 17-month period, the income tax department said. … Continued

PE investments jump 55% to all-time high of $24 bn across 591 deals in 2017

Private equity firms invested $23.8 billion across 591 deals in 2017, making it the biggest year for PE investments in India, says a report. According to deal tracker Venture Intelligence, the investment value is 39 per cent higher than the … Continued

Direct tax mop-up jumps 19% in FY18

Direct tax collections during the first nine-and-a-half months of the current fiscal have risen by 18.7% to Rs 6.89 lakh crore, the tax department said on Wednesday. The collections till January 15, 2018 represent over 70% of the Rs 9.8-lakh-crore … Continued

Unexplained deposits in focus, taxmen ordered to go all out in the next three months

The income-tax department will in all likelihood go into overdrive in the next three months with the Central Board of Direct Taxes — the apex body — alerting all senior tax officials that their performance is being “monitored at the … Continued

World Bank says India has huge potential, projects 7.3% growth in 2018

India’s growth rate in 2018 is projected to hit 7.3 per cent and 7.5 per cent in the next two years, according to the World Bank, which said the country has “enormous growth potential” compared to other emerging economies with … Continued

Listed SMEs to touch 1,000 in next 2 yrs: Merchant banker

The number of small and medium enterprises listed on BSE and NSE platforms is expected to reach 1,000 in the next two years from nearly 350 at present, leading merchant banker Guiness Corporate Advisory Services said today. More companies will … Continued

Bitcoin risks: Government warns against cryptocurrency, says don’t get trapped

Weeks after the Reserve Bank of India issued its third warning against the crypto currency trading, the Finance Ministry today said that virtual currencies are not legal tender and such currencies have no protection. It said the virtual currencies (VCs) … Continued

Non-compliance to be ‘very costly’ for companies: Government

Sending out a strong message to corporates, the government has said non-compliance will be “very costly” and strong deterrents will be there to curb the dangerous adventure of using companies for wrongful purposes. Continuing the clampdown on illicit fund flows, … Continued

Here’s why India has decided to crank up its crackdown against Bitcoins

Here’s why India has decided to crank up its crackdown against Bitcoins The rising craze for bitcoin, a cryptocurrency that has rocketed to shocking highs, has come under the government’s lens. Bitcoin can be an easy way to evade tax … Continued

Demonetisation, GST will bring long-term benefits for Indian economy: IMF on Narendra Modi’s one-off policy moves

The disruptive impact of demonetisation announced last year is a temporary phenomenon and the scrapping of the high-value currency would bring “permanent and substantial benefits”, according to the International Monetary Fund (IMF). In an interview to CNBC TV18, IMF Economic … Continued

117 companies raise Rs 62k cr via IPOs in Apr-Nov FY18, highest in 5 years

As many as 117 companies have garnered a staggering Rs 62,736 crore through IPOs in the first eight months of Financial Year 2017-18, much higher than the cumulative amount raised in the last five fiscals, Parliament was informed on Friday. … Continued

MCA introduces Condonation of Delay Scheme 2018 for defaulting companies

MCA introduces Condonation of Delay Scheme 2018 (CODS-2018) for defaulting companies to file its overdue returns/documents due for filing till 30.06.2017 by temporarily activating DIN of disqualified directors General Circular No………./2017 File No. 02/04//2017 Ministry of … Continued

FPIs pump over Rs 19,700 crore in November, highest in eight months

Foreign investors pumped over Rs 19,700 crore into the country’s stock markets in November, the highest in eight months, mainly due to government’s plan to recapitalise PSU banks and surge in India’s ranking in the World Bank’s ease of doing … Continued

CBDT shoots off letter to taxmen, says don’t go overboard on fishing and roving inquiries in wake of demonetisation drive

The Central Board of Direct Taxes (CBDT) has sent a missive to all assessing officers (AOs) to stick to protocol while pursuing cases of “limited scrutiny” and not resort to “fishing and roving inquiries” in such cases. The Central Board … Continued

Cannot provide relief for de-registered firms, disqualified directors: Minister

The Corporate Affairs Ministry has ruled out providing any relief for the 2.25 lakh de-registered companies and the 3.09 lakh disqualified directors, stating that these actions were caused by the ‘operation of law’. “There is no proposal before us to … Continued

GST return filings for October rise 11% to 4.4 million

Around 56% of the registered taxpayers have filed their GSTR-3B returns for October by 20 November, says GSTN Taxpayer compliance under the goods and services tax (GST) system is steadily improving with 4.4 million assessees filing summary of the transactions … Continued

CBDT signs 7 more unilateral APAs with taxpayers

The Central Board of Direct Taxes (CBDT) has signed seven more advance pricing agreements (APAs) with Indian taxpayers as it looks to reduce litigation by providing certainty in transfer pricing. The seven APAs signed over the last month pertain to … Continued

India jumps 30 places on World Bank’s ease of doing business index, breaks into top 100

Doing business in India became much easier over the past one year because of a raft of policy reforms, an annual World Bank index showed on Tuesday, in what is possibly a shot in the arm for Prime Minister Narendra … Continued

MCA scanner on banks lending to deregistered companies

The corporate affairs ministry is likely to ask the department of financial services to take action against the banks which have continued lending to companies that have been deregistered. The ministry is also likely to raise the issue of banks … Continued

GST returns filing: Tax experts doubt system’s accuracy; only a quarter of taxpayers meet October 31 deadline

Increasing the fear of an unravelling of the exercise of invoices-matching, which is crucial to realising the presumed merits of the goods and services tax (GST), like reduction of tax evasion and cascades, three-fourths of the 60 lakh eligible taxpayers … Continued

MCA extends the due date for filing all AOC-4 (Annual Financial Statemet) till 28.11.2017.

Ministry of Corporate Affairs has extended the due date for filing the Audited Financial Statement for Financial Year 2016-17 till November 28,2017. Keeping in view the requests received from various stakeholders, for allowing extension of time for … Continued

Government tightens screws on assets owned by deregistered companies

The corporate affairs ministry today asked states to complete identification of properties owned by deregistered companies at the earliest and ensure district administrations prevent transactions in those assets. Amid intensifying efforts to fight the black money menace, the ministry has … Continued

Exporters can claim refund this week for GST paid in August, September

Exporters can soon start claiming refunds for GST paid in August and September as GSTN will this week launch an online application for processing of refund, its Chief Executive Officer Prakash Kumar said today. GST Network (GSTN), the company handling … Continued

India should prioritise public banking sector reforms: IMF

India must prioritise implementation of public banking sector structural reforms, enhance the efficiency of labour and product markets, and modernise agriculture sector to accelerate its growth, the IMF said Friday. The country’s growth is expected to accelerate in the medium-term … Continued

Banks begin to accept GST input claims to grant working capital

More than 90 days after the roll-out of the goods and services tax (GST), lenders are gravitating to sanctioning working capital loans, especially to micro and small units, against documents used in the new tax regime. They are no longer … Continued

GST: Tax department seeks details of transitional credit data

The tax department has sought explanations from banks and financial institutions, including multinationals, on transitional credit claimed by them in July under the goods and services tax (GST) regime, two people with direct knowledge of the matter said. Deputy commissioners … Continued

IMF favors three structural reforms in India

The IMF has suggested a three- pronged approach for structural reform in India that includes addressing the corporate and banking sector weaknesses, continued fiscal consolidation through revenue measure, and improving the efficiency of labour and product markets. Deputy Director Asia … Continued

Individual businesses to soon be under ambit of bankruptcy code

The government on Tuesday expanded the scope of the new insolvency rules to bring individual businesses under its purview. On Tuesday, the Insolvency and Bankruptcy Board of India (IBBI) published the draft rules dealing with insolvency resolution process of individuals … Continued

SEBI fixes penalty for non-compliance of shareholding norms

SEBI has tightened the noose on listed companies not adhering to norms with regard to minimum public shareholding (MPS). Those that are non-compliant will have to pay a fine of Rs.5,000 a day. In addition, the entire promoter holding, except … Continued

GST Council meeting: Full text of recommendations made by panel today

More than three months after the Goods and Services (GST) was introduced, the GST Council made a number of big changes today, to give some relief to small and medium businesses (SMEs) on filing and payment of taxes. The panel … Continued

MCA plans to ease process for starting biz

The Ministry of Corporate Affairs plans to simplify the existing processes for setting up a company, according to a public notice. In this regard, the ministry — which is implementing the Companies Act — has sought views from the stakeholders. … Continued

Govt wants early warning system on shell companies

The ministry of corporate affairs (MCA) says work has begun for an “early warning system” regarding shell companies. The term is used to refer to a company without active business operations or much of assets. This by itself isn’t … Continued

India is world’s 40th most competitive economy: WEF

India has been ranked as the 40th most competitive economy — slipping one place from last year’s ranking — on the World Economic Forum’s global competitiveness index, which is topped by Switzerland. On the list of 137 economies, Switzerland is … Continued

200,000 more directors disqualified for holding posts in defaulting companies

The corporate affairs ministry has disqualified another 200,000 directors for holding posts in defaulting companies that have not filed their financial returns for the last three years or more, taking the total number to over 300,000, while cancelling the registration … Continued

India growing pretty robustly: World Bank President Jim Kim

India has been growing “pretty robustly”, World Bank President Jim Yong Kim has said as he predicted a strong global growth this year. Speaking at the Bloomberg Global Business Forum meeting here on Wednesday, Kim also called for more cooperation … Continued

GST interim returns: Over 30 lakh paid tax in August, matching July trend

While the number of businesses registered for the goods and services tax (GST) has crossed 90 lakh, much higher than tax base in the previous regime, filing of even the interim (summarised) returns and tax payments are not keeping pace. … Continued

FDI likely to rise further after GST: Moody’s

India is likely see increased foreign direct investment (FDI) inflows on the back of reforms such as introduction of the goods and services tax and the bankruptcy code, international ratings agency Moody’s said in a report on Monday. “Combined with … Continued

Jurisdiction-free I-T assessment on the cards

To check corruption and harassment, the tax department will soon launch a pilot of “jurisdiction-free assessment” where a tax officer will not get to know identity of the assessee as allotment of cases will be done randomly by computers rather … Continued

Financials hit a new high in India

Lending and borrowing money is now India’s fastest-growing segment, and the successful industry and lenders are the latest darlings of equity investors. The share of banks and non-banking finance companies (NBFCs) in the market capitalisation (market cap, or m-cap) of … Continued

I-T department goes after defunct companies for tax frauds

The tax office is reopening old records of many companies that have wound up and no longer exist in the books of the government — something the revenue department has rarely done in the past. Former directors of such closely-held … Continued

Bankruptcy board to register 100 more insolvency professionals to add to 940

The Insolvency and Bankruptcy Board of India (IBBI), which has so far registered 940 insolvency professionals (IPs), is in the process of granting registration to about 100 more such professionals, according to its whole time member Navrang Saini. “It is … Continued

Tax authorities to scan GST transition credit claim of 162 companies

As many as 162 companies that have claimed GST transitional credit of over Rs. 1 crore are under the scanner of tax authorities who would verify whether the claims are eligible. In the transitional credit form TRAN–1 filed by taxpayers … Continued

CBEC plans strategy to bring more businesses in GST net

Tax officials are working out strategies to encourage more businesses to register for the Goods and Services Tax (GST) and further increase the taxpayer base. At present, there are about 90 lakh businesses registered to file returns and pay taxes … Continued

FPI inflows: India’s forex reserves all set to hit whopping $400 bn mark; here is how long it took and why

India’s foreign exchange reserves have climbed tantalizingly close to the $400-billion mark on September 1 on the back of strong foreign portfolio investments into the Indian market, especially the debt segment The reserves are hitting the psychological threshold also because … Continued

Auditors come under lens amid crackdown on shell companies

A multi-agency clampdown has begun on shell companies to tackle the black money menace wherein the role of auditors has come under the scanner for alleged connivance in facilitating illegal transactions. The auditors’ role is also being looked into for … Continued

World Bank accepts many of Modi govt’s reform claims, big thumbs-up likely next month

The government expects a double-digit improvement in India’s rank in the global index on ease of doing business, likely to be announced by the World Bank next month. A senior official told ET that the World Bank had shared its … Continued

Filing Dates for GSTRs for July extended by a month to October 10

Press Information Bureau Government of India Ministry of Finance 09-September-2017 20:19 IST The GST Council, in its 21st meeting held at Hyderabad on 9th September 2017, has recommended the following measures to facilitate taxpayers: a) In view of … Continued

Centre asks banks to restrict accounts of 2.09 lakh firms

The finance ministry has advised all banks to take immediate steps to restrict transactions in bank accounts of more than 2.09 lakh companies, whose names have been struck off the Register of Companies. Banks have also been advised to step … Continued

Attack on shell firms: MCA issues notices to errant NBFCs

In yet another attempt to crack the whip on shell companies, the Ministry of Corporate Affairs has issued notices to companies which were supposed to act as non-banking financial companies (NBFCs) but have not registered with the Reserve Bank of … Continued

SEBI warns of rising external debt risks as masala bonds surge

The rupee-denominated bonds, popularly known as masala bonds, are likely to add to the nation’s external liabilities even if they don’t hold any risks to currency movement, a top Sebi official said on Wednesday. “When money flows into the country … Continued

Directors of Shell firms can’t join other companies’ boards