The Income Tax department’s ambitious plan to verify ITRs electronically through an internet-based system by using the Aadhaar and banking database has crossed the one crore mark.

The Income Tax department’s ambitious plan to verify ITRs electronically through an internet-based system by using the Aadhaar and banking database has crossed the one crore mark.

As per the latest data, over 1.02 crore Income Tax Returns (ITRS) have been verified by the internet-based electronic filing system of the department.

“The figures for e-verified ITRs stand at 1,02,08,715 as of now. The one crore mark was achieved recently and the department wants this to grow by leaps and bounds so that e-filing becomes more popular with taxpayers,” a senior official said.

The Central Board of Direct Taxes (CBDT), the policy-making body for the I-T department, had first launched the initiative of linking the two databases– Permanent Account Number and Aadhaar– late last year to start a hassle-free and quick electronic filing regime for taxpayers with the help of a One Time Password (OTP) via SMS or email.

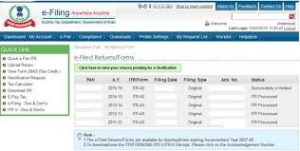

The e-filing system allows online verification of a person’s ITR by using either the Aadhaar number, internet banking or bank account along with email and mobile number, thereby ending the practice of sending paper acknowledgment to the Centralised Processing Centre (CPC) of the department located in Bengaluru.

The online ITR filing portal of the department is available at https://incometaxindiaefiling.Gov.In.

According to the rules notified in this regard by CBDT in July last year, any taxpayer whose income is Rs 5 lakh or below per annum and has no refund claims can straightaway generate the Electronic Verification Code (EVC) for e-filing and validating their ITR through their registered mobile number and e-mail ID with the department.

They get a system generated one-time password (OTP) to validate their ITRs with the help of the Aadhaar number, e-banking facility and through the ATM-link in certain cases.

This new measure has eliminated the need of sending the paper acknowledgment called ITR-V through post to the CPC.

Under the same initiative, over 65 lakh linkages have been achieved till now between the Aadhaar and PAN databse.