Over 75 lakh taxpayers availed the e-verification facility of their income tax returns filed till August 5 against around 33 lakh taxpayers last year till September 7, which will ensure faster processing of their returns. In all 226.98 lakh e-returns were filed in FY 2016-17 as compared to 70.97 lakh for the same period in FY 2015-16. The number is higher because last year the date of filing had been extended to September 7.

By September 7, 2015 nearly 207 lakh returns had been filed, which yields 9.8% rise in e-filing this year. Aadhaar based e-verification was used by 17.68 lakh taxpayers during the current year as against 10.41 lakh taxpayers during the same period in 2015-16, finance ministry said in a statement.

“In addition to these, 3.32 lakh returns were digitally signed. Thus, over 35% of taxpayers have already completed the entire process of return submission electronically,” it added. The forms that are not electronically verified have to be physically mailed to processing centre in Bengaluru before they can be processed.

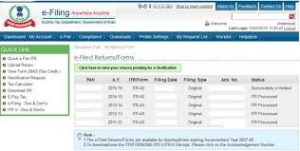

The revenue department is encouraging all taxpayers who have submitted their returns to e-verify them as an easy alternative to sending their ITR-V form to CPC, Bengaluru.

The government said tax refunds of Rs 14,332 crore have been issued this year till August 5. “The Central Processing Centre (CPC) Bengaluru has already issued over 54.35 lakh refunds totaling to Rs 14,332 crore have been issued this year till August 5. “The Central Processing Centre (CPC) Bengaluru has already issued over 54.35 lakh refunds totaling to Rs 14,332 crore which includes 20.81 lakh refunds for AY 2016-17 (current year returns) totaling to Rs 2,922 crore till August 5, 2016,” the statement said.

Source: http://economictimes.indiatimes.com/articleshow/53607133.cms