- WHAT IS DOUBLE TAXATION OF INCOME?

When the same income is taxed more than once, due to levying of tax by two or more jurisdictions, on the same income asset or financial transaction, this results in double taxation. This may happen, when an assessee – an Individual or a company, is taxed more than once for the same income in India, either on the basis of place of residence or on the basis of source of accrual, which leads to double taxation.

Countries have started entering into Double Taxation Avoidance Agreements (DTAA) with other countries to resolve double taxation issue so as to ease out the tax burden of their taxpayers. This relief for taxes paid in foreign country is given to taxpayer while taxing the same income in India, which is termed as Foreign Tax Credit (FTC).

B. HOW DOUBLE TAXATION AVOIDANCE AGREEMENT (DTAA) WORKS?

In any country, the tax is levied based on 1) Source Rule and 2) the Residence Rule.

The source rule holds that income is to be taxed in the country in which it originates irrespective of whether the income accrues to a resident or a non-resident whereas the residence rule stipulates that the power to tax should rest with the country in which the taxpayer resides.

If both rules apply simultaneously to a business entity and it were to suffer tax at both ends, the cost of operating on an international business would become prohibitive and would deter the process of globalization. It is from this point of view that Double Taxation Avoidance Agreements (DTAA) have become significant.

Where the Central Government has entered into an agreement with the Government of any country outside India or specified territory outside India, for granting relief of tax, or as the case may be, avoidance of double taxation, then, in relation to the assessee to whom such agreement applies, the provisions of this Act shall apply to the extent they are more beneficial to that assessee.

Impact of Double Taxation Avoidance Agreement:

1. WHERE DTAA EXISTS (SECTION 90):

There are two methods of granting relief under Double Taxation Avoidance Agreement.

Exemption method – A particular income is taxed in one of the both countries and exempted in the other

Example- For the Income from Dividend, Interest, royalty and fees for technical services Source Rule is applicable in treaty with Greece, Libyan and United Arab Republic. So for citizen of these 3 countries if the dividend, interest, royalty or fees for technical services is arising in India, then it will be solely taxable in India only and for a resident if such income is arising in any of these 3 countries then the income will solely be taxed in these 3 countries and it will not at all be taxable in India.

Tax Credit method- The income is taxed in both the countries as per the treaty and the country of residence will allow the tax credit / reduction for the tax charged in the country of Origin.

Example- Mr. A (an Indian resident) has received salary from a US company for job in US. Since Mr. A is a resident so his global Income will be taxable in India. In this case, source country is US (since the service has been rendered in US) and resident country is India. So at the time of computation of tax liability of Mr. A, the tax paid in US will be allowed as set off against his total tax liability but limited to the tax payable on such foreign income at Indian tax rates.

Therefore DTAA determines which method to be used first and, if the income is taxable only in one country then exemption method shall be used, but if the same is taxable in both countries then tax credit method comes into play.

In case where Bilateral agreement has been entered under section 90 of the Income Tax Act, 1961 with a foreign country then the assessee has an option either to be taxed as per the Double Taxation Avoidance Agreement (hereinafter referred as “DTAA”) or as per the normal provisions of Income Tax Act 1961, whichever is more beneficial to assessee.

Example- As per DTAA between India and Germany, tax on Interest is specified @ 10% whereas under Income Tax Act 1961, it depends on slab rates for individuals & HUF and flat rates (generally 30%) for other kind of assessees (like firm, company etc). Hence, one can follow DTAA and pay tax @ 10% only.

2. WHERE DTAA DOES NOT EXIST (SECTION 91):

i. If any person who is resident in India in any previous year, in respect of income which arose outside India (and which is not deemed to accrue or arise in India), and paid in any country with which there is no agreement under section 90 for the relief or avoidance of double taxation, then he shall be entitled to the deduction from the tax payable in India,

ii. Deduction shall be lower of:

- Tax calculated on such double taxed income at the Indian rates.

- Tax calculated on such double taxed income at the rate of tax of the said country

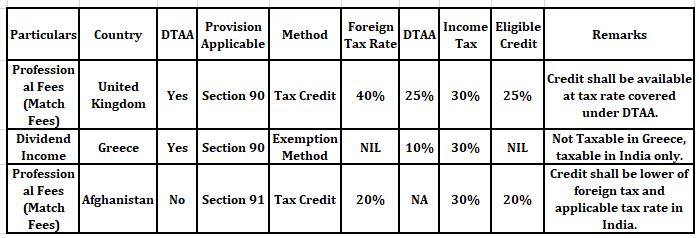

Example :Suppose Indian Sportsman, resident of India who earns foreign income in form of match fees being professional and dividend income as his other foreign income from the below mentioned countries, then in such case following provisions and method shall govern his taxability:

Therefore, both Tax Credit method u/s 90 and Section 91 deals with Foreign Tax Credit, but still having DTAA is beneficial because assessee is taxed at rate beneficial to him, which is not so in case of NO DTAA.

C. HOW CREDIT OF FOREIGN TAX IS AVAILED IN INDIA?

Rule 128 governs the credit of taxes paid on income earned in foreign country. An assessee shall be eligible to claim credit of foreign tax paid if he complies with provisions stated under Rule 128 of the Income Tax Rules which are discussed as follows:

1. Analysis of Rule 128 introduced under Indian Income Tax Rules

Applicability of the rules

The rules came into force with effect from 1.4.2017 applicable only for resident assessee for the amount of foreign taxes paid by him in a foreign country. The credit is available only if income corresponding to the taxes is offered for tax or assessed to tax in India during the year in which the credit is claimed.

In the cases where the income for which the foreign taxes paid or deducted is offered to taxes for more than one year, the credit will be given across the years in the same proportion to which the income is offered to tax in India during the year in which credit is claimed.

2. Foreign Tax Credit Defined under sub-rule 2:

i. FTC in case of DTAA countries: Taxes that are covered under the said agreement.

ii. FTC in case of other countries (No DTAA): Tax payable under the law in force in that country in the nature of income-tax referred in Section 91.

The LOWER OF tax payable under the act on such income or the foreign tax paid is eligible as FTC. However, while considering the foreign tax paid, it cannot exceed the amount arrived as per DTAA with that country.

3. Utilization of Foreign Tax Credit:

FTC is eligible for adjustment against the tax, surcharge and cess payable under the IT Act. FTC cannot be adjusted against interest, fee or penalty payable under the IT Act. FTC is not available in case foreign tax or part thereof is disputed by the assessee in any manner.

4. Exception & Conditions relating to Foreign Tax Credits:

Credit is allowed in the year in which the income is offered/assessed in India upon the assessee within six months from the end of the month in which dispute is finally settled and assessee furnishes:

- Evidence of settlement of dispute

- Evidence that the liability for payment of such foreign tax has been discharged and

- Undertaking that no refund in respect of such amount is directly or indirectly been claimed. Further, credit for each source of income shall be calculated separately for a specific country and then aggregated. The rate of exchange to be taken for this purpose is TT buying rate on the last day of the month immediately preceding month in which the tax is paid or deducted.

5. Documents required under Foreign Tax Credit:

- Furnish FORM 67 duly verified and certified by a Chartered Accountant on or before furnishing return of income u/s 139(1)

- Furnishing following certificates or statement specifying:

- Nature of income and,

- Amount of Tax paid of which statement given by:

- Tax authority of that country, or

- Person responsible for deduction of such tax, or

- Signed by the assessee:

In this case, it should be accompanied with – an acknowledgment of online payment or receipt or bank counterfoil for proof of payment of tax, if tax is paid by the assessee

- In case of tax deduction, proof of such Tax deducted at source

D. JUDICIAL PRECEDENTS UNDER FOREIGN TAX CREDIT

1. WIPRO LIMITED F TS – 565 – HC – 2015 (KAR)

The judgment of WIPRO provides that merely because the taxpayer’s income is exempt from tax due to a limited tax holiday provided under the ITA, does not mean that foreign tax credit can be simply denied.

2. TATA SONS [2011] 43 SOT 27 (MUM AT)

Though DTAA with USA provides credit only the tax paid with the Federal Government, credit was extended to the Taxes paid to State taxes as well. It has considered the relief u/s 91 which was beneficial to the assessee than that of the DTAA.

3. VIJAY ELECTRICALS [2015] 54 COM 19 (HYD AT)

Tax credit is available even if the same is not deposited with the overseas Government in the year in which the income is taxable.