The Income Tax department’s ambitious OTP-based ITR filing system for taxpayers has crossed the 50 lakh e-verification mark, while more than 39 lakh Aadhaar numbers have been successfully linked with the PAN database after the scheme was launched over six months back.

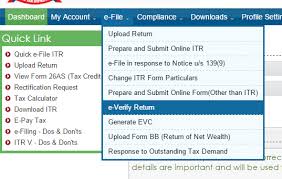

The new e-filing system, operationalised last year, allows online verification of a person’s Income Tax Returns (ITR) by using either the Aadhaar number, internet banking, ATM or email, thereby ending the practice of sending paper acknowledgment to the Centralised Processing Centre (CPC) of the IT department located in Bengaluru.

The new e-filing system, operationalised last year, allows online verification of a person’s Income Tax Returns (ITR) by using either the Aadhaar number, internet banking, ATM or email, thereby ending the practice of sending paper acknowledgment to the Centralised Processing Centre (CPC) of the IT department located in Bengaluru.

“The e-verification of ITRs recently crossed the 50 lakh figure which is a testimony to more and more people and entities opting for electronic filing of their IT returns. While sky is the limit here, getting these numbers just when the new year has begun will enable the government to usher in more and more facilities for e-filing of ITRs in the new financial year begining April 1,” a senior official said.

The official, quoting latest data of the week ending today, said a total of 50,10,282 ITRs have been e-verified, while Aadhaar linkages with the Permanent Account Number (PAN) has been achieved in 39,66,149 cases during the same period.

The online ITR filing portal of the department is available at http://incometaxindiaefiling.gov.in.

According to the rules notified in this regard by the Central Board of Direct Taxes (CBDT) in July last year, any taxpayer whose income is Rs 5 lakh or below per annum and has no refund claims can straightaway generate the ‘Electronic Verification Code’ (EVC) for e-filing and validating their ITR through their registered mobile number and e-mail ID with the department. They get a system generated One-Time Password (OTP) to validate their ITRs.

However, this simplified option will be subject to certain “restrictions” which have been prepared by the taxman based on the concerned taxpayer’s “risk criteria and profile” on a case-to-case basis.

These new measures would completely eliminate the need of sending the paper acknowledgment called ITR-V through post to the Bengaluru based CPC.

In other options, those taxpayers who have activated internet banking facility can also do the e-verification.

Once logged in to the banking portal, the taxpayer will be sent EVC on his mobile number provided to the official e-filing portal of the department which they will put in their ITR for final submission.

The Aadhaar database is also being used by the taxman to verify taxpayers’ credentials.

The department initiated these new technology-based measures in order to fully automate the e-filing system and also to end taxpayers’ grievances with regard to their ITR-V not reaching by post which led to their returns getting rejected.