In order to ensure quick redressal of taxpayer grievances, the Income Tax department will soon launch a new form called ‘e-nivaran’ on the lines of the ITR form to take care of issues related to refunds and others by sending personal SMSes and emails.

In order to ensure quick redressal of taxpayer grievances, the Income Tax department will soon launch a new form called ‘e-nivaran’ on the lines of the ITR form to take care of issues related to refunds and others by sending personal SMSes and emails.

The new form, like the e-Income Tax Returns (ITRs) and those created for I-T appeals and others, is the latest offering by the department and will be soon made public.

The one-page form will mandatorily seek the taxpayers name, Permanent Account Number (PAN), mobile number and email at the time of filing so that the resolution is automatically informed to the individual.

It also provides space for explaining the grievance in detail by either mentioning the Assessment Year (in case of individual) or the Financial Year (in case of deductor).

“The new system will ensure, like e-filing, that the taxpayer get his grievance redressed by just using an Internet-enabled computer and does not require them to travel to a tax office. The ‘e-nivaran’ project will be connected to all electronic databases of the department to ensure quick resolution. The form will be notified soon,” a senior official said.

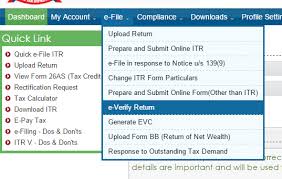

The form can be either filed online at the official e-filing website of the department or by manually filing it at the Aaykar Sampark Kendra (ASK) (tax facilitation centre) that are present in over 260 cities in the country.

The department will also issue a ‘Unique Grievance ID’ after the form is submitted and which can be quoted by the taxpayer for all his communications with the taxman in case the grievance takes time to resolve.

The Central Board of Direct Taxes (CBDT), policy-making body of the I-T department, had early this year launched the unique ‘e-nivaran’ module which aims to “fast track taxpayers grievance redressal, ensure early resolution by integrating all the online and physical grievances received by the department and keeping track of it untill it reaches its logical conclusion.”

A new logo for ‘e-nivaran’ has also been launched, the official said.