Japanese banks, known for the risk-aversion that spared them the worst of the credit crisis, have quietly grown into some of the world’s largest energy lenders.

Japanese banks, known for the risk-aversion that spared them the worst of the credit crisis, have quietly grown into some of the world’s largest energy lenders.

Mitsubishi UFJ Financial Group Inc (MUFG), Japan’s largest bank, disclosed last month it has become one of the biggest oil and gas lenders with 9.2 trillion yen, or about $85 billion, in exposure – $45 billion more than it had reported at the end of the year. Sumitomo Mitsui Financial Group Inc is not far behind with about $77 billion and Mizuho Financial Group Inc has about $48 billion, calculations based on the companies’ websites show.

The megabanks sought profits in the oil patch during the boom as Japan’s shrinking population and years of economic stagnation sapped the profitability of domestic lending. While energy is only a fraction of their business, souring loans have been a drag on earnings. MUFG sees full-year profit falling 11 per cent as negative interest rates squeeze loan profitability and bad-loan costs increase.

“Japanese banks were thought to have no exposure at all and all of a sudden they’re some of the most exposed companies around the world,” said Nicholas Smith, a strategist at brokerage CLSA Ltd in Tokyo who has covered Japanese equities for over 25 years. “Perhaps we shouldn’t be surprised, given their scramble to get overseas exposure.”

The longer oil remains around $50 a barrel, the worse it gets. MUFG and Sumitomo Mitsui reported in May that the cost of bad energy loans rose in the past 12 months to a combined $994 million. Sumitomo Mitsui said that number could rise in the next year. Mizuho didn’t disclose energy-related credit costs.

Brent gained 14 cents, or 0.3 per cent, to $52.65 a barrel on the London-based ICE Futures Europe exchange at 12:28 pm Singapore time.

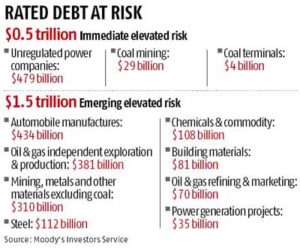

“Considering that we have downgraded more than 100 rated energy companies globally since December 2015, the banks’ energy and resource-related exposures in this uncertain environment could create losses that would reduce their capital,” Raymond Spencer, an analyst for Moody’s Investors Service in Tokyo, wrote in a May 19 note.

With defaults on the rise, bank investors around the world have been demanding more information about energy lending. MUFG’s exposure jumped after the bank expanded its most recent disclosure to include refineries and pipelines, borrowers that were left out of previous reports.

“I don’t believe that proactively lending to the natural resource and energy sector is in itself a mistake,” said Nobuyuki Hirano, president of MUFG, at a May 16 briefing discussing the company’s financial results. He said the company has prepared “appropriately” for potential losses. One concern for Japanese lenders is the deteriorating finances of the US shale industry. During the boom, drillers that outspent cash flow even when oil was $100 a barrel tapped credit from Japanese banks that were pushing to expand overseas lending.

Then prices plummeted below $30. Since the start of 2015, 142 oilfield service companies and oil and gas producers have gone bankrupt, owing almost $62 billion, according to law firm Haynes & Boone.

Sumitomo Mitsui is among the lenders to Stone Energy Corp., which is in restructuring talks. MUFG and Mizuho are among Linn Energy LLC,’s creditors, company records show. Linn owed $2.55 billion on two credit lines when it filed for bankruptcy May 11. Mizuho was also a lender to Breitburn Energy Partners LP, which owed $1.2 billion on its credit line when it filed for bankruptcy May 15.

While these credit lines are split up among a dozen or more lenders, and collateral in the form of oil and gas reserves may mitigate any losses, the risk is adding up. MUFG said in April that its North American subsidiary has made $5.52 billion in loans to exploration and production companies. Almost half of those loans are now marked as “criticised,” a regulatory designation that means that, at best, the loans exhibit potential weaknesses and at worst will result in losses.

The size of Sumitomo Mitsui’s total oil and gas-related exposure to non-Japanese borrowers, which is the area most vulnerable to changes in oil prices, is 6 per cent of its total portfolio, Koichi Miyata, president of the group holding company, said at a results briefing in Tokyo on May 13. “And this is a diverse mix including oil majors, 85 per cent of which I think is fair to say is extremely good credit,” he said.

Mizuho said its bad debts in the energy and resource sector totalled about $279 million as of March. “Even based on oil prices at the moment, we’re absolutely not seeing the recording of any major concentration of credit costs,” Mizuho’s President Yasuhiro Sato said at a May 13 briefing on the bank’s financial results.

“I don’t think we need to be worried at the current point in time,” said Nana Otsuki, chief analyst at Monex Group Inc, a Tokyo-based online securities firm. “But we’ll need to watch risks more carefully next year, particularly if there are any movements in the price of oil.”

Source: http://www.business-standard.com/article/international/japan-banks-enter-ranks-of-biggest-energy-lenders-116060901307_1.html