In a bid to improve the sale of bad loans by lenders, the Reserve Bank of India has allowed banks to sell these assets to other banks, non-banking financial companies (NBFCs) or financial institutions. It has also made banks’ boards more accountable for stress resolution.

In a bid to improve the sale of bad loans by lenders, the Reserve Bank of India has allowed banks to sell these assets to other banks, non-banking financial companies (NBFCs) or financial institutions. It has also made banks’ boards more accountable for stress resolution.

“Prospective buyers need not be restricted to SCs/RCs (securitisation companies/reconstruction companies). Banks may also offer the assets to other banks/NBFCs/FIs, etc, who have the necessary capital and expertise in resolving stressed assets,” said RBI.

The RBI believes this will lead to better price discovery, and to attract more buyers lenders have been asked to follow the e-auction process. Prospective buyers should also be given a minimum of two weeks for due-diligence and in case the exposure is above Rs 50 crore, then banks need to get at least two external valuation reports.

The head of banking and finance practice with an international advisory firm said while the intent was good, it was more an effort to regularise the process by specifying rules for asset sale. But, instead of leaving it to bank boards to decide on the valuation framework, the regulator could specify the standard policy for asset sale.

To expedite the process, RBI has nudged banks to use the “Swiss challenge method” to sell non-performing loans of recent vintage. Under this method, an entity (bank or lender) that receives an unsolicited bid for an asset or project has to publish the bid and invite third parties to match or exceed it. The entity that submits the unsolicited bid will be allowed to match or better the ensuing best bid.

RBI has decided to restrict banks’ investment in security receipts (SRs) backed by their own stressed assets. This is being done to ensure that there is “true sale of assets,” said RBI. The central bank has said from April 1, 2017, when SRs’ value is above 50 per cent of the amount of assets sold, banks need to make higher provisioning that should either be the net asset value declared by the SCs/RCs or provisioning as if it was a direct loan. However, from April 1, 2018, the threshold will be reduced to 10 per cent.

These ARCs or SCs will also have the first right of refusal in case they have already acquired a significant share, 25-30 per cent, of the asset.

Lenders have been asked to set up a board for early recognition and sale of assets, which must conduct periodic review at least once a year, and the board needs to be involved in the entire sale process, RBI said.

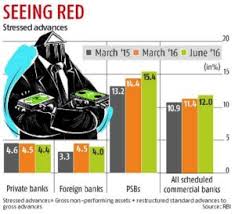

According to the norms, banks need to adopt a “top-down” process, which means their head offices will be involved in identification of the assets. This is in line with several steps taken by RBI to tackle rising stressed loans, which at the end of the quarter ended June stood at 12 per cent of the total advances.