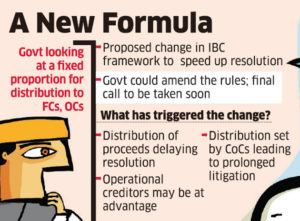

The government is considering a formula for distributing the proceeds of insolvency resolution among financial and operational creditors in a fixed proportion, said people with knowledge of the matter. The goal is to protect the interests of operational creditors and reduce delays due to litigation, ensuring that the objective of the Insolvency and Bankruptcy Code (IBC) is preserved.

“This is one of the solutions that is being looked at,” an official said. The government will take a final call only after extensive deliberations, he added.

Distribution of resolution proceeds has emerged as one of the key factors behind the extended litigation, delaying major insolvency cases. Dissatisfied operational creditors have been the source of such cases in some instances.

The Supreme Court is currently deciding on the distribution of proceeds in the case of Essar Steel, which entered the National Company Law Tribunal (NCLT) system in August 2017. The process was thought to have ended when Arcelor Mittal’s Rs 42,000-crore bid for the debt-ridden steel manufacturer was approved in March 2019. But the original promoters, the Ruias, opposed approval of the plan, questioning Arcelor Mittal’s eligibility.

Operational creditors rejected the plan on the grounds of discriminatory treatment. Financial creditor Standard Chartered Bank has also gone to court against the resolution plan on the same grounds. Financial creditors moved the Supreme Court after the National Company Law Appellate Tribunal (NCLAT) ordered proportional recovery for both financial and operational creditors. Under the IBC, cases have to be decided within a 330-day window.

The decision to change the rules to grant greater protection to operational creditors had come from the “highest levels of the government,” said one of the persons.

The Centre is looking at further changes to the IBC as it doesn’t want to leave any room for litigation on the distribution of proceeds, the person said. The IBC is regarded as one of the signal reforms of the first Narendra Modi government. The process got bogged down in litigation over some of the biggest cases, blunting the IBC’s aspiration of speeding up bankruptcy resolution and cleaning up banks’ books. The 2016 IBC has already been tweaked several times toward this end.

Operational creditors had slightly higher recoveries than financial creditors, according to data available with the government, said the person cited above. The Insolvency and Bankruptcy Board of India has pegged the average recovery for financial creditors in cases where there was successful resolution at 41.5% at the end of the September quarter.

In the latest set of amendments to the IBC, carried out in the budget session of parliament, the government had clarified that the CoC would have the right to decide on the distribution of proceeds but that all creditors must receive liquidation value or the amount they would receive if resolution proceeds were distributed according to the ‘waterfall mechanism,’ whichever is higher.

The waterfall mechanism under the IBC outlines the order of priority for repayment to creditors in the event of liquidation.

Under this, secured creditors have to be paid fully before any payments can be made to unsecured financial creditors who in turn have priority over operational creditors.

Experts said the government will have to come up with a balanced formulation. Setting a high fixed proportion for operational creditors could prompt CoCs to opt for liquidation instead of resolution. “At present, in many cases, operational creditors are not getting anything,” said Manoj Kumar, partner at Corporate Professionals.

Source: Economic Times