The Central Board of Direct Taxes (CBDT), the policymaking body of the income tax department, on Friday said that various law enforcing agencies have unearthed tax evasion of R1.37 lakh crore during the last three years as a result of over 23,000 searches and surveys. This led to criminal prosecution in 2,814 cases and arrest of nearly 4,000 persons.

The Central Board of Direct Taxes (CBDT), the policymaking body of the income tax department, on Friday said that various law enforcing agencies have unearthed tax evasion of R1.37 lakh crore during the last three years as a result of over 23,000 searches and surveys. This led to criminal prosecution in 2,814 cases and arrest of nearly 4,000 persons.

The CBDT’s performance appraisal report comes after the expiration of government’s second scheme for income disclosure called Prime Minister Garib Kalyan Yojana (PMGKY).

Although the finance ministry is yet to announce the amount declared under the scheme, an analysis of tax collection numbers done by FE earlier this week showed that PMGKY may have garnered only a fraction of its predecessor scheme, under which a declaration of R55,000 crore of unaccounted money was made and close to R13,000 crore was collected as taxes and penalties in 2016-17.

This first scheme expired on September 30 last year while PMGKY came into effect in December and expired on March 31.

Explaining the actions taken over last three fiscals, the CBDT said that the Enforcement Directorate intensified its anti-money-laundering actions by registering 519 cases and conducting 396 searches culminating in arrests in 79 cases and attachment of properties worth Rs 14,933 crore.

Additionally, the government identified more than 245 benami transactions with provisional attachments of properties worth Rs.55 crore in 124 cases, the CBDT statement said. It added that the benami prohibition law which remained inoperative for last 28 years was made operational through a comprehensive amendment with effect from November 2016.

During 2013-14 to 2015-16, income tax investigations led to the detection of more than 1,155 shell companies used as conduits by over 22,000 beneficiaries. The amount involved in non-genuine transactions of such beneficiaries was more than Rs 13,300 crore, the CBDT said in a statement. It added that the ministry of corporate affairs issued more than 1 lakh notices for striking off names of defunct and non-compliant companies.

“A high-powered group has been set up for coordinating and monitoring the actions taken by departments concerned with the objective of eliminating the conduits of black money generation and application,” the CBDT said.

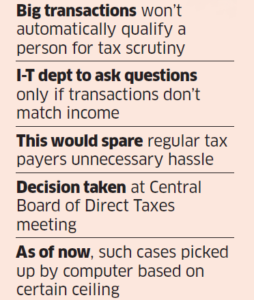

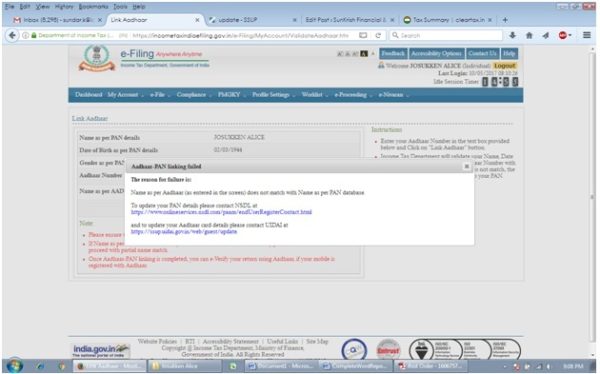

The board said that various steps have been taken to curb cash transactions including penalising cash transaction of more than Rs 2 lakh, limiting allowable cash expense up-to Rs 10,000 only, making Aadhaar mandatory for obtaining PAN and filing of income tax returns, and making PAN mandatory for cash deposits above Rs 50,000.

“The relentless crusade against black money will get further intensified in the coming days making the tax evaders and money launderers realise that they have to pay a heavy cost for their deviant behavior,” CBDT said.