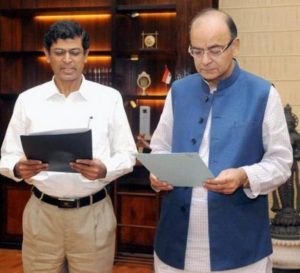

Over two weeks into the goods and services tax (GST) regime, Navin Kumar, chairman of GSTN — the IT backbone of the system — speaks to Sumit Jha on how taxpayers have adopted the new system.

What are the latest numbers on migration and new registrations on GSTN platform?

Till June 16, over 70 lakh have migrated to the portal while 7.4 lakh new taxpayers have registered so far. The number of migration has dwindled from 30,000 daily to about 12,000 since we reopened the window on June 25. However, the rate of new registration is still going as strong as it was on June 25 with nearly 35,000 taxpayers registering every day. Our system will remain open for migration till September 25 (3 months).

What explains the large number of new registrations?

A better analysis of why so many new taxpayers have registered can be provided by the tax department, but we are thinking on the lines that businesses realise that it would be harder to do business if they remain outside GST. According to our study, we were expecting a 4-5% growth in new taxpayers yearly. On an 80-lakh existing taxpayer base, this translates into around 4 lakh new registrations. Since June 25, we have had 7.40 lakh new registrations, which is nearly double our expectations. It shows businesses have welcomed GST.

What has been the response for composition scheme?

Till June 16, only 90,000 businesses had opted for composition scheme. I believe many more would want to but the problem is, if you don’t opt for it now, the next opportunity will arise only next year. Though we had collected information on composition scheme from VAT we can’t say off-hand how the registration under GST so far compares with the the figures in the VAT. One of the possible explanation for a subdued number could be that any inter-state supply made by a business makes it ineligible for the scheme.

Has the GSTN been able to deliver the application programming interfaces (APIs) on time?

There are two kinds of APIs: One is government-to-government meant for connecting the tax department with the GSTN, which is already functional. As far as APIs for GST suvidha providers (GSPs) are concerned, we had a meeting with them in June, where we shared a time schedule for releasing APIs. So far, we have stuck to that schedule.

Is there any pilot testing for uploading invoices being carried by GSTN?

The next big thing happening is we are opening the facility for uploading invoices for a closed group of businesses from June 24. Business-to-business people are required to record transactions at the invoice level for filing return. If you are generating 50,000 invoices every day, don’t wait until the last moment. If you have 5,000 invoices in a month, you can upload weekly but it must be done regularly.

A month ago you had questioned the GSPs’ preparedness. What is the status now?

We have asked all GSPs to be prepared, and they have assured us that they are working towards that. The invoice uploading pilot will tell us where they stand.

What is the expected format of filing interim return in August?

This is to be filed in the GSTR3B form where the taxpayer has to indicate his tax liability and input tax credit. So, it would be on self-declaration basis. When they submit the first full return in September for July, we will match their input tax credit submitted through GSTR3B as a form of cross-verification. The final position will be told to them then.

When is the e-way bill likely to come for approval?

The National Informatics Centre (NIC) is working on the e-way bill, and they are supposed to bring it for consideration by October 1. Currently, the removal of check posts at state borders is due to the nature of GST. Earlier you had tax arbitrage between VAT and CST which is gone now. However, state governments are concerned about movement of goods without paying taxes, which would be resolved once e-way bill is introduced.

Can businesses make amends in their information now?

We started the facility to amend registration data from June 18. Many people are coming and saying they need to change some data, including bank account number or phone number. Registration of non-residents and casual taxpayers will also open on June 18. This is for the people who come over in the country for a fair or exhibition for a few days or a month.