China’s total borrowings were more than double its gross domestic product (GDP) last year, a government economist said, warning that debt linkages between the state and industry could be “fatal” for the world’s second largest economy.

The country’s debt has ballooned as Beijing has made getting credit cheap and easy in an effort to stimulate slowing growth, unleashing a massive debt-fuelled spending binge.

While the stimulus may help the country post better growth numbers in the near term, analysts say the rebound might be short-lived.

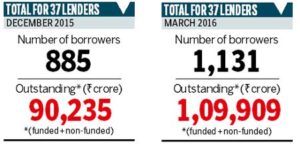

China’s borrowings hit 168.48 trillion yuan ($25.6 trillion) at the end of last year, equivalent to 249 per cent of the economy’s GDP, Li Yang, a senior researcher with a top government think tank, the China Academy of Social Sciences (CASS), told reporters yesterday.

The number, while enormous, is still lower than some outside estimates.

Consulting firm the McKinsey Group has said that the country’s total debt was likely as high as $28 trillion by mid-2014.

CASS, in a report last year, said China’s debt amounted to 150.03 trillion yuan at the end of 2014, according to previous Chinese media reports.

The most worrying risks lie in the non-financial corporate sector, where the debt-to-GDP ratio was estimated at 156 per cent, including liabilities of local government financing vehicles, Li said.

Many of the companies in question are state-owned firms that borrowed heavily from government-backed banks and so problems with the sector could ultimately trigger “systemic risks” in the economy, he said.

| DRAGON IN TROUBLE |

|

“The gravity of China’s non-financial corporate (debt) is that if problems occur with it, China’s financial system will have problems immediately,” Li said. He added that the problem will also affect state coffers because Chinese banks are “closely linked to the government”.

“It’s a fatal issue in China. Because of such a link, it is probably more urgent for China than other countries to resolve the debt problem,” he said.

Speaking earlier this week, David Lipton, first deputy managing director with the International Monetary Fund, also singled out China’s corporate borrowing as a major concern, warning that addressing the issue is “imperative to avoid serious problems down the road”.

Despite the concerns, China is having difficulty kicking its credit addiction. On Wednesday, the People’s Bank of China announced that new loans extended by banks jumped to 985.5 billion yuan last month, up from 555.6 billion yuan in April.