Income Tax Bill, 2025 to replace Income Tax Act, 1961: Key Changes

Finance Minister Nirmala Sitharaman has presented the new Income Tax Bill 2025 in Parliament today, February 13, 2025. This presentation marks a significant step in reforming India’s direct tax system. Key Features of the Bill The Income Tax Bill 2025 … Continued

Budget-2025: A Roadmap for economic growth and inclusive development

Source: Budget 2025-26

Government waives late fee for delayed GST filings

The Central Board of Indirect Taxes and Customs (CBIC) Thursday announced a waiver of late fees for delayed filings of reconciliation statements and annual returns for the financial years 2017-18 to 2022-23. The Ministry of Finance has issued a notification … Continued

Latest Update on ITR (U) Form: What You Need to Know

The Income Tax Department has recently made significant updates to the ITR (U) form, also known as the Updated Income Tax Return. This form allows taxpayers to rectify errors or omissions in their previously filed returns. Here’s a detailed look … Continued

CBDT extends deadline for furnishing belated / revised ITRs for Asst Year 2024-25 to January 15th, 2025

The Central Board of Direct Taxes (CBDT) has announced an extension for furnishing belated or revised income tax returns for the Assessment Year (AY) 2024-25. In a recent notification, the CBDT exercised its powers under Section 119 of the Income-tax … Continued

CBDT extends due date for filing ITR of Audited Accounts till November 15,2024

The Central Board of Direct Taxes (CBDT) has recently announced extension of the due date for filing Income Tax Returns (ITR) for audited accounts for Asst Year 2024-25. In a recent announcement, the Central Board of Direct Taxes (CBDT) has … Continued

Tax Audit Report due date extended to 07-October-2024

CBDT has extended the specified date of furnishing of Tax Audit Report under any provision of the Act for the Financial Year 2023-24, which was 30th September, 2024 to 07th October, 2024. The reason behind the extension is because … Continued

GST Invoice Management System: A game changer for businesses from October 2024

Through an advisory issued on September 3, 2024, the IMS is set to go live for taxpayers starting October 1, 2024, marking a significant milestone in the evolution of GST compliance procedures. Key Features of the GST Invoice Management System … Continued

Advisory on reporting of supplies to un-registered dealers in GSTR-1/GSTR-5

An advisory has been issued on September 3,2024 by the Government of India for the recent amendment under Notification No. 12/2024 Central Tax, dated 10th July 2024, that lessens the threshold limit for the reporting of inter-state taxable outward supplies … Continued

Tax Reforms & Highlights in the Finance Budget 2025

The Union Budget for FY 2024-25, presented by Finance Minister Nirmala Sitharaman, brings several significant changes aimed at boosting the economy, simplifying tax structures, and promoting sustainable growth. Here are the key highlights: ===================== 1. Revised Income … Continued

CBDT rulings relating to donations made by a trust / institution to another trust / institution.

The amendment introduced in the Finance Act, 2023 has significant implications for eligible Trusts and institutions. Let’s delve into the key points: Eligible Donations Treatment: When an eligible Trust or institution donates to another eligible Trust or institution, the donation is … Continued

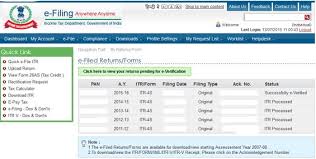

ITR filing for AY 2024-25 – New Regime & Old Regime-How to file

Income Tax Return Form of ITR-1, 2 and 4 are enabled to file through Online mode with prefilled data at the Income Tax e-filing portal, for Assessment Year 2024-25. In the above, the new income tax regime has become the … Continued

Union Budget 2024 Highlights: Announcements by Finance Minister Nirmala Sitharaman

Summary of Direct and Indirect Tax Proposals: Budget 2024-25 Summary of the direct and indirect tax proposals made in the Budget 2024-25 (Finance Bill 2024) presented by Smt Nirmala Sitharaman, Union Minister of Finance and Corporate Affairs: Highlights of the … Continued

Chairman, CBIC has launched CBIC’s WhatsApp Channel – ‘CBIC India’

In the weekly newsletter dated January 8, 2024, Chairman Sanjay Kumar Agrawal of the Central Board of Indirect Taxes and Customs (CBIC) shared noteworthy updates. From the launch of CBIC’s WhatsApp channel to commendable achievements, the newsletter provides insights into … Continued

New ITR forms: What’s new in ITR-1 and ITR-4 for AY 2024-25?

New ITR forms AY 2024-25: Taxpayers will now be required to provide information regarding cash receipts and all their bank accounts within the country according to the latest Income Tax Return (ITR) Forms for the Assessment Year 2024-25, as notified … Continued

Extension of time for GSTR-3B Filing for November 2023 in specific districts of Tamil Nadu

In response to the devastation caused by the MICHAUNG cyclone in early December 2023, the deadline for monthly GST returns has been extended, in respect of the taxpayers whose principal place of business is located in the four cyclone-affected districts … Continued

Know about: “Discard Income Tax Return option.”

The income tax department has introduced a new functionality on its website- ‘Discard ITR’. This new feature will allow taxpayers to discard their previously filed but unverified Income Tax Returns (ITR). Starting from Assessment Year 2023-24, this new ‘Discard ITR’ … Continued

Updated Income Tax Return (ITR U) – Check out this option

Filing an Updated Income Tax Return (ITR-U) under section 139(8A) ITR-U refers to the Updated Return form used for filing an amended or revised income tax return in India. It is a provision provided by the Income Tax Department to … Continued

IT Refund: IT Department urges Taxpayers to respond to Past Tax Demands.

The Income Tax Department on September 23, 2023, called upon taxpayers to promptly respond to intimation of outstanding tax demands, adding that it will help in faster processing of income tax returns (ITR) and quicker issuance of refunds. For the … Continued

CBDT extends deadline for filing ITR return and submitting audit report.

Income Tax Department has extended the deadline for ITR filing for certain categories of taxpayers. This has brought great relief to the taxpayers/institutions falling in these categories and they have also been saved from paying heavy penalties due to delay. … Continued

New Annual Information Statement (AIS) – 50 Transactions reported in Income Tax Portal

The Income Tax Department has announced the roll-out of a new statement namely Annual Information Statement (AIS) which would provide you with almost all details about your financial transactions during the year. So far, the Income Tax Department has been … Continued

ITR filing for AY 2023-24 starts. CBDT enables Excel Utilities for ITR-1, ITR-4

ITR filing for AY 2023-24 starts. CBDT enables Excel Utilities for ITR-1, ITR-4 For the assessment year 2023-24, the Income Tax Department has released an offline Excel-based utility for filing ITR-1 Sahaj and ITR-4 Sugam. The utility is available for download … Continued

Linking PAN & Aadhaar before March 31, is mandatory

It is mandatory to link Permanent Account Numbers (PAN) to Aadhaar by March 31, 2023. The last date to link Permanent Account Number (PAN) to Aadhaar is nearing soon. According to the Central Board of Direct Taxes (CBDT), the apex … Continued

Link PAN with Aadhaar to prevent being inoperative from 1st April 2023?

“As per the Income Tax Act, 1961, the last date to link PAN with Aadhaar is 31.3.2023 for all PAN card holders, who do not fall in the exempted category. If not linked with Aadhaar, PAN will become inactive,” tweeted … Continued

CBDT extends due date for filing Income Tax Return for AY 2022-23 to Nov 7

The Central Board of Direct Taxes (CBDT) said in a notification that the ITR filing due date has been extended as it had last month extended the deadline for filing audit reports. CBDT extends the due date for furnishing Income … Continued

CBDT reduces time limit for e-verification of ITR from 120 days to 30 days.

For the Financial Year ended March 31, 2022 (Asst Year 2022-23), even as 5.82 crore people filed their ITRs (Income Tax Returns), only around 4.02 crore of them were verified. Thus, over 1.8 crore people did not verify their ITR … Continued

CBDT notifies New Income Tax Return Forms 1 to 5 for Assessment Year 2022-23

The Finance Ministry has recently notified the new Income Tax Return (ITR) forms for the assessment year (AY) 2022-23 to file a return of income earned in the financial year (FY) 2021-22. So far, the Central Board of Direct Taxes … Continued

CBDT extends the timeline for filing Income Tax Returns and various Tax Audit Reports for Asst Year 2021-22

The Central Board of Direct Taxes, via Circular No. 01/2022 issued on 11th January 2021, has extended the timeline for filing of Income Tax Returns and various Reports of Audit for the Assessment Year 2021-22. This has been done … Continued

I-T department rolls out new Annual Information Statement – How AIS will be helpful in filing your tax returns

The income tax department (I-T dept) on Monday rolled out the new annual information statement (AIS) on the compliance portal. This annual statement provides a comprehensive view of information to a taxpayer and the facility to submit online feedback. The … Continued

GST collection in October crosses ₹1.3 lakh crore, second highest ever

The gross GST revenue collected in the month of October 2021 exceeded ₹1.3 lakh crore. The GST revenues for October is the second highest ever since introduction of GST, second only to that in April 2021, which related to year-end … Continued

ITR filing deadline for FY 2020-21 extended to December 31, 2021

The government on Thursday extended the deadline to file income tax return (ITR) for FY 2020-21 by 3 months to December 31, 2021 from September 30, 2021. The extension of the deadline is for those individuals whose accounts are not … Continued

CBDT extends Due Date for filing various Income Tax Forms

The Central Board of Direct Taxes (CBDT) has extended the due dates for electronic filing of various Forms under the Income-tax Act, 1961. Considering the difficulties reported by the taxpayers and other stakeholders in the electronic filing of certain Forms, … Continued

Government grants further extension in timelines of Income tax compliances

Government grants further extension in timelines of Income tax compliances The Government has granted further extension of timelines of compliances under Income Tax Act. It has also announced tax exemption for expenditure on COVID-19 treatment and ex-gratia received on … Continued

New TDS rules to be applicable from July 1- Highlights

Till date, TDS was deducted only on the notified nature of payments. From 1st July,2021, businesses are required to deduct TDS on purchase of goods along with the current scope of TDS deduction applicable on notified nature of payment or … Continued

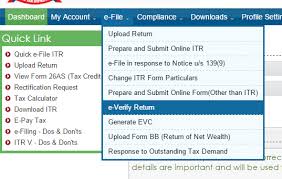

Launch of new Income Tax Return Filing Portal 2.0: What’s New

The tax department has launched the much-awaited new portal of filing income tax return (ITR) — www.incometax.gov.in — on Monday night. The new e-filing portal (www.incometax.gov.in) is aimed at providing taxpayer convenience and a modern, seamless experience to taxpayers; New … Continued

Belated and Revised ITR Filing Date extended for AY 2020-21 to 31st May 2021 due to COVID-19

In view of the adverse circumstances arising due to the severe Covid-19 pandemic and also in view of the several requests received from taxpayers, tax consultants & other stakeholders from across the country, requesting that various compliance dates may be … Continued

Key changes in new ITR forms for AY 2021-22

Keeping minimum change and with the view to minimise compliance burden, The Central Board of Direct Taxation (CBDT) has notified new income tax return forms — ITR-1 to ITR-7, for the Assessment Year 2021-22, the ministry of finance said in a statement on April 1. In this new … Continued

Extension of due date for furnishing of Annual Returns GSTR-9 and GSTR-9C for financial year 2019-20 to March 31, 2021

CBIC had extended, vide Press Note regarding extension of due date for furnishing of Annual Returns GSTR-9 and GSTR-9C for financial year 2019-20 to March 31, 2021. This is the second extension given by the government. The deadline was earlier … Continued

International Taxation: Decoding DTAA & Foreign Tax Credit

WHAT IS DOUBLE TAXATION OF INCOME? When the same income is taxed more than once, due to levying of tax by two or more jurisdictions, on the same income asset or financial transaction, this results in double taxation. This may … Continued

6 Crucial changes in GST Rules applicable from January 1st, 2021

The year 2021 has come up with the various changes in Goods and Service Tax (GST) Rules which will have a direct impact on the business registered under the GST regime and the businessmen who are planning to get themselves … Continued

Govt. cancels GST Registration of 163k Business entities for Non-Filing of Tax Returns

The Government has canceled the Goods and Service Tax (GST) registration of 163,000 business entities who have not filed monthly tax returns (GSTR-3B) for the last six months or more. Furthermore, the department would persuade 25,000 taxpayers, who have … Continued

Govt cancels GST registration of 163k business entities over non-filing of tax returns

The Government has canceled the Goods and Service Tax (GST) registration of 163,000 business entities who have not filed monthly tax returns (GSTR-3B) for the last six months or more. Furthermore, the department would persuade 25,000 taxpayers, who have not … Continued

QRMP scheme launched for GST payers with turnover up to Rs 5 crore

The government has launched the Quarterly Return Filing and Monthly Payment of Taxes (QRMP) scheme in a bid to ease the return filing experience of the Goods and Services Tax (GST) taxpayers. The scheme will come into effect from January … Continued

Income Tax department to reject tax audit reports filed without ICAI authentication

The income tax department will validate with the Institute of Chartered Accountants of India (ICAI) the unique document identification number (UDIN) of chartered accountants when they upload tax audit reports, the finance ministry said on Thursday. To curb fake certifications … Continued

Finance Ministry extends deadline for making a declaration under Vivad Se Vishwas Scheme

The Ministry of Finance has extended the deadline for making a declaration under Vivad Se Vishwas Scheme till 31′ January, 2021 from 31st December, 2020. The Ministry of Finance has extended the deadline for making a declaration under Vivad Se … Continued

I-T refunds worth Rs 1.32 lakh cr issued to 39.75 lakh taxpayers

The Income Tax department has issued refunds worth over Rs 1.32 lakh crore to over 39 lakh taxpayers so far this fiscal. This include Personal income tax (PIT) refunds amounting to Rs 35,123 crore and corporate tax refunds amounting … Continued

GSTN Portal now displays Annual Aggregate Turnover for Previous Financial Year

Prime Minister Narendra Modi launched GST into operation on the 1 st of July, 2017. GST was publicised as ‘one nation, one tax’ by the government, aimed to provide a simplified, single tax regime. GST is a dual levy where the Central Government … Continued

Finance Ministry extends due date for filing of Income Tax Returns for FY 2019-2020

The income tax return (ITR) filing deadline for FY 2019-20 has been extended to December 31, 2020, for most individual taxpayers, from the earlier deadline of November 30, 2020. This the second time the tax filing deadline for FY20 has … Continued

Govt extends due dates for filing IT returns, audit reports, GST annual return

The government on Saturday said due dates for filing income tax returns and tax audit reports for FY20 for various classes of tax payers have been extended to give more time for tax payers to comply. The government also, on … Continued

Income Tax refunds worth Rs 88,652 cr issued to 24.64 lakh taxpayers so far this fiscal

The Income Tax department on Friday said it has issued refunds worth Rs 88,652 crore to over 24 lakh taxpayers so far this fiscal. This include personal income tax (PIT) refunds amounting to Rs 28,180 crore issued to over 23.05 … Continued

A platform to honour honest taxpayers will strengthen compliance and broaden tax base

Prime Minister Narendra Modi announced several tax measures on the eve of India’s Independence Day last week honouring the honest tax-paying citizen. You will now have to file your income-tax (IT) return or pay higher percentage of tax deduction at … Continued

CBDT revises E-Assessment Scheme, 2019: Scope extended to cover Best Judgement Assessments by Faceless Assessment

The Central Board of Direct Taxes (CBDT) on Thursday revised the ‘E-assessment Scheme, 2019’ notified on September 12, 2019. The Government notified that now, the e-Assessment scheme shall be called Faceless Assessment. Now, the National e-Assessment Centre shall intimate the … Continued

New Compliances for the Charitable Trust & Institutions

Very Important update for Charitable Trusts and Exempt Institution registered under section 80G, 12A or section 12AA : New – Fresh Registration Required : Last Date 31.12.2020 All Charitable trusts and exempt institution which are already registered under section 80G, … Continued

CBDT extends FY19 income tax return filing deadline till September 30 due to COVID-19

The Central Board of Direct Taxes (CBDT) on Wednesday (July 29) extended the deadline for filing income tax returns for 2018-19 fiscal till September 30 due to coronavirus COVID-19 pandemic. “In view of the constraints due to the Covid pandemic … Continued

CBDT to start e-campaign on Voluntary Compliance of Income Tax from 20th July, 2020

The Income Tax department’s data analysis has identified certain taxpayers with high value transactions who have not filed ITR for AY 2019-20 (i.e. FY 2018-19). In addition to the non-filers, another set of return filers have also been identified wherein … Continued

CBDT has refunded Rs. 71,229 crore so far to help taxpayers during COVID-19 pandemic

The Central Board of Direct Taxes (CBDT) has issued refunds worth Rs 71,229 crore in more than 21.24 lakh cases upto 11th July, 2020, to help taxpayers with liquidity during COVID-19 pandemic, since the Government’s decision of 8th April, 2020 to issue … Continued

CBDT allows One Time Relaxation for Verification of Tax Returns

The Central Board of Direct Taxes (CBDT) on Monday notified the one-time relaxation for verification of tax return for the Assessment Year 2015-16, 2016-17, 2017-18, 2018-19 and 2019-20, which are pending due to non-filing of ITR- V form and processing … Continued

SEBI signs MoU with CBDT for Data Exchange

A formal Memorandum of Understanding (MoU) was signed today between the Central Board of Direct Taxes (CBDT) and the Securities and Exchange Board of India (SEBI) for data exchange between the two organizations. The MoU was signed by Smt. … Continued

New TDS rates on high-value cash withdrawals apply from today.

In order to tighten the noose on those who don’t file income tax returns (ITR) despite earning taxable income and discourage cash transactions, the Finance Act 2020 introduced higher TDS (Tax Deducted at Source) rates on cash withdrawals for those … Continued

Government has further extended time limits for Income Tax return,TDS, Vivad Se vishwas Scheme etc

In view of the challenges faced by taxpayers in meeting the statutory and regulatory compliance requirements across sectors due to the outbreak of Novel Corona Virus (COVID-19), the Government brought the Taxation and Other Laws (Relaxation of Certain Provisions) Ordinance, … Continued

ICAI enables generation of Bulk UDINs for Certificates

A provision for generating UDIN in bulk for Certificates has been incorporated in UDIN Portal. Using this facility now the members will be able to generate UDIN in bulk (uptil 300 UDINs) for various types of Certificates in one go. … Continued

GST Council provides relief for GSTR 3B delays

The 40th GST Council met under the Chairmanship of Union Finance & Corporate Affairs Minister Smt Nirmala Sitharaman through video conferencing here today- 12th June 2020. The meeting was also attended by Union Minister of State for Finance & Corporate … Continued

Govt rolls out facility of filing of NIL GST Return through SMS

In a significant move towards taxpayer facilitation, the Government has today onwards allowed filing of NIL GST monthly return in FORM GSTR-3B through SMS. This would substantially improve ease of GST compliance for over 22 lakh registered taxpayers who had … Continued

Key changes notified in the ITR forms the Asst Year 2020-21

CBDT notified Income Tax Return forms of FY 2020-21 G.S.R. 338(E).— In exercise of the powers conferred by section 139 read with section 295 of the Income-tax Act, 1961 (43 of 1961), the Central Board of Direct Taxes has made the … Continued

CBDT replaces Annual Statement of TDS/TCS with new Annual Information Statement

The Central Board of Direct Taxes (CBDT) on Thursday notified Income Tax (11th Amendment) Rules, 2020. In exercise of the powers conferred by section 285BB read with section 295 of the Income-tax Act, 1961 (43 of 1961), the Central Board … Continued

Income Tax Refunds of Rs. 26,242 crores issued since 1st April 2020: CBDT

Income Tax Deptt. has issued refunds of Rs. 26,242 crores since 1st April 2020 to 16.84 lac individual/ corporate assessees. Further, the refund process has been geared up for necessary action to match the Aatma Nirbhar Bharat initiative (COVID-19) announced … Continued

NCLT makes ‘default record’ mandatory

Financial creditors moving the National Company Law Tribunal (NCLT) for initiation of insolvency process will have to mandatorily file ‘default record’ from the information utility (IU). No new petition will be entertained without record of default under Section 7 of … Continued

Govt. extends Due Dates of all Income Tax Returns for FY 2019-20

The Central Government has extended the all due dates of all Income Tax Returns for the Financial Year 2019-20 amid COVID-19 outbreak. Due date of all income-tax return for FY 2019-20 will be extended from 31st July, 2020 & 31st … Continued

Highlights of Special GOI Package of Rs 20 lakh crores for Atmanirbhar Bharat (COVID-19)

Key Highlights of the Special economic and comprehensive package of Rs 20 lakh crores Announced by the Govt. of India, for relief and credit support related to businesses, especially MSMEs to support Indian Economy, Atmanirbhar Bharat and to fight against COVID-19. … Continued

TDS / TCS Rates for non-salaried payments reduced by 25% till March 31, 2021

In order to provide more funds at the disposal of the taxpayers, the rates of Tax Deduction at Source (TDS) for non-salaried specified payments made to residents and rates of Tax Collection at Source (TCS) for the specified receipts has … Continued

CBDT orders tax officials to not issue scrutiny notices to taxpayers

After rejecting “ill-conceived” suggestions by a group of Indian Revenue Services (IRS) officers, the Central Board of Direct Taxes (CBDT) directed officials not to keep any communication with assessees or issue scrutiny notices to them without the board’s approval. According … Continued

CBDT Defers Requirement of Registration of Charitable, Religious Trusts by 4 Months Till October 1

In a relief to religious trusts, educational institutions and other charitable institutions, the income tax department on Friday deferred by 4 months till October 1 the requirement of registration of these entities. In a relief to religious trusts, educational institutions … Continued

TDS on salary and New Income Tax rates: Highlights

The Central Board of Direct Tax (CBDT) recently came out with a circular, offering clarifications for tax-paying employees on how they can migrate to the new concessional tax regime, which was announced in this year’s Union Budget. The lower income … Continued

All pending income tax refunds up to Rs 5 lakh to be released immediately, amid rise in coronavirus cases.

In the context of the COVID-19 situation and with a view to providing immediate relief to the business entities and individuals, it has been decided to issue all the pending income-tax refunds up to Rs. 5 lakh, immediately. This would … Continued

Nirmala Sitharaman: ITR / GST Return filing dates extended, relief from late fee, penalties

Finance minister Nirmala Sitharaman announced a slew of measures for extension of statutory and regulatory compliances in view of the corona virus pandemic spreading its wings and impacting the economy. Allaying fears that there is no economic emergency in the … Continued

30 important Key features of GST New Return System:

First 15 features (1-15 points) as PART-I:- Supplier can upload the Tax Invoices on real time basis in Anx-1. Recipient can view his purchase Invoices on near real time basis. Recipient can also view whether supplier has filed his return … Continued

CBIC extends GSTR-9 and GSTR-9C filing dates in a staggered manner

The Central Board of Indirect Taxes and Customs (CBIC) late on Friday night extended the due date for furnishing GST Annual Return and Reconciliation Statement (GSTR-9 / 9A and GSTR-9C) for FY 2017-18 in a staggered manner. The last date … Continued

GST returns can now be filed in a staggered manner

The Finance Ministry has announced the three due dates for filing GSTR-3B for different categories of Taxpayers. The Finance Ministry today said that now GST taxpayers can file their GSTR-3B returns in a staggered manner. Considering the difficulties faced by … Continued

ITR Form for AY 2020-21: new disclosures that taxpayers need to make in new ITR forms

More disclosures are aimed at improving income tax compliances & e-assessments. In AY 2018-19, 58.7 million returns were filed, out of which about 23.7 million people filed returns with no tax liability While it may be commonplace in Uncle Sam’s … Continued

CBDT extends till Jan 31 deadline for compounding of I-T offences

Taxpayers get one more chance to clear their tax dues. The CBDT has extended till January 31 the last date for taxpayers to avail a “one-time” facility to apply for compounding of income tax offences, an order issued on Friday … Continued

Availing of ITC restricted to 10% in case of GST details mismatch

Tax authority given the right to restrict the use of balance in electronic credit ledger In an effort to curb the menace of fake invoices and tax evasion, the Finance Ministry has notified a new norm of limiting the input … Continued

Non-filing of GST returns may lead to attachment of bank accounts

December, 26th 2019 CBIC issues Standard Operation Procedure to deal with non-filers Non-filing of GST (Goods & Services Tax) returns may lead to attachment of bank accounts and even cancellation of registrations. This is part of the Standard Operating Procedure … Continued

Not filing GST return could cost businesses their tax registration, assets

Not filing Goods and Services Tax (GST) returns on time could cost businesses their assets as well as their tax registration, according to a set of instructions the government has issued to field officers, aimed at forcing compliance. The standard … Continued

Govt extends deadline for filing GSTR-9 (Annual Return) and Form GSTR-9C (Reconciliation Statement)

In a relief to taxpayers, the government on Thursday extended the due dates for filing GST annual returns for 2017-18 to December 31 and for the financial year 2018-19, to March 31 next year. The dates for filing the reconciliation … Continued

Not received your tax refund? Here is what you should do

Direct credit to bank accounts of taxpayers is the only way the income tax department credits tax refunds. Filed your income tax return (ITR) for the assessment year (AY) 2019-20 on time but yet not receive your refund? Don’t worry. … Continued

Faceless scrutiny of income tax return.. Here is all you need to know

The E-assessment Scheme 2019 aims to eliminate human interface, reduce corruption and bring in transparency. The idea of faceless E-assessment was mooted in the Budget 2018 by the late Finance Minister, Arun Jaitley, who announced the proposal to introduce the … Continued

CBDT extends the due date for filing ITRs & Tax Audit Reports from 30 th September to 31, October 2019

The Central Board of Direct Taxes (CBDT) has decided to extend the deadline for filing of ITRs and Tax Audits Reports by a month. Given the relentless demands by Chartered Accountants (CAs) and tax consultants, the CBDT has given a … Continued

File revised tax returns after rectifying errors

Most of us collate all information relating to our annual income, investments and tax deducted at source (TDS) before proceeding to file our income tax returns. However, the income tax filing process is a fairly comprehensive exercise. We might miss … Continued

Missed Income Tax Return (ITR) Filing Deadline? Here Are Your Options

Individuals having an annual income of up to Rs2.5 lakh are not required to file income tax returns, according to Income Tax department. Missed the August 31 deadline for filing income tax return (ITR) for financial year 2018-19 (assessment year … Continued

Deadline to file income tax return for FY2018-19 extended to August 31

The finance ministry has extended the deadline for filing income tax return (ITR) for FY2018-19 by individuals to August 31, 2019 from July 31, 2019. The extension is a much needed relief as there were multiple problems being faced by … Continued

Income tax department eyes over Rs 100 bn from ‘struck off’ firms

The income-tax (I-T) department is estimating tax recovery of over Rs 100 billion from companies that have been struck off from records of the Registrar of Companies (RoC) last year. The tax department is in the process of filing a petition before the National Company … Continued

CBDT to share data with GST department to trap tax evaders

The government on Tuesday authorized the income tax department to share details including sales and profits that businesses have reported in their income tax returns with GSTN, the company that processes Goods and Services Tax (GST) returns, to scale up … Continued

Income Tax Return Forms for Salaried Class, Professionals and self-employed individuals available for e-filing

The Income Tax Department has informed that the tax return forms i.e, ITR-1 and ITR-4 for the salaried persons, Professionals, and self-employed individuals are available in the official portal for e-filing. It also said that the other forms for Companies … Continued

Auditors barred from putting a value on companies they are auditing

An income tax tribunal has barred auditors from issuing valuation certificates to the companies they are auditing. This is set to impact several tax disputes around valuations in companies including angel tax disputes involving start-ups. The Bangalore Income Tax Appellate … Continued

32nd GST Council Meeting – Key Takeaways

Outcome of 32nd GST Council Meeting -The highlights of the reliefs announced by FM Arun Jaitley are as below: 1. Threshold limit for GST Registration increased to 40 Lakhs Effective April 1, the GST exemption threshold has been raised from … Continued

GST Council extends Due Dates for Annual Returns and other GST Returns

The 31st GST Council meeting concluded today under the guidance of Union Minister Arun Jaitley has taken some important decisions including the due date extension for GST Annual Returns and some other Returns. As per the recommendation of the Council, … Continued

CBDT warns Cash Transactions above Permissible Limits

With a view to promoting cashless transactions, the Central Board of Direct Taxes ( CBDT ) has issued an advisory on its official website regarding cash transactions over and above the prescribed limits specified under the law. The advisory … Continued

GSTN enables facility to claim Refund of Tax due to any Other Reason

The facility to claim Refund on account of any other reason has now enabled in the Goods and Services Tax Network ( GSTN ). In statement released today, the official twitter account of the GSTN tweeted that “Facility to claim … Continued

GSTN updates facility to claim Refund of ‘Excess Payment of Tax’

The Goods and Services Tax Network (GSTN) has updated a new functionality enabling the taxpayers to claim refund on account of excess payment of tax. “Facility to claim refund on account of excess payment of tax has been enabled on … Continued

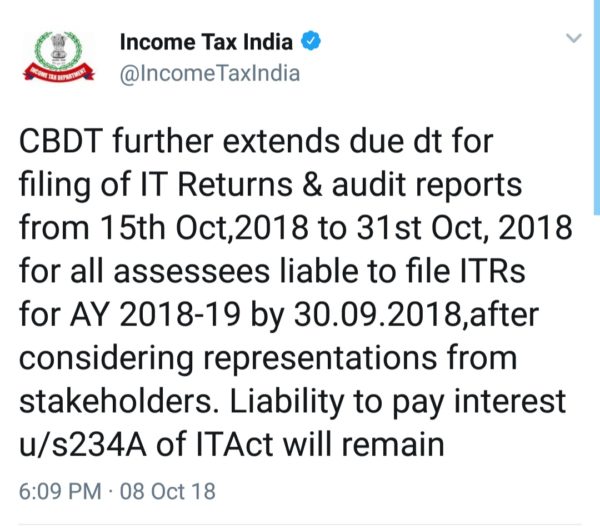

CBDT further extends due date for filing IT Returns & Tax Audit Reports up to 31 October.

The Central Board of Direct Taxes (CBDT) has further extended due date for filing Income Tax Returns and Audit Reports to October 31st. The due date for filing of Income Tax Returns and Audit Reports for Assessment Year 2018-19 is … Continued

As SEBI reforms startup listing, SMEs must ensure funds are not misused

Amid SEBI banning as many as 239 entities for alleged money laundering, taxation consultancy PwC has called for a three-year locking-in for the entire pre-listing capital held by promoters to curb tax evasion and other illegal activities through market platforms. … Continued

CBDT extends deadline for filing ITRs with audit reports to Oct 15, 2018

The government has extended last date for filing of income tax returns (ITRs) for those taxpayers who are required to file their returns along with audit reports from Sept 30 to Oct 15, 2018. The text of the … Continued

CBIC to weed out a million assessees from GST tax net

The Central Board of Indirect Taxes and Customs (CBIC) has initiated a process to weed out approximately 12 lakh Goods and Services Tax (GST) assessees who have fallen off the tax map. “The CBIC has communicated to field officers to … Continued

Surge in filing of Income Tax Returns by 71% upto 31st August,2018

There has been a marked improvement in the number of Income Tax Returns (ITRs) filed during FY 2018 (upto 31/08/2018, the extended due date of filing) compared to the corresponding period in the preceding year. The total number of ITRs … Continued

GSTR 3B required to be filed by 20th of Next Month from July 2018 to March 2019

The Central Government has notified that the Form GSTR 3B for each month from July 2018 to March 2019 required to be filed by 20th of next month. A Notification issued by the Central Board of Indirect Taxes and … Continued

No Due Date Extension for filing Income Tax – CBDT

CBDT confirms News of Income Tax Return filing due date extension in Social Media is Fake CIRCULAR No.4/2018 F.No.370889/25/2018 Government of India Ministry of Finance Department of Revenue Central Board of Direct Taxes New Delhi, Dated 21st … Continued

GST payers can move jurisdictional tax officer to change username, password

Taxpayer would be required to approach the concerned jurisdictional tax officer to get the password for the GST Identification Number (GSTIN) allotted to the business The Finance Ministry on Thursday said that GST registrants can approach jurisdictional tax officer … Continued

I-T department bars CAs from valuing shares of closely held firms

The income tax (I-T) has barred all Chartered Accountants (CAs) from valuing shares of closely-held companies. Earlier, the fair market value of unlisted equity shares was calculated at the option of the company on either the book value on the … Continued

How new single monthly GST return system will be implemented

The Goods and Services Tax (GST) Council on Friday finally approved single monthly return with an aim to boost collections and compliance. The new system is scheduled to be implemented in next six months — but could take more time. “The … Continued

PAN-Aadhaar linking deadline extended to June 30: CBDT

The CBDT today extended the deadline for the PAN-Aadhaar linking to June 30. The policy-making body of the tax department issued an order extending the deadline from the current last date of March 31. The order said the deadline for … Continued

CBEC to verify GST transitional credit claims of 50,000 taxpayers

In order to check “frivolous and fraudulent” tax credit claims by businesses, the CBEC has decided to verify demands of top 50,000 tax payers claiming maximum GST transitional credit, starting with those where the quantum exceeds Rs 25 lakh. The … Continued

Income Tax Return filing deadline: Waiver on LTCG Tax to end on 31 March

In the Budget 2018, Union Finance Minister Arun Jaitley had introduced long term capital gains (LTCG) on sale of equity and mutual funds, which will be taxed from April 1 onwards. One must remember that any capital gains arising out … Continued

GSTR-3B may be extended till June, simplified return forms on cards

The GST Council in its meeting on Saturday is likely to extend the deadline for filing of simplified sales return GSTR-3B by three months till June. The Council, chaired by Finance Minister Arun Jaitley and comprising his state counterparts, is … Continued

IGST payout: Govt refunds Rs 4,000 crore to exporters; asks them to clear mismatch issues

Even as the government grapples with incomplete details and mismatch errors in refund claims by exporters, it has refunded Rs 4,000 crore out of verified claims of Rs 5,000-6,000 crore on account of payment of Integrated GST (IGST) on exports … Continued

Deadline for filing revised or belated income tax return for past 2 assessment years is March 31

The date you actually need to focus on is March 31, because that is the last day to file revised and belated income tax returns (ITR) for assessment years (AY) 2016-17 and 2017-18, with interest, if any, for late filing. … Continued

Shell companies crackdown: Govt removes exemptions from ITR filing

Seeking to crackdown on shell companies, the government has proposed to remove exemption available to firms with tax liability of up to Rs 3,000 from filing I-T returns beginning next fiscal. The Union Budget 2018-19 has rationalised the I-T Act … Continued

IT raid cases not to be processed under e-assessment: CBDT

The soon-to-be rolled out pan India e-assessment system for scrutiny cases of taxpayers will not be applicable to instances where a raid has been conducted against an assessee by the Income Tax (IT) department, the CBDT has said. It has … Continued

GST mop up could top Rs 1 trillion a month post anti-evasion steps

Revenues from the Goods and Services Tax could cross Rs 1 lakh crore a month towards the end of next fiscal once anti-evasion measures like matching of tax data and e-way bill are put in place, finance ministry officials said … Continued

Deposited ‘large amount of cash’ during note ban? File ITR by March 31

The Income Tax Department on Friday urged those who deposited “large amounts of cash” post demonetisation and all companies to file their returns by March 31, failing which they may face penalty and prosecution. It also cautioned eligible trusts, … Continued

Direct tax mop-up jumps 19% in FY18

Direct tax collections during the first nine-and-a-half months of the current fiscal have risen by 18.7% to Rs 6.89 lakh crore, the tax department said on Wednesday. The collections till January 15, 2018 represent over 70% of the Rs 9.8-lakh-crore … Continued

Unexplained deposits in focus, taxmen ordered to go all out in the next three months

The income-tax department will in all likelihood go into overdrive in the next three months with the Central Board of Direct Taxes — the apex body — alerting all senior tax officials that their performance is being “monitored at the … Continued

World Bank says India has huge potential, projects 7.3% growth in 2018

India’s growth rate in 2018 is projected to hit 7.3 per cent and 7.5 per cent in the next two years, according to the World Bank, which said the country has “enormous growth potential” compared to other emerging economies with … Continued

Bitcoin: Income tax department in tough spot as investors go all tech

Crypto currencies appear to be living up to their cryptic reputation. Days after the income-tax department issued about 5 lakh notices to high net-worth individuals (HNIs) who own bitcoins or any other crypto currency, investors are drafting replies that would … Continued

Here’s why India has decided to crank up its crackdown against Bitcoins

Here’s why India has decided to crank up its crackdown against Bitcoins The rising craze for bitcoin, a cryptocurrency that has rocketed to shocking highs, has come under the government’s lens. Bitcoin can be an easy way to evade tax … Continued

You can shift residence, fudge address but you can’t avoid income tax notice anymore

Avoiding income tax notices by fudging addresses or shifting residence will now become difficult. Income tax rules have been amended that will allow the tax department to deliver notices to assessees at addresses given by them to banks, insurance companies, … Continued

Income Tax department can now send communication to more addresses

The central board of Direct Taxes has amended the rules relating to service of notice, summons, requisition or order. The step widens the scope of addresses that the I-T department can use for delivering any form of communication with the … Continued

I-T notices to 4-5 lakh individuals trading in bitcoins across the country

Widening its probe into bitcoin investments and trade, the Income Tax (I-T) department is set to issue notices to 4 to 5 lakh high networth individuals (HNI) across the country who were trading on the exchanges of this unregulated virtual … Continued

GST Council makes inter-state e-way bill compulsory from February 1, 2018

Ferrying goods across states may get quicker as the GST Council today decided to make rollout of all India electronic-way bill compulsory from February 1, two months ahead of the earlier plan. “The rules for implementation of nationwide e-way … Continued

GST data: CBEC orders taxmen to intensify efforts against uncooperative taxpayers

After receiving ground reports of difficulty faced by tax officials in collecting comparative data from unwilling assessees, the Central Board of Excise and Customs (CBEC) has written to all commissioners urging them to intensify their efforts and challenge the objections … Continued

CBDT signs first ever two Indian APAs with Netherlands in Nov-2017

CBDT signs first ever two Indian APAs with Netherlands in Nov-2017. The total number of APAs entered into by the CBDT has gone up to 186 Press Information Bureau Government of India Ministry of Finance 01-December-2017 11:53 … Continued

CBDT shoots off letter to taxmen, says don’t go overboard on fishing and roving inquiries in wake of demonetisation drive

The Central Board of Direct Taxes (CBDT) has sent a missive to all assessing officers (AOs) to stick to protocol while pursuing cases of “limited scrutiny” and not resort to “fishing and roving inquiries” in such cases. The Central Board … Continued

GST return filings for October rise 11% to 4.4 million

Around 56% of the registered taxpayers have filed their GSTR-3B returns for October by 20 November, says GSTN Taxpayer compliance under the goods and services tax (GST) system is steadily improving with 4.4 million assessees filing summary of the transactions … Continued

CBDT signs 7 more unilateral APAs with taxpayers

The Central Board of Direct Taxes (CBDT) has signed seven more advance pricing agreements (APAs) with Indian taxpayers as it looks to reduce litigation by providing certainty in transfer pricing. The seven APAs signed over the last month pertain to … Continued

GST returns filing: Tax experts doubt system’s accuracy; only a quarter of taxpayers meet October 31 deadline

Increasing the fear of an unravelling of the exercise of invoices-matching, which is crucial to realising the presumed merits of the goods and services tax (GST), like reduction of tax evasion and cascades, three-fourths of the 60 lakh eligible taxpayers … Continued

Exporters can claim refund this week for GST paid in August, September

Exporters can soon start claiming refunds for GST paid in August and September as GSTN will this week launch an online application for processing of refund, its Chief Executive Officer Prakash Kumar said today. GST Network (GSTN), the company handling … Continued

Banks begin to accept GST input claims to grant working capital

More than 90 days after the roll-out of the goods and services tax (GST), lenders are gravitating to sanctioning working capital loans, especially to micro and small units, against documents used in the new tax regime. They are no longer … Continued

GST: Tax department seeks details of transitional credit data

The tax department has sought explanations from banks and financial institutions, including multinationals, on transitional credit claimed by them in July under the goods and services tax (GST) regime, two people with direct knowledge of the matter said. Deputy commissioners … Continued

GST Council meeting: Full text of recommendations made by panel today

More than three months after the Goods and Services (GST) was introduced, the GST Council made a number of big changes today, to give some relief to small and medium businesses (SMEs) on filing and payment of taxes. The panel … Continued

GST crashes even money lenders’ usurious rates

Interest rates that money lenders charged borrowers hardly budged for decades irrespective of policy decisions. But even that is collapsing faster than what it is in the formal banking system, thanks to the implementation of Goods and Services Tax. Borrowing … Continued

Govt wants early warning system on shell companies

The ministry of corporate affairs (MCA) says work has begun for an “early warning system” regarding shell companies. The term is used to refer to a company without active business operations or much of assets. This by itself isn’t … Continued

GST interim returns: Over 30 lakh paid tax in August, matching July trend

While the number of businesses registered for the goods and services tax (GST) has crossed 90 lakh, much higher than tax base in the previous regime, filing of even the interim (summarised) returns and tax payments are not keeping pace. … Continued

Jurisdiction-free I-T assessment on the cards

To check corruption and harassment, the tax department will soon launch a pilot of “jurisdiction-free assessment” where a tax officer will not get to know identity of the assessee as allotment of cases will be done randomly by computers rather … Continued

I-T department goes after defunct companies for tax frauds

The tax office is reopening old records of many companies that have wound up and no longer exist in the books of the government — something the revenue department has rarely done in the past. Former directors of such closely-held … Continued

Tax authorities to scan GST transition credit claim of 162 companies

As many as 162 companies that have claimed GST transitional credit of over Rs. 1 crore are under the scanner of tax authorities who would verify whether the claims are eligible. In the transitional credit form TRAN–1 filed by taxpayers … Continued

CBEC plans strategy to bring more businesses in GST net

Tax officials are working out strategies to encourage more businesses to register for the Goods and Services Tax (GST) and further increase the taxpayer base. At present, there are about 90 lakh businesses registered to file returns and pay taxes … Continued

Income-tax department, MCA team up against shell firms

The income tax (I-T) department and the Ministry of Corporate Affairs (MCA) have signed a pact to regularly share data, including PAN and audit reports of firms, to crack down on shell companies, the government said on Thursday. The pact … Continued

Auditors come under lens amid crackdown on shell companies

A multi-agency clampdown has begun on shell companies to tackle the black money menace wherein the role of auditors has come under the scanner for alleged connivance in facilitating illegal transactions. The auditors’ role is also being looked into for … Continued

World Bank accepts many of Modi govt’s reform claims, big thumbs-up likely next month

The government expects a double-digit improvement in India’s rank in the global index on ease of doing business, likely to be announced by the World Bank next month. A senior official told ET that the World Bank had shared its … Continued

Filing Dates for GSTRs for July extended by a month to October 10

Press Information Bureau Government of India Ministry of Finance 09-September-2017 20:19 IST The GST Council, in its 21st meeting held at Hyderabad on 9th September 2017, has recommended the following measures to facilitate taxpayers: a) In view of … Continued

No Aadhaar card? Here are 10 things that are banned for you, from opening a bank account to processing of I-T returns

If you thought that filing an income tax return or opening a bank account are the only few things which require Aadhaar cards now, then think again. The fact is Aadhaar has now been made mandatory for so many things, … Continued

Over 2.09 lakh firms struck off, bank accounts frozen: Govt

Banks have also been asked to step up their vigil against those companies that are non-compliant with various regulations and not carrying out business activities for long, a senior finance ministry official said as authorities continue their crackdown against shell … Continued

I-T Department to focus more on e-assessment to reduce human interface

The Income Tax Department will focus on widening of tax base and maximise e-assessment to cut down on human interface, according to an official statement. Also, efforts will be made by the Central Board of Direct Taxes (CBDT) to exceed … Continued

CBDT signs 4 more APAs with taxpayers in August

The Central Board of Direct Taxes (CBDT) signed four more advance pricing agreements (APAs) in August with Indian taxpayers as it looks to reduce litigation by providing certainty in transfer pricing. The four APAs entered into during August, 2017 pertain … Continued

Deadline for Aadhaar-PAN linkage extended till December 31

The government on Thursday extended by four months the deadline for linking PAN with biometric identifier Aadhaar till December 31. The deadline for linking PAN with Aadhaar for taxpayers was to end on Thursday. This comes at a … Continued

GST returns filing: Deadline ends, figures suggest robust collections

Given that the states’ combined GST tax revenue is estimated to be roughly equal to that of the Centre, a monthly GST revenue of Rs 1.55 lakh crore would meet the projections. As the extended deadline for filing the first … Continued

Debt resolution top priority in insolvency process, says IBBI chief

Resolution of indebtedness of a firm will be the top priority of all constituents of the insolvency and bankruptcy mechanism in the interest of the stakeholders, and it will think about liquidation only if it finds that the resolution is … Continued

GST amount collected hits Rs 50,000 cr mark from 20 lakh businesses

The government has collected goods and and service tax (GST) amount of Rs 50,000 crore so far with 20 lakh assessees having filed an interim tax returns on the GST Network as of Wednesday evening. In addition, 28 lakh … Continued

Income tax scrutiny to remain limited despite ITR filings surge

The income tax department will maintain the number of income tax returns (ITRs) chosen for scrutiny at the current level of less than 1% of all returns, in spite of a surge in individual tax filings to keep the process … Continued

I-T plans to pursue property-holders who have never filed income tax returns

Income tax authorities plan to pursue those who have properties in their name but haven’t ever filed income tax returns on the suspicion that these may be benami holdings on behalf of people looking to conceal their wealth. The exercise … Continued

Big relief for taxpayers, GST deadline to file returns extended by CBEC to August 28

In what could bring relief to small taxpayers with cash flow issues, the Central Board of Excise & Customs (CBEC) has extended the deadline for taxpayers claiming input tax credit on transition (pre-GST) stocks to file the first interim returns … Continued

Here’s how a missing column in GST return form is creating trouble for India Inc

A top conglomerate may have to shell out a bit extra in advance tax this quarter due to an unusual glitch in the tax returns form. Another Delhi-based firm, which does not want to bear any extra tax, may simply … Continued

10 days to go; GSTN set for last minute rush on slow pace of returns filing

With barely 10 days left for goods and services tax (GST) assessees to file summarised interim returns, the GST Network (GSTN), the IT back end for the indirect tax regime, hasn’t yet started witnessing high-frequency traffic, indicating a possible last-minute … Continued

Biz can file returns, pay taxes for July on GSTN portal

Businesses can start filing their first tax return under the new Goods and Services Tax (GST) regime as the GST Network has started the facility for return filing and paying taxes on the portal. “The window for filing GSTR–3B has … Continued

SEBI crackdown on trading in 331 shell companies blocks investors’ Rs 9,000 cr

The government crackdown against 331 “suspected shell companies” has hit several investors, including mutual funds and small investors, who hold shares worth nearly Rs 9,000 crore in these companies. In a late circular on Monday, market regulator Securities and … Continued

Income Tax Return Filings Grew 25%, Says Government

The number of Income Tax Returns (ITRs) filed for 2016-17 year grew by 25 per cent to 2.82 crore, as increased number of individuals filed their tax returns post demonetisation, the tax department said today. The growth in ITRs filed … Continued

Direct tax collection rises fastest since 2013-14

The Income Tax Department’s time series data of direct taxes for 2016-17 estimates the government has collected ₹8,49,818 crore as income tax on individuals and businesses, recording a 14.5 per cent growth, the highest rise since 2013-14. Personal income taxes … Continued

5 lakh businesses opt for composition scheme under GST: Hasmukh Adhia

Five lakh businesses have opted for the GST composition scheme, which allows them to pay taxes at a concessional rate and makes compliance easy, the government said today. Nearly 71 lakh excise, service tax and VAT assessees have migrated to … Continued

Businesses can start filing July returns on GSTN from August 5

The first tax returns under the new Goods and Services Tax (GST) regime can be filed from Saturday and the facility will remain open till August 20, GST Network CEO Navin Kumar said today. Businesses can start filing their first … Continued

Income tax returns filing, PAN-Aadhaar linking deadlines extended to 5 Aug, 31 Aug on deluge of complaints

In a last minute decision, the government on Monday extended the deadline for filing Income Tax Returns (ITRs) and linking Aadhaar with the Permanent Account Number (PAN) of taxpayers. While ITRs can now be filed by August 5, the Aadhaar-PAN … Continued

Tax base widens to 63 mn in FY17, will expand process of e-assessment: CBDT

Income taxpayer base moved up substantially to 6.26 crore at the end of the last fiscal, from nearly 4 crore earlier, CBDT Chairman Sushil Chandra said on Monday. Clearing the air on disclosure of bank account details of non-resident Indians … Continued

GST Impact: Undue profit of over Rs 1 crore to come under authority’s lens

The proposed anti-profiteering authority under the new GST regime will take up for scrutiny only those cases that have mass impact and those where undue profit of more than Rs 1 crore has been earned, a senior government official said. … Continued

GST deadline: Tax composition scheme last date extended till August 16

The government today extended the deadline for small businesses to opt for the composition scheme in the GST regime by nearly four weeks to August 16. Small businesses with turnover of up to Rs 75 lakh earlier had time till … Continued

Now, India Inc vendors under I-T lens, firms asked to give payment details

The income-tax (I-T) department has asked large corporate entities, including multinational firms, to furnish details of employees off the payroll to check whether they are filing tax returns after deduction at source, or TDS. According to I-T officials, many lawyers, … Continued

Government draws up checklists for GST audits

The Centre has created a detailed road map for goods and services tax (GST) audits barely 20 days after the levy’s rollout, listing risks, target industries and even potential auditees for officials examining corporate India’s transition to the new regime. … Continued

GST impact on taxpayers: GSTN chief Navin Kumar says 35,000 registering every day

Over two weeks into the goods and services tax (GST) regime, Navin Kumar, chairman of GSTN — the IT backbone of the system — speaks to Sumit Jha on how taxpayers have adopted the new system. What are the latest … Continued

GSTN portal to be ready for invoice uploading from July 24

Businesses can start uploading their sale and purchase invoices generated post-July 1 on the GSTN portal from July 24, a top company official said today. The Goods and Services Tax has kicked in from July 1 and so far, the … Continued

Directorate set up under CBEC for data analytics and nabbing evaders

The government has set up a new wing under the indirect taxes body to provide intelligence inputs and carry out big data analytics for taxmen for better policy formulation and nabbing evaders. The Directorate General of Analytics and Risk Management … Continued

Taxpayers have to opt for GST composition scheme by July 21

Small businesses with turnover of up to Rs. 75 lakh have time till July 21 to opt for composition scheme under the Goods and Services Tax regime, GST Network said. To opt for composition scheme, the taxpayer needs to log … Continued

What GSTIN means, how to register for GSTIN, what is ARN number, code in GST India 2017

GST or Goods and Services Tax is currently the poster boy for the Indian Economy. While experts, as well as regular citizens, are divided on how GST is going to transform India, the real effects can only be seen after … Continued

Historic GST launched at midnight, from today India is finally one nation, one tax

India embraced the goods and services tax (GST) on the intervening night of Friday-Saturday, in a move that marked the culmination of the country’s long and chequered journey toward a uniform, all-encompassing, pan-India indirect tax system. The GST would militate … Continued

Aadhaar-PAN linking mandatory from 1 July, govt notifies rules

Individuals having permanent account number (PAN) will have to link it to their existing Aadhaar number from 1 July, a Finance Ministry notification said on Wednesday. Amending income tax rules, the government has made quoting the 12-digit identification number or … Continued

GST spawns Rs 20,000 crore business for tax, tech consultants

For decades, Sugal & Damani Group focused on lotteries before it entered the online bill payment business with Payworld. Now, it has become a GST service provider (GSP), an entity that will help businesses register, upload electronic invoices and file … Continued

Companies can avail input tax credit for most business expenses

Buying cleaning liquids for ‘Swachh Bharat’ as part of corporate social responsibility or taking a business associate out for lunch, companies will be able to set off all taxes paid on their consumption of goods and services when they clear … Continued

Central Board of Direct Taxes cuts profit margin for safe harbour rules

Given the lukewarm response to the safe harbour mechanism for transfer pricing, Central Board of Direct Taxes (CBDT) on Thursday cut the operating profit margin for information technology-enabled services, knowledge process outsourcing services (KPOs) and research and development (R&D) related … Continued

One nation, one tax department: I-T takes cue from GST

The one-nation, one-tax principle that underlines the goods and services tax (GST), set to be rolled out on July 1, could be adopted in a much more broader sense by the income tax department through a path-breaking initiative on jurisdiction-free … Continued

Finnish companies looking for new opportunities in India

India is becoming one of the favorite destinations for investments in manufacturing, clean tech, infrastructure and hi-tech for Finnish companies. Nina Vaskunlahti, Ambassador of Finland to India, in an interview with BusinessLine said, “There is increasing interest in economic cooperation, … Continued

Income Tax department warns against cash dealings of Rs 2 lakh, seeks tip-off

Income Tax department today warned people against indulging in cash transaction of Rs 2 lakh or more saying that the receiver of the amount will have to cough up an equal amount as penalty. It also advised people having knowledge … Continued

Tax evasion in India: Rs 1.4 lakh cr hunted down in 3 years, says CBDT

The Central Board of Direct Taxes (CBDT), the policymaking body of the income tax department, on Friday said that various law enforcing agencies have unearthed tax evasion of R1.37 lakh crore during the last three years as a result of … Continued

No tax scrutiny of big transaction if it matches income

If you splurged on something really expensive or made an enormous investment recently, rest assured your accounts won’t be opened up for scrutiny by the income tax department as long as these can be squared with your declared income. “Scrutiny … Continued

High-value transactions by doctors, lawyers under income tax lens

Senior tax officials are reaching out to chartered accountants and CFOs to drive home the point that by May 31 business establishments, various financial institutions and professionals, including doctors, lawyers and architects, will have to report a slew of high-value … Continued

CBDT online facility to link Aadhaar with PAN

The Income-Tax Department has launched an online facility to link Permanent Account Numbers with Aadhaar. It was reported that taxpayers were finding it difficult as their names did not match in both systems (Eg. Names with initials in one and … Continued

Government to soon make Aadhaar compulsory for regulatory filings under Companies Act

The government will soon make quoting of Aadhaar number compulsory for key managerial personnel and directors in regulatory filings under the Companies Act. The move, primarily aimed at tackling the issue of bogus identities, comes at a time when authorities … Continued

CBDT allots PAN and TAN in a day for ease of doing business

In another move to improve ease of doing business in India, the Income Tax Department has tied up with the Corporate Affairs Ministry (MCA) to issue Permanent Account Numbers (PAN) and Tax Deduction Account Numbers (TAN) within a day, an … Continued

Operation Clean Money 2.0: I-T to probe deposits of Rs 5-10 lakh now

Following a poor response to the Pradhan Mantri Garib Kalyan Yojana (PMGKY), an income declaration scheme, the Income Tax (I-T) department is set to launch another drive to catch hold of tax evaders who could have deposited large sums during … Continued

File FATCA compliance to banks by April 30 to avoid account being blocked

The Income Tax Department has said that all account holders of financial institutions should provide self-certification of compliance under Foreign Account Tax Compliance Act (FATCA) by April 30, 2017, without which their accounts will be blocked. The Central Board of … Continued

As Narendra Modi government gets set to crack GST whip on tax evaders, India Inc voices concern

Many functionaries from corporate India and tax experts have voiced concerns over the government’s plan to give unprecedented teeth to the country’s indirect tax administrators by making tax evasion above `5 crore a “cognizable and non-bailable offence” in the upcoming … Continued

New ITR forms for Assessment Year 2017-18 notified by CBDT

The CBDT has notified new income-tax return forms (ITR forms) for the assessment year 2017-18. It has prescribed simplified version of ITR-1 with fewer columns. A new column has been inserted in ITR Forms to report cash deposits in banks … Continued

Aadhaar for PAN and tax return filing – Likely challenges for foreigners and Indian citizens abroad

Aadhaar is a unique identification number issued by the Indian government to every individual resident of India. It is based on demographic and biometric data of the individual and thus no duplicate number can be issued to the same individual. … Continued

Government notifies simplified ITR forms; e-filing to start from April 1

The government today notified a simpler, one-page form for filing income tax returns while making it mandatory to quote Aadhaar number and disclose bank deposits of more than Rs 2 lakh post demonetisation. The Income Tax Return Form-1 (Sahaj) will … Continued

Aadhaar to be mandatory for mobile phone verification

After making Aadhaar mandatory for filing income tax returns and applying for a permanent account number (PAN), the government has moved to make Aadhaar-based e-KYC (know your customer) mandatory for mobile phone connections. In a notification late Thursday, the department … Continued

Aadhaar to be mandatory for income tax returns, getting PAN

The government on Tuesday proposed making Aadhaar, the unique number issued by the Unique Identification Authority of India, mandatory for filing of income-tax returns as well as for obtaining and retaining the permanent account number (PAN). It also proposed making … Continued

Fresh transfer pricing trouble for MNCs

A new provision for secondary adjustment in transfer pricing, announced in the Union Budget for 2017-18, is likely to affect the cash flow of multinational corporations (MNCs) and the dividend distribution tax paid by their Indian subsidiaries. The provision has … Continued

Expect a visit from taxman if you’ve ignored I-T dept’s email

Income Tax officials could soon be at your doorstep if you have deposited a huge amount during the note-swapping exercise last year, and have not yet explained the source of the cash. “We have tried to keep the exercise non-intrusive. … Continued

I-T refunds rise by a whopping 41.5%, government issues 1.62 cr refunds worth Rs 1.42 lakh cr

The income tax department has issued refunds to the tune of Rs 1.42 lakh crore so far this fiscal till February 10, 41.5 per cent higher than last year’s. The Centralised Processing Centre (CPC) of the tax department has already … Continued

Delay in filing Income Tax returns will now attract fine up to Rs 10,000

The Budget has proposed imposing a fine for not filing income tax returns within the due date. For income below Rs.5 lakh, filing returns after July will attract a fine of R1,000, while for income above Rs. 5 lakh it … Continued

Operation Clean Money: I-T dept scans 1 crore accounts, 18 lakh people to be questioned

In a bid to clamp down on unaccounted money funnelled into bank accounts post demonetization, the tax department has scrutinised and matched as many as 1-crore accounts and asked 18 lakh people to explain the source of fund. The tax … Continued

The govt has revised 40 tax treaties for information

India has revised 40 treaties for avoidance of double taxation so that the information exchanged with partner nations on tax matters can also be utilised for other purposes including criminal proceedings, Parliament was informed today. “Treaty partner countries have been … Continued

All I-T returns must be filed by March-end of assessment year

With a view to expedite tax assessments, the income tax department proposes to make it mandatory for tax payers to file I-T returns as well as revised returns by March end of the assessment year (AY). The department, in … Continued

Benami Act comes into play: I-T issues 87 notices; attaches assets worth crores

Initiating a stringent action against black money holders post notes ban, the Income Tax department on Monday said it has issued 87 notices and attached bank deposits worth crores in 42 cases nationwide under the newly enforced Benami Transactions Act … Continued

Tax avoidance rules: POEM norms to take effect from April, 2017

Confirming that India’s so-called POEM regulations — which are meant to ascertain the residential status of companies and use it to curb tax avoidance — will take effect from April 1, the Central Board of Direct Taxes (CBDT) on Tuesday … Continued

CBDT tightens screws on shell companies

The Central Board of Direct Taxes (CBDT) on Tuesday issued the much-awaited “guiding principles” for determination of a Place of Effective Management (PoEM) of a company, scotching speculation that the Budget may see its removal from the statute book. Put … Continued

Transfer pricing treaty for investors from cyprus

The government on Monday afternoon clarified that according to the amended Cyprus treaty, investors need to pay only 10% tax with retrospective effect from November 1, 2013, instead of the 30% tax they have already paid. While bringing in clarity … Continued

With GST on its way, India rises to second spot on global biz optimism index

India improved its ranking by one spot in a global index of business optimism, with policy reforms and Goods and Services tax (GST) expected to become a reality soon, says a survey. According to the latest Grant Thornton International Business … Continued

With GST on its way, India rises to second spot on global biz optimism index

India improved its ranking by one spot in a global index of business optimism, with policy reforms and Goods and Services tax (GST) expected to become a reality soon, says a survey. According to the latest Grant Thornton International Business … Continued

Ease of doing business: India banks on ‘remarkable work’ to improve World Bank ranking

As the World Bank looks set to release its annual ranking of countries in the ease of doing business later this week, India expects to improve its position from last year’s 130 out of 189 economies. The optimism stems from … Continued

Salaried taxpayers to get SMS alerts on TDS deductions

As many as 2.5 crore salaried taxpayers will now receive SMS alerts from the Income Tax department regarding their quarterly TDS deductions. Finance Minister Arun Jaitley on Monday launched the SMS alert service for Tax Deducted at Source (TDS) for … Continued

GST lends more weight to India’s 8% growth projection: S&P

Calling GST as the most important structural reform till date by the Modi government, S&P Global Ratings today said the passage of the indirect tax law gives it additional conviction of India clocking 8 per cent growth in the next … Continued

File income tax return (ITR) even if your income is not taxable

Many people think it an avoidable headache to file income tax returns, when their income falls below the taxable limit, or when tax is deducted at source or when no taxes are due. They also unnecessarily fear some notice will … Continued

GST Council: Tax exemption threshold fixed at Rs 20 lakh

The first session of the GST Council that concluded here on Friday made good progress in ironing out some of the contentious issues between the Centre and states: The exemption threshold for the goods and services tax (GST) has been … Continued

Indirect tax mop-up rises 27.5% to Rs 3.36 lakh cr till August

Net indirect tax collections in the April-August period grew 27.5 per cent to Rs 3.36 lakh crore on the back of surge in excise collections. The collection till August 2016 show that 43.2 per cent of the annual budget target … Continued

GST bringing realty shake-up

Retailers, both of physical stores and e-commerce entities, fast moving consumer goods (FMCG) companies and those in consumer durables have started rejigging their warehouse strategy. This is in preparation for the national goods and services tax (GST), with the government … Continued

Banks can accept tax dues in cash under IDS: RBI

The Reserve bank of India (RBI) on Thursday directed banks to accept tax dues in cash under the domestic black money declaration scheme which closes on September 30. Under the Income Declaration Scheme, 2016, which came into effect on June … Continued

CBDT launches online ‘nivaran’ to resolve I-T grievances

CBDT has launched the ambitious ‘e-nivaran’ facility for online redressal of taxpayers’ grievances related to refunds, ITRs and PAN among others as part of its initiative to reduce instances of harassment of the public when it comes to complaints related … Continued

Tax dept not to take action on cash deposits made after declaring income under IDS

The government has said no adverse action will be taken by Financial Intelligence Unit or the income-tax department solely on the basis of the information regarding cash deposit made consequent to the declaration under the black money scheme. Credit … Continued

IDS: CBDT issues circular endorsing validity of e-declarations

The CBDT has issued an order endorsing the legal validity of the e-declarations made under the ongoing domestic black money window, known as the Income Declaration Scheme (IDS). With only a month left for the IDS to close on September … Continued

Tax resolution scheme: CBDT to write to 2.59 lakh taxpayers

Keen to bring down the number of tax litigations, the Income Tax Department will soon write to over 2.59 lakh taxpayers asking them to avail the one-time dispute resolution scheme to settle their cases. And to cut down on communication … Continued

India has 7.4 crore taxpayers: CBDT chief

India’s income taxpayer base has touched 7.4 crore, CBDT Chairperson Rani Singh Nair said here on Tuesday. This is a significant increase from the 5 crore number bandied about in official circles in the recent past. Prime Minister Narendra Modi … Continued

Govt allows Aadhaar e-KYC for new mobile connections

Forget the bulky paperwork, you can now apply, validate and activate new pre-paid and post-paid mobile connections using your Aadhaar card and fingerprint at the point of sale. The government today issued e-KYC guidelines to make the online process … Continued

Over 75 lakh taxpayers availed e-verification facility for filing Income Tax Returns

Over 75 lakh taxpayers availed the e-verification facility of their income tax returns filed till August 5 against around 33 lakh taxpayers last year till September 7, which will ensure faster processing of their returns. In all 226.98 lakh e-returns … Continued

CBDT signs bilateral APAs with Japanese trading firm arm

The Central Board of Direct Taxes has signed bilateral advance pricing agreements with Indian arm of a Japanese trading company, a move that will help bring down transfer pricing disputes relating to intra-group transactions. “The Central Board of Direct Taxes … Continued

Today is the last day to file Income tax return, know easy steps if you haven’t filed yet

The last date for filing income-tax returns was extended to August 5, and it ends today. Tax returns for 2015-16 (assessment year 2016-17) were originally to be filed by July 31. But in view of the day-long strike at public sector banks, … Continued

Extension of Due Date – Filing of Income Tax Return for Assessment Year 2016-17

Income tax department has issued order that due date of filing of returns of income for the Assessment Year 2016-17 has been extended from July 31, 2016 to August 5, 2016, for those assessees, whose due date was originally … Continued

CBDT tightens scrutiny rules for assessing officers

If you have received an income-tax scrutiny notice, there’s no need to be unduly fearful as the government has sought to protect you against possible harassment. That’s in line with Prime Minister Narendra Modi’s recent message to the tax department … Continued

Central Board of Direct Taxes (CBDT) signs seven Unilateral Advance Pricing Agreements (APAs)

The Central Board of Direct Taxes (CBDT) entered into seven (7) Unilateral Advance Pricing Agreements (APAs) today, i.e., 18th July, 2016, with Indian taxpayers. Some of these agreements also have a Rollback” provision in them. The APA Scheme was … Continued

Black money: No cut in tax, warns CBDT

The government on Thursday clarified that tax paid under the ongoing amnesty scheme for persons with undisclosed domestic assets can’t be reduced to an effective 31% from 45% prescribed by enjoying immunity not only for such income declared but also … Continued

E-filing: ATM-based Income Tax Return (ITR) validation facility enhanced

The Income Tax department has widened the ATM-based validation system for filing e-ITRs by taxpayers with the inclusion of Axis Bank, after SBI, as part of its measure to enhance the paperless regime of filing the annual I-T returns. “Now, … Continued

Black money window: CBDT issues notification to ensure secrecy