Given the need for large chunks of equity capital to infuse new life into banks’ stressed assets, the government plans a new fund of “significant size” with this mandate, minister of state for finance Jayant Sinha said on Tuesday. A variety of other funds including the proposed National Infrastructure Investment Fund (NIIF) could help bolster the planned stressed assets fund, he added.

Given the need for large chunks of equity capital to infuse new life into banks’ stressed assets, the government plans a new fund of “significant size” with this mandate, minister of state for finance Jayant Sinha said on Tuesday. A variety of other funds including the proposed National Infrastructure Investment Fund (NIIF) could help bolster the planned stressed assets fund, he added.

“We need an efficient resolution (of the issue of rising stressed assets) and recovery process for our banks,” Sinha said on the sidelines of a conference organised by rating agency Crisil on the deepening of corporate bond markets. He said a committee might be set up to take a look at what kind of haircuts would need to be taken by banks and what their sustainable levels of debt could be. While these could be commercial decisions taken by banks, the government would ensure the process is carried out with integrity, he emphasised.

Many state-owned lenders are facing a tough situation, having reported large losses owing to assets turning sour. Gross non-performing assets in the banking system at the end of March are estimated at Rs 5.7 lakh crore while the provisions set aside by banks in FY16 was Rs 1.43 lakh crore. Total losses of PSBs in FY16 was Rs 17,022 crore.

“We expect a variety of funds — distressed debt funds, special situations fund and NIIF — to participate in the equity investments in these stressed assets,” the minister said. The NIIF, intended to give a leg-up to the country’s efforts to find the elusive equity capital for its huge plans for infrastructure creation, is being set up with an initial corpus of Rs 40,000 crore, half of that from the government, which will remain a minority partner.

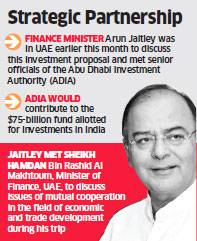

The NIIF, which will have several sector-specific sub-funds, is expected to catalyse financing of infrastructure projects by leveraging the corpus multiple times. Many global sovereign wealth funds including the Abu Dhabi Investment Authority, Singapore’s Temasek and Russian Direct Investment Fund have evinced interest in investing in the NIIF. The search for the CEO of the fund has reached the final stage, the minister indicated.

Sinha said: “There are also many other players who are looking to invest in the stressed assets of Indian banks. So we expect that there will be a vibrant market to be able to take these assets that are in need of equity capital right now.” On Tuesday, finance minister Arun Jaitley, on a visit to Japan, pitched for investments in the NIIF to Japanese investors.

While Sinha has indicated the NIIF’s participation in the proposed stressed assets fund, the former’s stated objective has been to maximise economic impact mainly through infrastructure development in commercially viable projects, both greenfield and brownfield, including stalled projects. It could also consider other nationally important projects if commercially viable.