The Reserve Bank on Saturday came up with revised long format audit report (LFAR) norms with a view to improving efficacy of internal audit and risk management systems.

The LFAR, which applies to statutory central auditors (SCA) and branch auditors of banks, has been updated keeping in view the large scale changes in the size, complexities, business model and risks in the banking operations, the RBI said.

RBI/2020-21/33

Ref.No.DOS.CO.PPG./SEC.01/11.01.005/2020-21

September 05, 2020

To:

The Chairman / Managing Director / Chief Executive Officer

All Scheduled Commercial Banks (Excluding RRBs)

All Local Area Banks

All Small Finance Banks and

All Payment Banks

Madam /Dear Sir,

Long Form Audit Report (LFAR) – Review

Please refer to RBI circular No. DBS.CO.PP.BC.11/11.01.005/2001-2002 dated April 17, 2002 on revision of Long Form Audit Report (LFAR).

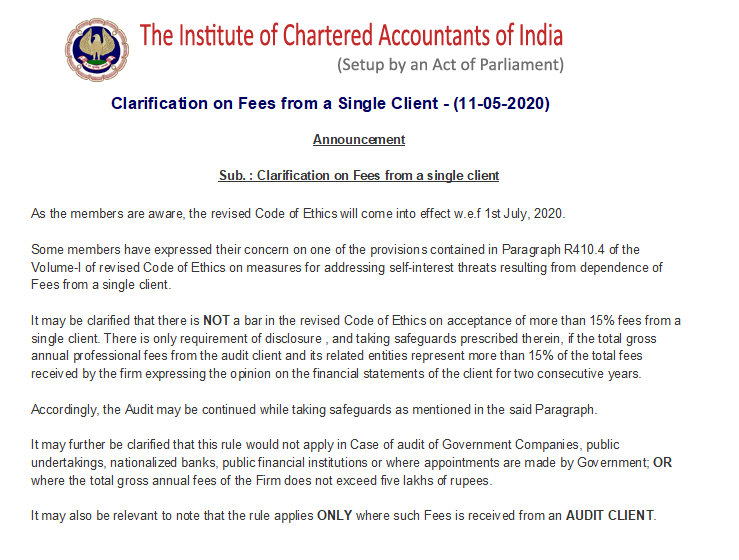

2. Keeping in view the large scale changes in the size, complexities, business model and risks in the banking operations, a review of the LFAR formats, in consultation with the stakeholders, including the Institute of Chartered Accountants of India (ICAI), was undertaken and it has been decided to make the following changes.

3. The format of LFAR, as mentioned below, have been revised:

- Annex I for Statutory Central Auditors (SCA)

- Annex II for Branch Auditors

- An Appendix as part of Annex II for the specialized branches and

- Annex III on Large / Irregular / Critical accounts for branch auditors.

The revised formats are enclosed.

4. The revised LFAR formats are required to be put into operation for the period covering FY 2020-21 and onwards. The mandate and scope of the audit will be as per this format and if the SCA feels the need of any material additions, etc., this may be done by giving specific justification by the SCA and with the prior intimation of the bank’s Audit Committee of Board (ACB).

5. Regarding other operational issues relating to submission of LFAR, we further advise as under:

- Timely receipt of LFARs from the auditors should be ensured;

- The LFAR on the bank, after due examination, should be placed before the ACB / Local Advisory Board of the bank indicating the action taken/proposed to be taken for rectification of the irregularities, if any, mentioned therein; and

- A copy each of the LFAR (i.e. for the bank / all Indian Offices of foreign bank as a whole) and the relative agenda note, together with the Board’s views or directions, should be forwarded to the concerned Senior Supervisory Manager (SSM) in the Department of Supervision, Reserve Bank of India within 60 days of submission of the LFAR by the statutory auditors.

6. The LFAR format and other instructions issued vide RBI circular No. DBS.CO.PP.BC.11/11.01.005/2001-2002 dated April 17, 2002 stand repealed.

7. Please acknowledge receipt.

Yours faithfully,

(Ajay Kumar Choudhary)

Chief General Manager

Encl: Annex I and II and III