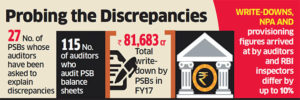

The Reserve Bank of India (RBI) has questioned scores of auditors at 27 public sector banks on the process and logic they had used to compute and report write-downs at the lenders, two people close to the development told ET.

The RBI has sought written explanation on differences in the write-down assessments by its own inspectors and those certified by the auditors. A write-down is a reduction in the estimated and nominal value of an asset, and is charged off as a loss to the profit and loss account for the relevant period. In some cases, the RBI has also questioned the provisioning methodology and non-performing asset (NPA) figures arrived at by the auditors at a few public sector banks, sources told ET.

The banking regulator is examining whether auditors at these state-run lenders followed RBI guidelines on write-downs, provisioning and NPAs. “This is part of RBI’s annual assessment. Auditors will have to explain how they provisioned for NPA and how they calculated write-downs,” said a person aware of the matter.

The write-downs, NPA and provisioning figures arrived at by the auditors and RBI inspectors differ by up to 10%.

WRITE-DOWNS & PROVISIONING

According to RBI data, PSU banks in FY17 have written off Rs 81,683 crore against Rs 2.49 lakh crore in the past five years. In a few cases, the audit reports of some of these lenders do not reflect these write-downs, said one of the persons cited above. Most banks do not separately report write-downs in their accounts, combining them often with quarterly provisioning.

Most Indian public sector banks use more than one auditor due to the enormous size of their balance sheets. Most auditors are mid-to-small Indian firms that audit several branches. The 27 public sector banks collectively employ 115 auditors, according to data analysed by the ET Intelligence Group.

According to the people in the know, auditors at State Bank of India, Punjab National Bank, Bank of Baroda, Canara Bank, Allahabad Bank and Bank of India (BoI) were sent the show-cause notices about two weeks ago.

ET’s detailed email queries to the regulator and the affected lenders – SBI, PNB, BoB, IDBI, Indian Overseas Bank, Canara Bank, BoI, Oriental Bank of Commerce (OBC) and Allahabad Bank – did not elicit any response.

REGULATOR HAS PRIVILEGED ACCESS’

According to a major bank’s auditor who did not wish to be identified, the differences are not unexpected. “The RBI has access to information an auditor may not. Like, if a loan in bank X has gone toxic, the auditor of bank Y may not know, but the RBI would,” he said. He added that there is a time lapse between auditors preparing an account and the RBI conducting inspections. “What you must look at is the impact on the P&L of a bank due to divergence. In most cases, that is not much,” he said.

To be sure, there may have been ‘technical’ errors in interpreting the writedown rules, resulting in the differences. “There is a direct impact of the new accounting standards on the way write-downs are arrived at,” said a senior executive at a top audit firm. “Under the old accounting system, the rules around write-downs were not as precise, and there is a possibility that some auditors may have ignored this.”

Source: Economic Times