Companies in the distressed assets business have patiently waited for close to a decade to strike gold but got regularly sidestepped by banks that won’t part with their lemons at a reasonable rate.

Companies in the distressed assets business have patiently waited for close to a decade to strike gold but got regularly sidestepped by banks that won’t part with their lemons at a reasonable rate.

The wait could come to an end soon, as the burgeoning bad debt burden and their humongous provisioning requirement is putting capital-starved banks in serious jeopardy, with no resolution in sight. The word has spread, bringing in its wake an army of globally savvy vulture funds that are sweeping down to get a chunk of the share.

These investors have ready cash and the government is on their side, allowing the sponsors to hold 100 per cent in a fund, and arming them with the Bankruptcy Code that would give the firms and banks power to wind down a company in mere 180 days, say sector watchers.

Banks, though, are still resisting, sometimes with such unreasonable demands like asking for 100 per cent of the principal amount or more, to offload the bad debt. But, experts say, unless banks become experts in recovering their dues themselves, the lenders won’t be able to hold for long.

“Banks have to offload the bad debts in the market but it remains to be seen how the market emerges,” said Birendra Kumar, managing director (MD) of International Asset Reconstruction Co.

Following the Reserve Bank’s (RBI’s) asset classification norm, a bank has to categorise a stressed loan as a loss and provide an amount equal to it on their books if it remains so for more than three years (provisions increase progressively from 15 per cent to 25 per cent, 40 per cent and then 100 per cent, depending on the age of the bad debt).

“Banks know they can hold the assets for one or two years only. After three-four years, they will have to get rid of it anyway. Otherwise, they not only incur heavy provisions; the assets also lose their viability,” said Siby Antony, MD at Edelweiss ARC.

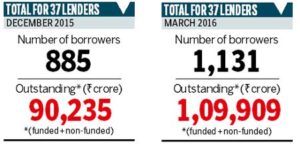

Bad debts in Indian banks have worsened progressively in the past few years and are now at about Rs 6 lakh crore, up from Rs 4.5 lakh crore in December 2015 and Rs 2.52 lakh crore in December 2013. In the interim, the minimum provisioning requirement has gone up from five per cent to 15 per cent, and capital infusion by the government is not even enough to cover the total capital erosion that banks have witnessed.

| TIME TO CLEAR DEBTS |

- Banking sector NPA stood at Rs 5.94 lakh crore in March 2016

- There are 15 asset reconstruction companies in India; 10, or more applications awaiting approval

- RBI directed asset reconstruction companies to pay 15% in cash and rest in security receipts

- Experts predict emergence of cash deals

- Recently, Brookfield and SBI floated $1-billion stressed funds

- The govt has also directed banks to float distressed funds

- Bankruptcy Code will give more teeth to recovery

|

While it is true that Indian banks have managed to recover and upgrade some of the loans, this is not even 15 per cent of the total stress. And, much of the book clean-up has been done by selling the assets to asset reconstruction companies (ARCs).

Typically, ARCs issue security receipts (SRs) to banks and pay about 15 per cent of the asset price upfront. They then act as an agent for banks to recover the dues, earning a spread. ARCs can also buy assets upfront and recover the dues for themselves but that is hardly followed in India. However, this practice could change, with distress funds from round the world setting up shop in India with a deep pocket, ready to buy assets in all-cash deals. According to Birendra Kumar, banks are now reluctant on selling assets on SR basis, as it takes years to recover the due, but the cash discounts offered by the banks is not good enough to attract buyers of stressed assets.

“It would continue to be a mix of SRs and cash. Global players would generally prefer to buy on cash basis, and banks in such situations will have to offer a higher discount,” said Kumar.

According to various estimates, in India, banks sell stressed assets at not more than a 40-45 per cent discount. In the case of a cash deal, globally the practice is to sell assets at not more than 25-30 per cent of the value. “The current size of the ARC industry is a matter of conjecture, given the lack of authoritative data. However, based on the agency’s discussions with market participants, it is understood that SRs are outstanding to the tune of Rs 60,000 crore, backed by NPAs (non-performing assets) close to Rs 1 lakh crore as at end-March 2016,” says a report from India Ratings (Ind-Ra).

About 71.4 per cent of the SRs rated by Ind-Ra belong to the small and medium enterprises segment. Large corporates constitute 9.6 per cent and retail (individuals) account for 19 per cent.So far, 15 ARCs have been given a licence by RBI and at least 10 more are pending with the central bank. Global vulture funds and stressed fund specialists like JC Flowers & Co, Eight Capital Management LLC, SSG and KKR are partnering with domestic firms such as Ambit Holdings, Piramal, etc, for the ARC business. Besides, Brookfield Asset Management, a stressed funds specialist, in partnership with the country’s largest lender, State Bank of India (SBI), is floating a fund to take advantage of the distressed market. The Brookfield-SBI venture has committed $1 billion to start with, underscoring the market’s potential.

Meanwhile, the existing ARCs continue to suffer from lack of capital and the stipulation that assets can be purchased only after paying up at least 15 per cent upfront. This has limited their ability to take large exposure.

“The challenges the older ARCs face are inadequate capital and specialist management expertise to drive turnarounds of acquired stressed assets. The ARC industry has capital of $400-500 million, with the total of stressed assets in the banking sector estimated to be $130 billion,” said Nikhil Shah, the MD at Alvarez & Marsal India, a turnaround specialist. Shah says the new funds that are coming to India will change the game in favour of asset resolution.

“The older ARCs have not demonstrated capability in reviving acquired stressed businesses. The new entrants are expected to be more aggressive in implementing measures like management changes and deploying significant primary capital in the businesses to improve value,” he added.

“The Bankruptcy Code, with its time-bound resolution, will provide ARCs and stressed assets funds more teeth to execute changes in a shorter time frame.”

However, Antony of Edelweiss ARC does not believe the new stressed fund managers would do something drastically different. “With the new relaxation in the Budget, where the government allowed sponsors to hold up to 100 per cent stake in an ARC and allowing 100 per cent foreign direct investment in ARCs via automatic route, the capital issue of ARCs have been addressed,” said Siby of Edelweiss, adding the legal structure is also getting fixed and that will allow stressed funds to grow exponentially. Now, if only banks would listen to reason and lower their prices for stressed funds, a flurry of activity in India’s stressed assets market would become the norm.

Source: http://www.business-standard.com/article/finance/stressed-asset-business-ready-to-take-off-116072801716_1.html

Parliament today passed a bill which empowers banks to confiscate security in the case of loan default, a development that assumes significance in view of the episode surrounding industrialist Vijay Mallya.

Parliament today passed a bill which empowers banks to confiscate security in the case of loan default, a development that assumes significance in view of the episode surrounding industrialist Vijay Mallya.