The CBDT has notified new income-tax return forms (ITR forms) for the assessment year 2017-18. It has prescribed simplified version of ITR-1 with fewer columns. A new column has been inserted in ITR Forms to report cash deposits in banks above 2 lakhs during the demonetisation period, i.e., from November 9, 2016 to December 30, 2016.

The CBDT has notified new income-tax return forms (ITR forms) for the assessment year 2017-18. It has prescribed simplified version of ITR-1 with fewer columns. A new column has been inserted in ITR Forms to report cash deposits in banks above 2 lakhs during the demonetisation period, i.e., from November 9, 2016 to December 30, 2016.

CBDT had prescribed new ‘Form ITR 4 Sugam’ for taxpayers opting for presumptive taxation scheme. A new column has been prescribed to mention digital receipts as the rate of presumptive income is 6% for such receipts.

The new ITR forms prescribed are listed below:-

ITR_1 For Individuals having Income from Salaries, one house property, other sources (Interest etc.) and having total income upto Rs.50 lakh

ITR_2 For Individuals and HUFs not carrying out business or profession under any proprietorship

ITR_3 For individuals and HUFs having income from a proprietary business or profession

ITR_4 For Presumptive Income from Business & Profession

ITR_5 For persons other than – (i) individual, (ii) HUF, (iii) company and (iv) person filing Form ITR-7

ITR_6 For Companies other than companies claiming exemption under section 11

ITR_7 For persons including companies required to furnish return under sections 139(4A) or 139(4B) or 139(4C) or 139(4D) or 139(4E) or 139(4F)

Changes in new ITR forms are as follows.

1) Simplified one page ITR Form for Salaried class taxpayers

[ITR 1 Sahaj] Now the Govt. has notified simplified one page form ‘ITR-1 Sahaj’ for individuals earning income from salary, pension, one house property and income from other sources. It has removed columns which are not frequently used by the taxpayers.

New ‘ITR-1 Sahaj’ has retained those deductions which are most frequently used by the taxpayers, viz, under Section 80C, 80D, 80G and 80TTA.

If any taxpayer wants to claim deduction under any other provision of chapter VI-A he can specify the relevant Section in column titled as ‘Any other’. Schedules of TDS and TCS have been merged into one in order to make ITR 1 shorter and simpler.

However, new columns have been inserted to report dividend income and long-term capital gains exempt under Section 10(34) and Section 10(38) respectively.

2) Disclosure of cash deposits during demonetization

[ITR 1, 2, 3, 4, 5, 6, 7] A new column has been introduced in all ITR Forms to report on cash deposited by taxpayers in their bank accounts during the demonetization period, i.e., from November 9, 2016 to December 30, 2016. However, taxpayers are required to fill up this column only if they have deposited Rs 2 lakh or more during the demonetization period.

3) Quoting of Aadhar Number

[ITR 1, 2, 3, 4] The Finance Bill, 2017 as passed by Lok Sabha has introduced a new Section 139AA requiring every person to quote Aadhar number in the return of income. If any person does not possess the Aadhaar Number but he had applied for the Aadhaar card then he can quote Enrolment ID of Aadhaar application Form in the ITR.

It may be noted that firms are also required to Quote Aadhaar number of their Partner/members in new ITR 5. Further, in case of trust Aadhaar number of Author(s) / Trustee(s) / Manager(s), etc., are required to be specified in new ITR 7.

4) Income taxable at special rates

Unexplained income [ITR 2, 3, 5, 6, 7]

As per Section 115BBE any unexplained credit or investment attracts tax at 60% (plus surcharge and cess, as applicable), irrespective of the slab of income.

Now new columns have been inserted in ITR Forms under ‘Schedule OS’ to report such unexplained income under ‘Schedule SI’.

It may be noted that any taxpayer having unexplained income cannot opt for ITR-1 Sahaj.

Dividend above Rs 10 lakhs

As per Section 115BBDA the dividend received from domestic company is taxable at rate of 10% if aggregate amount of such dividend exceeds Rs. 10 lakh. New column has been inserted in ITR Forms to declare such dividend income in ‘Schedule OS’.

It may be noted that any taxpayer having dividend income above Rs 10 lakhs and covered under Section 115BBDA cannot opt for ‘ITR-1 Sahaj’.

Patent income

A new column has been inserted in ITR Forms to declare royalty income from patent developed and registered in India and chargeable to tax at 10% under section 115BBF.

5) Deduction under section 80EE

[ITR 2, 3, 4] Section 80EE allows deduction on home loan interest for first time home buyers. This deduction is over and above the Rs 2 lakhs limit covered under Section 24(b).

A new field has been provided in new ITR Forms under Schedule VI-A deductions to claim home loan interest under Section 80EE.

6) Declaration of value of assets and liabilities by Individuals/HUF earning above Rs 50 lakhs

[ITR 2, 3, 4] During 2016, the Govt. had introduced new Schedule requiring individuals/HUFs to declare the value of assets and liabilities if their total income exceeds Rs. 50 lakhs. Taxpayers were required to mention cost of immovable property, jewellery, bullion, vehicles, shares, bank and cash balance, etc.

Now tax payers are also required to disclose address of immovable property and description of movable assets in new ITR Forms. Further, new fields have been introduced in ITR Forms for disclosure of ‘Interest held in the assets of a firm or AOP as a partner or member’. Such members/partners are also required to disclose name, address, PAN of the firm or AOP.

7) Registration number of Chartered Accountant Firm

[ITR 3, 5, 6] Now taxpayers are required to mention registration number of firm of Chartered Accountant which has done audit in ITR Forms.

8) Bifurcation of receipt/expenses from business and profession in no account case.

[ITR 3, 5] In old ITR Forms there was no option to bifurcate income and expense of business and profession separately. All receipts were to be clubbed together and shown in ITR.

Now in new ITR forms, there is an option to show receipts from business and profession separately.

9) Deduction of additional depreciation in case of asset put to use for less than 180 days in preceding year

[ITR 3, 5, 6] In case of purchase of an asset which is put to use for less than 180 days, additional depreciation shall be restricted to 50% for that year and remaining would be allowable in the succeeding year.

In old ITR Forms, no column was there under ‘Schedule DPM’ to claim unutilized 50% additional depreciation in succeeding year. Now in new ITR Forms such column has been inserted to claim unutilized 50% depreciation.

10) Segregation of digital receipts and other receipts under presumptive taxation scheme

[ITR 4] As per the presumptive taxation scheme under Section 44AD, 8% of gross receipts or turnover will be deemed as income of the taxpayer. However, in 2017 Union Budget such limit has been proposed to be reduced to 6% for digital receipts of taxpayer.

In new ITR form, new columns have been inserted to show turnover received through digital mode. Consequently, columns have been inserted to show presumptive income at 6% and 8%.

The Finance Act 2016, had introduced the presumptive taxation scheme for professionals as well. Now new ITR 4 Form shows an option to avail such presumptive taxation scheme for professionals under Section 44ADA.

11) Details of receipts as mentioned in Form 26AS under TDS schedule

[ITR 4] ITR 4 which is now applicable for taxpayer opting for presumptive taxation scheme has a new column under the ‘Schedule TDS2’ to show the receipts as mentioned in Form 26AS.

12) Disallowance for non-deducting or non-payment of Equalisation levy

[ITR 3, 5, 6] The Finance Act, 2016 has introduced new provision to deduct 1% Equalization Levy on payment made for certain advertisement services paid to non-residents.

Any default in deduction or payment of Equalization levy would attract disallowance of Section 40(a)(ib). In new ITR Forms a new column has been inserted under ‘Part A-OI’ to mention such disallowance under section 40(a)(ib).

13) Disallowance of any amount payable for use of railway assets

[ITR 3, 5, 6] Any sum payable by the assessee to the Indian Railways for the use of railway assets shall be allowed as deduction on actual payment basis as per section 43B.

A new column has been inserted under ‘Part A-OI’ for disallowance under section 43B in case of non-payment of such amount on or before due date of furnishing return of income.

14) New schedule to report ‘receipt and payment’ account of a company under liquidation

[ITR 6] A new schedule ‘Part A-OL’ has been inserted in ITR 6 to furnish details of ‘receipt and payment’ account of company under liquidation.

15) Changes related to ITR 7 in respect of Charitable Trusts

[ITR 7] Various changes have been introduced in the new ITR 7 form. Now trust is required to furnish following additional details in new ITR 7 –

- a) Registration number and date of registration for business trusts registered with the SEBI.

- ) ‘Schedule AI’ to report aggregate of income referred to in section 11 and 12 excluding voluntary contribution.

- c) ‘Schedule ER’ to report amount applied to charitable or religious purposes (revenue account).

- d) ‘Schedule EC’ to report amount applied to charitable or religious purposes (capital account).

- e) ‘Schedule 115TD’ to report accreted income of trust under section 115TD

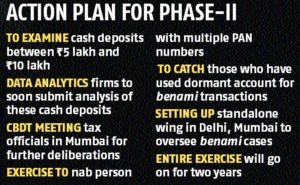

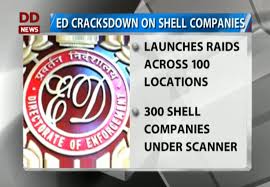

Following a poor response to the Pradhan Mantri Garib Kalyan Yojana (PMGKY), an income declaration scheme, the Income Tax (I-T) department is set to launch another drive to catch hold of tax evaders who could have deposited large sums during the demonetisation drive.

Following a poor response to the Pradhan Mantri Garib Kalyan Yojana (PMGKY), an income declaration scheme, the Income Tax (I-T) department is set to launch another drive to catch hold of tax evaders who could have deposited large sums during the demonetisation drive.