Finance Minister Arun Jaitley presented the Union Budget 2017, his fourth annual budget, today. Here are the highlights of this year’s budget:

Finance Minister Arun Jaitley presented the Union Budget 2017, his fourth annual budget, today. Here are the highlights of this year’s budget:

►Income Tax rate cut to 5 pc for individuals having income between Rs 2.5 lakh to Rs 5 lakh

►10 pc surcharge on individual income above Rs 50 lakh and upto Rs 1 cr to make up for Rs 15,000 cr loss of due to cut in personal I-T rate

►15 pc surcharge on income above Rs 1 cr to continue

►Of 3.7 cr individuals who filed tax returns in 2015-16, 99 lakh showed income below exemption limit

►Direct tax collection not commensurate with income and expenditure pattern

►Revenue deficit reduced to 2.1 pc from 2.3 pc for 2016-17

►Govt pegs fiscal deficit target at 3.2 per cent for 2017-18 and 3 per cent for next year.

► Monetary policy to be expansionary in major economies

► More steps will be taken to benefit farmers and the weaker sections; budget being presented during weak global economy

►Pace of remonetisation has picked up; demonetisation effects will not spill over to next year

►Functional autonomy of the railways to be maintained

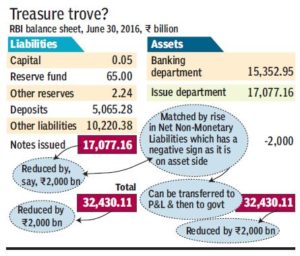

►Demonetisation will help in transfer of resources from tax evaders to government:

►Merger of Railways Budget with General Budget brings focus on a multi-modal approach for development of railways, highways and inland water transport

►Only transient impact on economy due to demonetisation; long term benefit include higher GDP growth and tax revenue

►GDP will be bigger, cleaner after demonetisation

►Effects of demonetisation not expected to spill over to the next year, says Finance Minister

►Govt took two tectonic policy initiatives – passage of GST Bill and demonetisation

►Demonetisation was a continuation of series of measures taken by govt in 2 yrs; it is bold and decisive measure

►We are seen as engine of global growth; IMF sees India to grow fastest in major economies

►36 pc increase in FDI flow; forex reserves at USD 361 billion in January enough to cover 12 months needs

►CAD declined from 1 pc last year to 0.3 pc in first half of current fiscal: FM

►India has emerged as bright spot in the world: FM

►Uncertainty around commodity prices especially oil to have impact on emerging economies: FM

►Double digit inflation has been controlled; sluggish growth replaced by high growth; war on blackmoney launched: FM

►We have moved from discretionary based administration to policy based administration: FM Jaitley

► Agricultural sector is expected to grow at 4.1 per cent this fiscal, says Jaitley

►Demonetisation was a bold and decisive strike in a series of measures to arrive at a new norm of bigger, cleaner and real GDP

►Committed to double farm income in 5 years

►Plan, non-plan classification of expenditure done away with in the Budget for 2017-18 to give a holistic picture

►Mini labs by qualified local entrepreneurs to be set up for soil testing in all 648 krishi vigyan kendras in the country

►Budget presentation advanced to help begin implementation of schemes before onset of monsoon

►We will continue the process of economic reform for the benfit of poor.

►Spend more in rural areas, infra, poverty alleviation, while maintaining fiscal prudence as guiding principle of Budget

►Our agenda for next year is to transform, energise and clean India

►World Bank expects GDP growth rate at 7.6 pc in FY18 and 7.8 pc in FY19

►Allocation under MNREGA increased to 48,000 crore from Rs 38,500 crore. This is highest ever allocation

►Rs 9,000 cr higher allocation for payment of sugarcane arrears

►Target of agriculture credit fixed at Rs 10 lakh cr in 2017-18

►Tax administration honouring the honest is one of the 10 pillars of Budget 2017-18

►National Testing agency to conduct all examinations in higher education, freeing CBSE and other agencies

►133-km road per day constructred under Pradhan Mantri Gram Sadak Yojana as against 73-km in 2011-14

►Govt to set up dairy processing fund of Rs 8,000 crore over three years with initial corpus of Rs 2,000 crore

►1 cr households to be brought out of poverty under Antodya Scheme

►Participation of women in MNREGA increased to 55 pc from 45 pc in past

►Modern law on contract farming will be drafted and circulated to states

►Dedicated micro-irrigation fund to be created with a corpus of Rs 5000 crore

►Market reforms will be undertaken, states will be asked to denotify perishables from Essential Commodities Act

►Space technology to be used for monitoring MNREGA implementation

►Sanitation coverage in villages has increased from 42 pc in Oct 2016 to 60 pc, a rise of 18 pc, says FM

►We propose to provide safe drinking water to 28,000 arsenic and fluoride affected habitations

►To construct one crore houses by 2019 for homeless. PM Awas Yojana allocation raised from Rs 15,000 cr to Rs 23,000 cr

►100 pc electrification of villages to be completed by May 2018

►27,000 cr on to be spend on PMGSY; 1 cr houses to be completed by 2017-18 for houseless

►PM Kaushal Kendras will be extended to 600 districts; 100 international skill centres to be opened to help people get jobs abroad

►The allocation for rural agri and allied sector in 2017-18 is record Rs 1,81,223 crore

►In higher education, we will undertake reforms in UGC, give autonomy to colleges and institutions

►A system of annual learning outcome in schools to be introduced; innovation fund for secondary education to be set up

►Two new AIIMS to be set up Jharkhand and Gujarat

►New rules regarding medical devices will be devised to reduce their cost

► 1.5 lakh health sub centres to be converted to Health Wellness Centres

►National Housing Bank will refinance indiviual loans worth Rs 20,000 crore in 2017-18

►Rs 500 cr allocated to set up Mahila Shakti Kendras; Allocation raised from Rs 1.56 lakh cr to Rs 1.84 lakh cr for women & child welfare.

►Capital and development expenditure pegged at Rs 1.31 lakh cr for railways in 2017-18 from Budget

►Allocation for SCs increased from Rs 38,833 cr to Rs 52,393 cr, a rise of 35 per cent

►35 pc increase in allocation for SC to Rs 52,393 cr

►For senior citizens, Aadhaar based health cards will be issued

►Model Shops and Establishment Bill to open up additional opportunities for employment of women

► Select airports in tier-II cities to be taken up for operations, development on PPP mode

►New metro rail policy to be unveiled

►Railway tariffs to be fixed on the basis of cost, social obligation and competition

►Service charge on e-tickets booked through IRCTC will be withdrawn

►Delhi and Jaipur to have solid waste management plants and five more to be set up later

►Government proposes Coach Mitra facility to redress grievances related to rail coaches

►500 stations will be differently abled by providing lifts and escalators

►Unmanned railway level crossings to be eliminated by 2020

►Railway line of 3,500 km will be commissioned in 2017-18 as against 2,800 km in 2016-17

►Total allocation for rural, agri and allied sectors for 2017-18 is a record Rs 1,87,223 cr, up 24 per cent from last year

►Rs 1 lakh cr corpus for railway safety fund over five years

►A scheme for senior citizens to ensure 8 per cent guaranteed returns

►Dedicated micro-irrigation fund to be set up by NABARD to achieve mission of Per Drop, More Crop

►Digi Gaon will be launched to promote tele-medicine and education

►Crude oil strategic reserves to be set up in Odisha and Rajasthan apart from 3 already constructed

►Coverage of Fasal Bima Yojana to go up from 30 pc of cropped area to 40 pc in 2017-18 and 50 per cent next year

►For transport sector, including railways, road and shipping, government provides Rs 2.41 lakh crore

►Allocation of Rs 10,000 cr for Bharat Net project for providing high-speed broadband in FY18

►Allocation for national highways stepped up to Rs 64,000 cr from Rs 57,676 cr

►Budget allocation for highways stepped up to Rs 64,000 crore in FY18 from Rs 57,676 crore

►Dispute resolution in infrastructure projects in PPP mode will be institutionalised

►Rs 2,74,114 crore allocated for defence expenditure, excluding pension; This includes Rs 86,000 crore for defence capital

►Govt to further liberalise FDI policy

►Over 90 per cent of FDI proposls are now through automatic route

►FIPB will be abolished

►Trade Infrastructure Export Scheme to be launched in 2017-18; total allocation for infra at record Rs 3.96 lakh cr

►Second phase of solar power development to be taken up with an aim of generating 20,000 MW

►After demonetisation on Nov 8 last year, deposit of between Rs 2 lakh and Rs 80 lakh made in 1.09 cr bank accounts at an average of Rs 5.03 lakh till Dec 30

►More funds beyond Rs 10,000 cr for recapitalisation of banks will be provided if needed

►The shares of railway CPSCs like IRCTC and IRFC to be listed on various stock exchanges

►We are largely a tax non-compliant society

►New ETF with diverse stocks will be launched in 2017-18

►Of 76 lakh individuals who reported income of over Rs 5 lakh, 56 lakh are salaried

►Integrated public sector oil major to be created to match global giants

►Govt will amend the Multi-state Cooperative Act to protect the poor and gullible investors

►Urgent need to protect poor from chit fund schemes, draft bill placed in public domain

►Computer emergency response team to be set for cyber security of financial sector

► Govt to introduce two new schemes to promote BHIM App – referal bonus for users and cash back for traders

►Govt doubles distribution target under Mudra Yojana to Rs 2.44 lakh crore for 2017-18

►Over Rs 80 lakh deposits in 1.48 lakh cr at an average of Rs 3.31 cr per account

►Customs duty on LNG halved to 2.5 pc

►FPI to be exempt from indirect transfer provisions

►Political parties can receive donations in cheque, electronic mode; electoral bonds to be issued by RBI

►Maximum amount of cash donation a political party can receive will be Rs 2000 from any one source as part of effort to clean political funding

►Capital expenditure stepped up by 25.4 pc in FY18 over previous year

►Total expenditure in FY18 at Rs 21.47 lakh cr

►Duty exempted on various POS machines and iris readers to encourage digital payments

►Rs 7,200 cr revenue loss due to reduction in tax on smaller companies

►Govt mulling introduction of legal changes to confiscate assets of offenders, including economic offenders, who flee the country

►Govt to set up a web-based interactive platform for defence pensioners

►Head post offices to issue passports

►Govt considering option to amend Negotiable Instruments Act to ensure that holders of dishonoured cheques get payment

►FRBM review committee has recommended 60 pc debt to GDP ratio; 0.5 pc of GDP deviation from stipulated fiscal deficit targets

►Payment regulatory board to be set up in RBI to regulate electronic payments, replacing Board for Regulation and Supervision in Payments and Settlements System

►3 yr period for long-term capital gains tax on immovable property reduced to 2 years; base year indexation shifted from 1.4.1981 to 1.4.2001

►A proposal to receive all government receipts beyond a certain threshold through e-modes under consideration

►GST implementation to bring more taxes to Centre and states

►No transaction above Rs 3 lakh in cash will be allowed as suggested by SIT

►Customs duty on LNG to be reduced from 5 pc to 2.5 pc

►To make MSME companies more viable, govt proposes to reduce IT tax with annual turn over of Rs 50 core up to 25 per cent

►I-T for smaller cos with turnover of upto Rs 50 cr up to 25 per cent

►Not possible to remove MAT levied on advance tax for now; carry forward allowed for 15 yrs instead of 10 yrs

►Relaxation in norms for Start Ups for getting tax exemption

►Capital gains tax exempted for the land pooled to build new capital of Andhra Pradesh effective from 2.6.2014

►Increase in personal tax collections is 34.8 per cent in last three quarters. Demonetisation has played a role

►17 pc growth in direct tax revenue for the second year in a row in 2016-17

►As against 4.2 crore people working in organised sector, only 1.74 crore individuals filed income tax returns

►Solar tempered glass used for manufacture of solar cells/panels exempted from customs duty

►Import duty on aluminium ores and concentrates raised to 30 pc from nil presently

►Actual revenue loss on tax proposals Rs 22,700 cr; gain from additional resource mobilisation is Rs 2,700 cr

►Net revenue loss from direct tax proposals to be about Rs 20,000 cr

►Excise duty on pan masala containing tobacco (Gutkha) raised to 12 pc from 10 pc

►Excise duty on non-filter cigarettes of length not exceeding 65 mm raised to Rs 311 per thousand from Rs 215 per thousand

Source:http://economictimes.indiatimes.com/articleshow/56907865.cms

In a bid to clamp down on unaccounted money funnelled into bank accounts post demonetization, the tax department has scrutinised and matched as many as 1-crore accounts and asked 18 lakh people to explain the source of fund.

In a bid to clamp down on unaccounted money funnelled into bank accounts post demonetization, the tax department has scrutinised and matched as many as 1-crore accounts and asked 18 lakh people to explain the source of fund.