The Ministry of Corporate Affairs (MCA) has officially extended the deadline for the mandatory dematerialization of securities for private companies.

According to the latest notification issued on February 12, 2025, the new compliance deadline has been pushed to June 30, 2025.

This amendment revises the Companies (Prospectus and Allotment of Securities) Rules, 2014, specifically Rule 9B, which mandates dematerialization for specific categories of private companies.

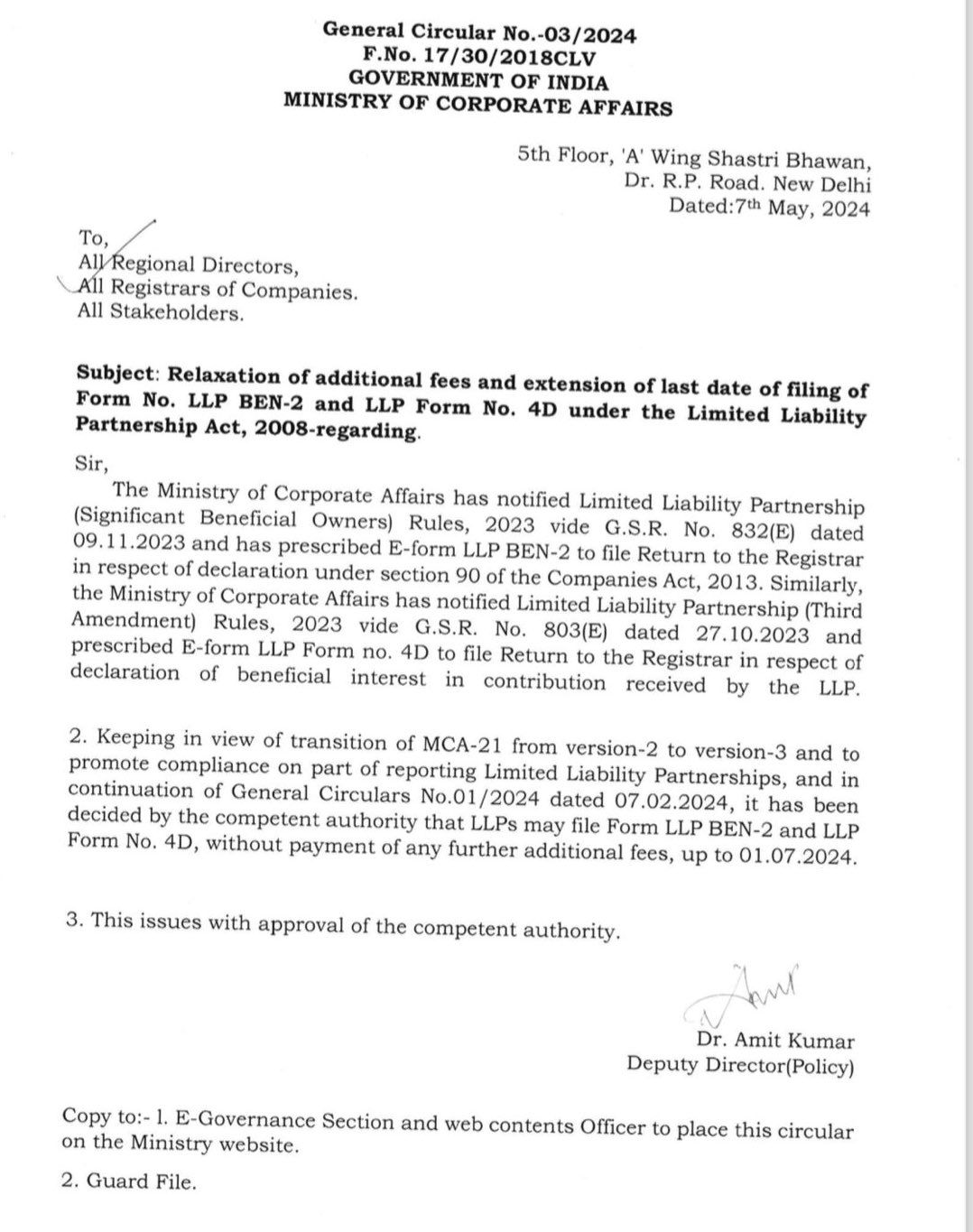

The official Notification is attached here for reference:

Key Highlights of the MCA Notification

Extension until June 30, 2025

- The deadline for compliance with Rule 9B (2) has been extended from March 31, 2023, to June 30, 2025.

- This provides private companies (other than small and producer companies) with more time to complete the dematerialisation of securities and obtain ISIN (International Securities Identification Number).

Applicability of the Rule

- All private companies, excluding small companies and producer companies, are required to comply.

- Companies that intend to issue new shares, transfer shares, or make any alterations in their capital structure must do so only in dematerialised form.

The objective of the Amendment

- To ease the transition for private companies that have not yet complied.

- To ensure greater market transparency and alignment with regulatory frameworks for public companies.

- To facilitate smooth investor participation and digital securities transactions.

What is the Dematerialization of Shares?

Dematerialization is the process of converting physical share certificates and other securities into an electronic format, eliminating the need for paper-based documents. Once dematerialized, these securities are held in a demat account, which functions like a digital repository for financial instruments.

A depository is an entity that holds securities in an electronic form and facilitates seamless transactions. It ensures security, transparency, and ease of trading. In India, depositories are governed under the Depositories Act of 1996 and regulated by the Securities and Exchange Board of India (SEBI).

The two SEBI-registered depositories in India are:

- NSDL (National Securities Depository Ltd.) – Primarily linked with the National Stock Exchange (NSE).

- CDSL (Central Depository Services (India) Ltd.) – Associated with the Bombay Stock Exchange (BSE).

Rule 9B: Mandatory Dematerialization of Securities for Private Companies

In October 2023, the Ministry of Corporate Affairs (MCA) introduced Rule 9B under the Companies (Prospectus and Allotment of Securities) Rules, 2014. This regulation made it mandatory for certain private companies to dematerialize their securities, aligning them with corporate governance standards applicable to public companies.

Applicability of Dematerialization of Shares

The dematerialization of shares applies to various entities within the securities market, ensuring transparency, security, and ease of transactions.

Public Companies

All public companies in India are mandated to hold and transact their securities in dematerialized form.

Private Limited Companies

All private limited companies, except those categorized as small companies, must comply with dematerialization regulations.

Holding and Subsidiary Companies

- Any private limited company that is a holding company or a subsidiary of another corporate entity must dematerialise its shares.

- This applies even if the company qualifies as a small company under financial thresholds.

Small Companies – Exception to Dematerialization

A small company is defined as a private limited company that meets the following financial criteria:

- Paid-up capital: INR4 crore (INR 40,000,000) or less

- Turnover: INR40 crores (INR 400,000,000) or less in the preceding financial year

Small companies are exempt from mandatory dematerialisation unless they are:

- A holding company of another entity

- A subsidiary company of another corporate body

In these cases, they must comply with dematerialisation requirements, irrespective of their financial position.

Last date for Dematerialization of Physical Shares

Considering the challenges faced by companies in executing the dematerialisation process, the Ministry of Corporate Affairs (MCA) has extended the compliance deadline. The new last date for mandatory dematerialisation of shares is June 30, 2025, revised from the earlier deadline of September 30, 2024.

Implications of the Deadline Extension for Private Companies

- For Non-Compliant Private Companies: Companies that have not obtained their ISIN or completed dematerialisation now have extra time to comply. They must coordinate with depositories (NSDL/CDSL), registrar & transfer agents (RTAs), and professionals to initiate the dematerialisation process.

- For Companies already in Compliance: Those who have already obtained their ISIN and dematerialised securities will not be affected. However, they should continue ensuring that any new share issuance or transfer occurs only in dematerialised form.

How to Convert Physical Shares into Demat?

Converting physical share certificates into electronic form is a simple and efficient process. Below is a step-by-step guide to help complete the dematerialization process:

Step 1: Open a Demat Account

To begin, you need to open a Demat account with a Depository Participant (DP), such as a bank, stockbroker, or financial institution. This account will hold your shares in electronic form.

You must fill out an account opening form and provide essential details, including:

- Bank account details (Account number, IFSC code, Bank name, and Branch address)

- Identity and address proof

- PAN card

Once your Demat account is successfully set up, you can initiate the dematerialization process.

Step 2: Submit a Demat Request Form (DRF)

Obtain a Demat Request Form (DRF) from your DP, complete it accurately, and sign it. Ensure that the names and signatures on the form match those on the share certificates and the company’s records.

Step 3: Verification and Processing

After submission, the DP will verify your details and issue a Dematerialization Request Number (DRN) to track the status of your request.

Step 4: Forwarding to Registrar and Share Transfer Agent (RTA)

Your DP will forward the dematerialization request along with your physical share certificates to the respective Registrar and Share Transfer Agent (RTA) of the issuing company.

Step 5: Conversion to Electronic Form

Once the RTA verifies and approves the request, your physical share certificates will be cancelled and converted into electronic form to prevent misuse.

Step 6: Credit to Your Demat Account

The dematerialized shares are then credited to your Demat account, allowing you to sell, transfer, or pledge them as needed.

Penalties for Non-Compliance with Dematerialization Requirements

Failure to comply with Rule 9B of the Companies Act, 2013, can result in serious consequences for private companies, including:

- Restrictions on Securities Transactions: Companies failing to comply will be barred from issuing or allotting any securities, including those related to bonus issues and buybacks.

- Limitations for Shareholders: Shareholders holding physical shares will be restricted from selling or transferring their securities. They may also lose eligibility for rights issues and dividend benefits.

- Monetary Penalties for Companies

- Penalties for Company Officers: Officers in default may face penalties of up to INR 50,000 for non-compliance.

- Initial penalty: INR 10,000

- Continuing penalty: INR 1,000 per day until compliance is met, up to a maximum of INR 200,000.

Conclusion

The extension of the dematerialisation deadline to June 30, 2025, provides much-needed relief for private companies, allowing them additional time to comply with Rule 9B of the Companies Act, 2013. Companies should take advantage of this extension to complete the demat process, obtain their ISIN, and ensure compliance to avoid penalties and restrictions on share transactions.

Frequently Asked Questions (FAQs)

- What is the new deadline for the mandatory dematerialisation of private company shares?

The Ministry of Corporate Affairs (MCA) has extended the compliance deadline to June 30, 2025, from the earlier date of September 30, 2024.

- Which companies are required to dematerialise their shares?

All private limited companies, except those categorised as small companies, must comply with the dematerialisation requirements under Rule 9B of the Companies Act, 2013. Additionally, holding and subsidiary companies must also dematerialise their shares, regardless of their size.

- Are small companies exempt from the dematerialisation requirement?

Yes, small companies (those with a paid-up capital of INR4 crore or less and turnover of INR40 crore or less) are exempt. However, if they are a holding or subsidiary company, they must comply with the dematerialisation mandate.

- What happens if a company does not complete the dematerialisation process by the deadline?

Non-compliant companies may face:

- Restrictions on issuing or allotting securities, including bonus shares and buybacks.

- Limitations for shareholders, preventing them from selling or transferring physical shares.

- Monetary fines of INR 10,000, with an additional INR 1,000 per day until compliance is met (up to INR 2,00,000).

- Penalties for company officers, with fines up to INR 50,000.

- How can physical shares be converted into dematerialised form?

The dematerialisation process involves:

- Opening a Demat account with a Depository Participant (DP).

- Submitting a Demat Request Form (DRF) along with physical share certificates.

- Verification and processing by the DP and Registrar & Share Transfer Agent (RTA).

- Conversion to electronic format and crediting to your Demat account.

- Which depositories handle dematerialisation in India?

The two SEBI-registered depositories in India are:

- NSDL (National Securities Depository Ltd.)

- CDSL (Central Depository Services (India) Ltd.)

- Is dematerialisation required for new share issuances and transfers?

Yes, as per Rule 9B, all new share issuances and transfers must be conducted in dematerialised form. Companies that have already completed the demat process must ensure ongoing compliance for any future transactions.

- How to get help with the dematerialisation process?

You can get help from professional bodies that provide end-to-end assistance for companies looking to dematerialise their shares through NSDL/CDSL. They help in documentation, coordination with depositories, and compliance filing to ensure a seamless transition to electronic shareholding.