Analysis of integrated e-Form INC-29 for Company Incorporation and Ease of doing business

Analysis of integrated e-Form INC-29 for Company Incorporation and Ease of doing business

With the introduction of the INC-29, the Ministry of Corporate Affairs (MCA) has begun to make good on its promise to improve India’s ranking on the World Bank’s Ease of Starting a Business Index to within the top 50 from the current 158.

The INC-29 form for company registration, combines the application for DIN allotment, name reservation, incorporation and even PAN & TAN, while making the process faster and simpler. As the entire incorporation process is in a single form, correct filing could mean approval in 48 hours. Compared to the old process, this helps in formation of company saving a lot of time, if properly implemented.

Purpose of the eForm – eForm INC-29 deals with the single application for reservation of name, incorporation of a new company and/or application for allotment of DIN. This eForm is accompanied by supporting documents including details of Directors & subscribers, MoA and AoA etc. Once the eForm is processed and found complete, company would be incorporated with Corporate Identification Number (CIN) and the Certificate of Incorporation would be issued. Also DINs gets issued to the proposed Directors, who do not have a valid DIN. Maximum three Directors are allowed for using this integrated form for allotment of DIN while incorporating a company.

Key Features of e-form INC-29

- The integrated e-Form INC-29 is available with effect from 01.05.2015 for One Person Company, Private Company as well as Public Company.

- INC-29 does away with filing of multiple applications/forms saving time and payable fees.

It combines the processes relating to:-

- Allotment of Director Identification Number (DIN) (up to three Directors),

- Incorporation of a company, and

- Appointment of first Directors of the company.

3. The new e-Form does away with the need for reserving a name for the company prior to applying for its incorporation.

- Declarations are in-built in the e-Form. Separate attachments containing such declarations are not required.

- The e-Form is enabled for future integration with e-Biz platform of DIPP for generating applications for PAN, ESIC and EPFO numbers on the platform and therefore provides a single interface for these applications also.

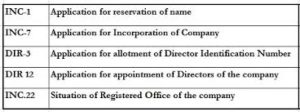

Forms no longer to be filed individually as per the new Form INC 29: