An income tax tribunal has barred auditors from issuing valuation certificates to the companies they are auditing. This is set to impact several tax disputes around valuations in companies including angel tax disputes involving start-ups.

An income tax tribunal has barred auditors from issuing valuation certificates to the companies they are auditing. This is set to impact several tax disputes around valuations in companies including angel tax disputes involving start-ups.

The Bangalore Income Tax Appellate Tribunal (ITAT) said that auditors of a company cannot double up as accountants especially in situations while dealing with “share valuation for the purpose of excess share-premium taxability.”

In several cases the income tax department has disputed valuations of companies around the time of investments.

The ITAT ruling came in a case where the tax department had challenged valuation of a company by its auditor.

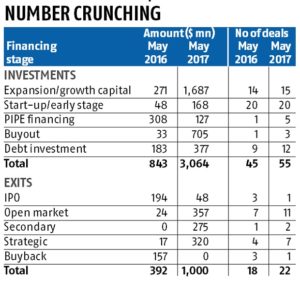

In most cases, valuations of startups were challenged by the tax department, leading to “angel tax.” The angel tax controversy surrounds the valuations during various rounds of startup funding. In several cases, the revenues at startups kept reducing or remained stagnant, but their valuations increased. The taxman is questioning the premiums paid by the investors and wants to categorise them as income that would be taxable at 30%. In most cases, the investments made by angel investors, venture capital funds or any other investor have been challenged by the taxman.

Many accountants and valuers are already facing heat from the tax department. ET had, on December 25, reported that the tax department has started issuing show-cause notices to valuation experts, questioning the premiums several startups fetched during their investments rounds.

Valuation experts, however, say that they merely projected and calculated future growth, using the facts and figures provided by the startups. Many tax experts point out that the tax department’s approach to the fair value as a benchmark for calculating premiums may not be accurate in the context of startups.

Income tax officers claim that the scrutiny on startups is mainly due to concerns that black money may have changed hands.

ITAT Ruling